NYC hours = Volatility

Since the start of July, the bulk of BTC / ETH gains have been generated during NYC market hours (13:00-21:00 UTC) while European and Asian trading session returns have remained mostly flat to -ve

So what does this mean and why is it significant?

NYC is the financial capital of the world, trillions of dollars are traded weekly on stock and crypto exchanges during this session

This time is also when significant news & Fed policies are discussed

This action is what creates the correlation between BTC and the S&P 500

Due to their size and historical trading performance, it is safe to assume "smart money" trades here, those who you'd be unwise to counter-trade

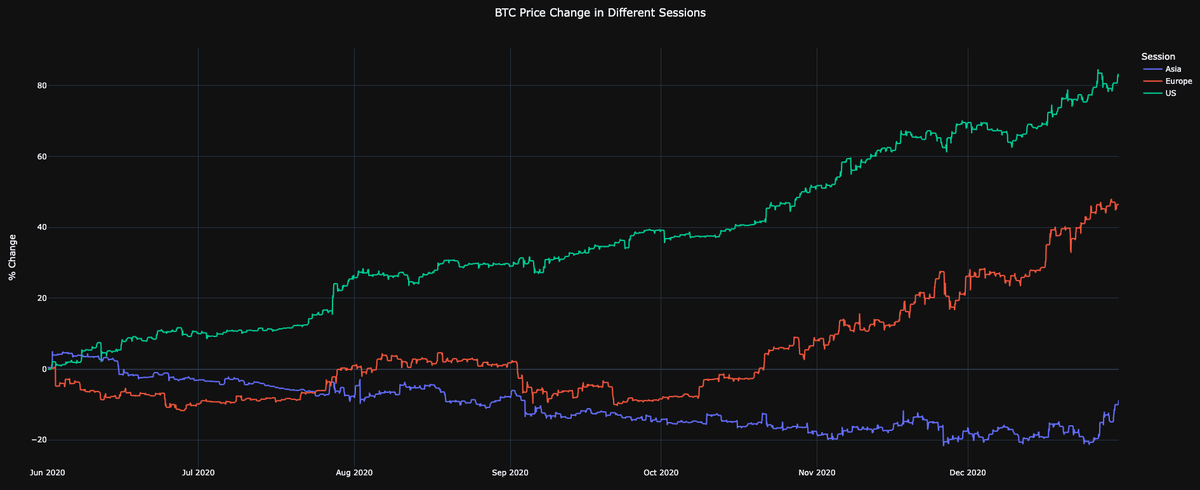

Following their green line below from June-December 2020, we see NYC drove the rally that launched BTC from <10k to >60k in < a yr

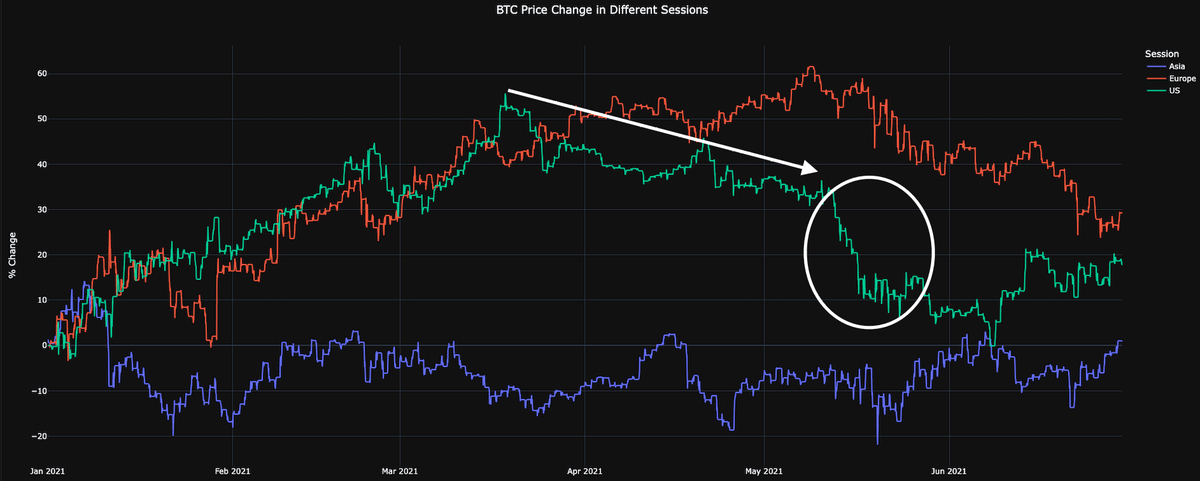

Below is another example of their prescience

After driving BTC to new heights this session shifted in March '21, there the NYC session began to dump BTC while it was at the highs above $60k (white arrow)

