$ETHPOW? $ETHPOS? $ETH? WTF?

Everything you need to know about the Ethereum hard fork and $ETH after the Merge.

Simply explained so that your grandma will understand it too.

A couple of bonus trades at the end.

I. THE MERGE

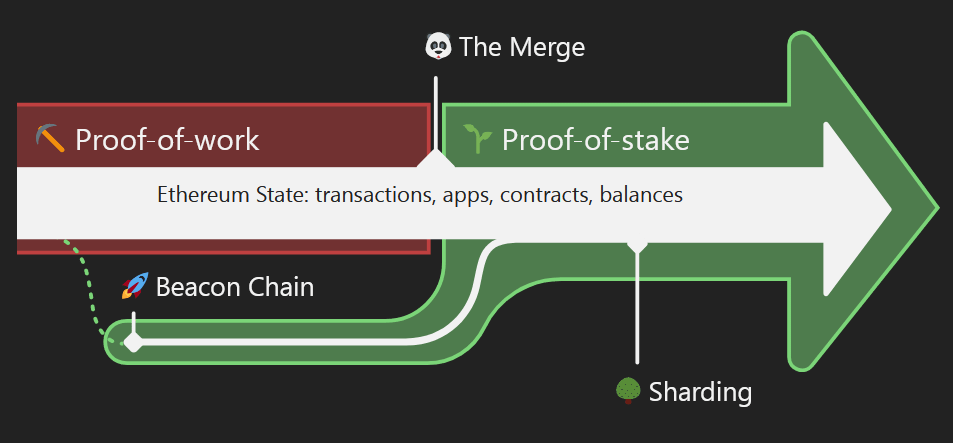

The Merge is a switch from Proof-of-work (PoW) to Proof-of-stake (PoS) consensus on the Ethereum blockchain.

Imagine Ethereum is a spaceship and PoW is its current engine.

PoS is a new more efficient engine that will replace the old one mid-flight (zero downtime).

PoS has many benefits over PoW:

- Less energy-intensive (99% reduction)

- More decentralized (lower economies of scale in staking)

- More secure (harder to attack the network)

- Lower $ETH issuance (deflationary supply possible)

- Opens up further scalability upgrades

II. HARD FORK

The Merge is technically a hard fork - a chain will split into two:

- Old PoW chain

- New PoS chain

At the beginning both chains will be identical and your holdings will get duplicated.

After the Merge you will have two copies of:

- $ETH: $ETHPOS and $ETHPOW

- NFTs

- Tokens, including stablecoins

One copy will live on the PoW chain, the other one on the PoS chain.

If you have 1 ETH and 1000 USDC on Ethereum now, you will have them on two chains later.

If you use some dapps, your positions will be duplicated too.

- You provide liquidity on Uniswap for ETH and USDC. The same liquidity position will be on PoW and PoS.

- You lend ETH and borrow USDC on Aave. The same loan will be on PoW and PoS.

But not for long...

III. DECISION TIME

The network can be technically duplicated but not the value.

There will be 2 USDC / USDT for 1 USD held by @circlepay / @Tether_to.

Stablecoin issuers will have to choose which chain stores the true value.

Does it mean Circle or Tether decide which chain will become the new Ethereum?

Theoretically, yes. But they won't do anything against social consensus. It would hurt their business.

The Ethereum community has decided to switch to PoS. Stablecoin issuers will just conform.

IV. CHAOS

If USDC, USDT and other centralized stablecoins are worth 0 on PoW chain, the DeFi domino collapses.

All the tokens paired with stables in liquidity pools are worth 0.

All the loans against stables are not collateralized and become bad debt.

DeFi on PoW is dead.

The only valuable asset on PoW may be $ETHPOW.

Some exchanges will list it so speculation on the asset will give it a price.

Therefore, there will be a rush to extract as much ETHPOW from the dead DeFi ecosystem as possible.

But you have no chance in this race...

Bots will be ready to execute their plan in seconds.

Even if you write a bot, your transactions will be front-ran by MEV wizards who can cooperate with miners and get priority inclusion in the blocks.

If you are not MEV artist, you better just hold ETH.

twitter.com/lemiscate/status/1554099170776158210

V. TRADE

What should you do with $ETHPOW?

Whatever you want. Not financial advice :)

I know I will sell it quickly. There is no community behind Ethereum on PoW other than psy-ops masters trying to talk it up for exit liquidity.

Don't fall for it.

twitter.com/hasufl/status/1555902244977000450

BONUS I

You can maximize your exposure to $ETHPOW by borrowing $ETH before the Merge.

Your collateral on PoW chain will most likely be worth 0 so you won't have to pay back your debt and you will have more $ETHPOW to dump.

But be wary of borrowing rate which may go up a lot.

BONUS II

Borrowing $ETH may become a crowded trade. Moreover, if everyone plans to sell $ETHPOW after the Merge, I don't know who the buyers will be.

It may be better to ignore $ETHPOW and lend ETH in DeFi to profit from the high interest rate.

twitter.com/Cryptoyieldinfo/status/1555924142800908288

Valuable insights into the Ethereum hard fork:

- @hasufl shares his 9 reflections: twitter.com/hasufl/status/1555902237548896256

- @lemiscate gives examples what will happen on PoW chain: twitter.com/lemiscate/status/1554041635369017344

- @spreekaway touches interesting subject of tax liabilities: twitter.com/spreekaway/status/1555941724287111170?t=6w5DX_c28fucIVvz6ACqTA&s=35