~8 weeks later it was trading below $30k

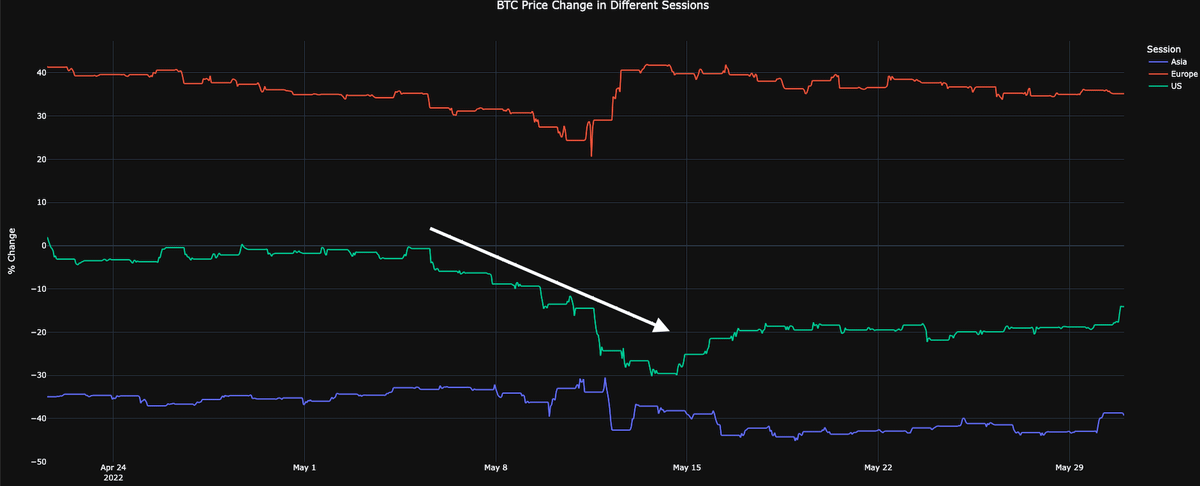

We saw this on display once again just prior to the collapse of Luna/UST in May of this year

The NYC session began2sell off BTC above 40k just prior to Luna's death spiral

That lead to a market-wide mass deleveraging event as BTC crashed by over 50% in just 6 weeks after

They were also the first2buy in July 2021 just prior to the short squeeze from 30k-69k

And the first to sell in November-December 2021 just prior to the crash back down

Below we see them exhibiting bullishness past month as they led the huge squeezes on both BTC & ETH

However, Monday was August 1st...the start of a new month, and the NYC session tend to obey seasonality trends

While the NYC squeeze may continue, it would not be surprising to see this NYC buying pressure instead dissipate if they begin to take profits

In fact, we already saw some signs of profit taking on ETH following its 70%+ pump

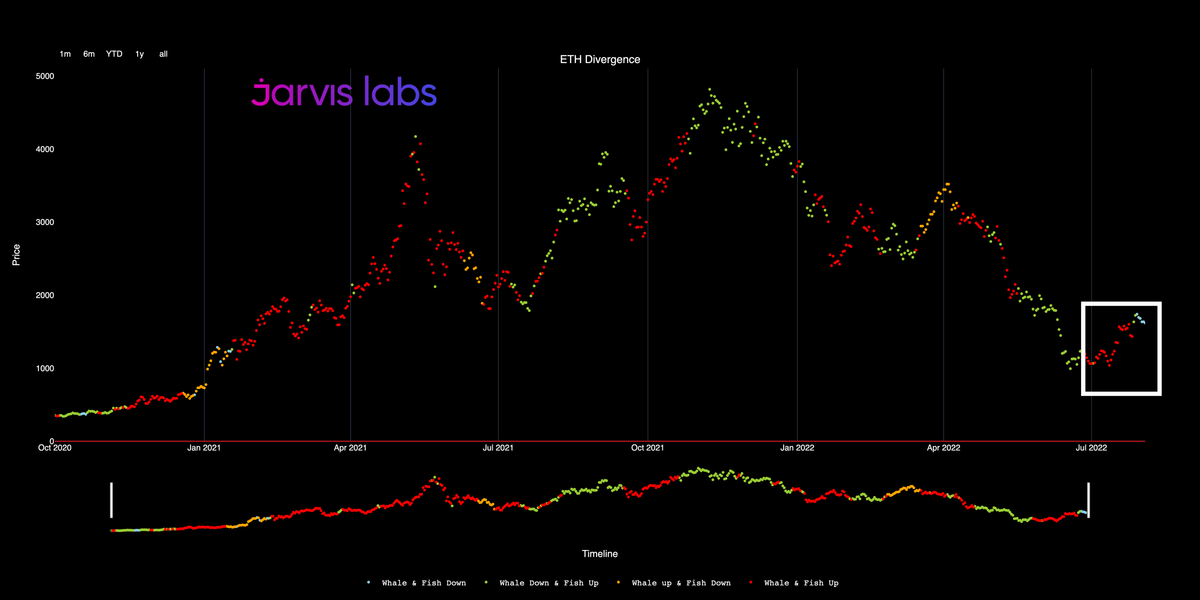

The red dots below signify the whale accumulation at the lows throughout July's bottom

The blue dots show both whale and retail traders have shifted to selling/profit taking to start August

This is something 2be mindful of as things advance, July's NYC session bullishness does not guarantee the continuation

But, if we see NYC bid start2pick up again end of this week and into next it will be a strong signal that higher highs are in store for the end of summer

For a more detailed discussion on our NYC session research and its intricacies please read, subscribe, and share our weekly Espresso update below jarvislabs.substack.com/p/the-rising-trend