ICYMI, @coinmetrics @coinmetrics put together this incredibly comprehensive 40 page ETH research report:

"Mapping Out The Merge"

We found it quite informative and wanted to be sure to share it with our readers in TLDR format, with a few of our fav metrics for added context

The Merge is scheduled to take place on 9-15-2022

When this happens validators of ETH's blockchain will switch from Proof-of-Work mining to Proof-of-Stake

PoW vs PoS has been the topic of much debate, but in short PoS proposes to improve ETH's security, economics,& emissions

At present PoW miners alone validate transactions and secure Ethereum's network

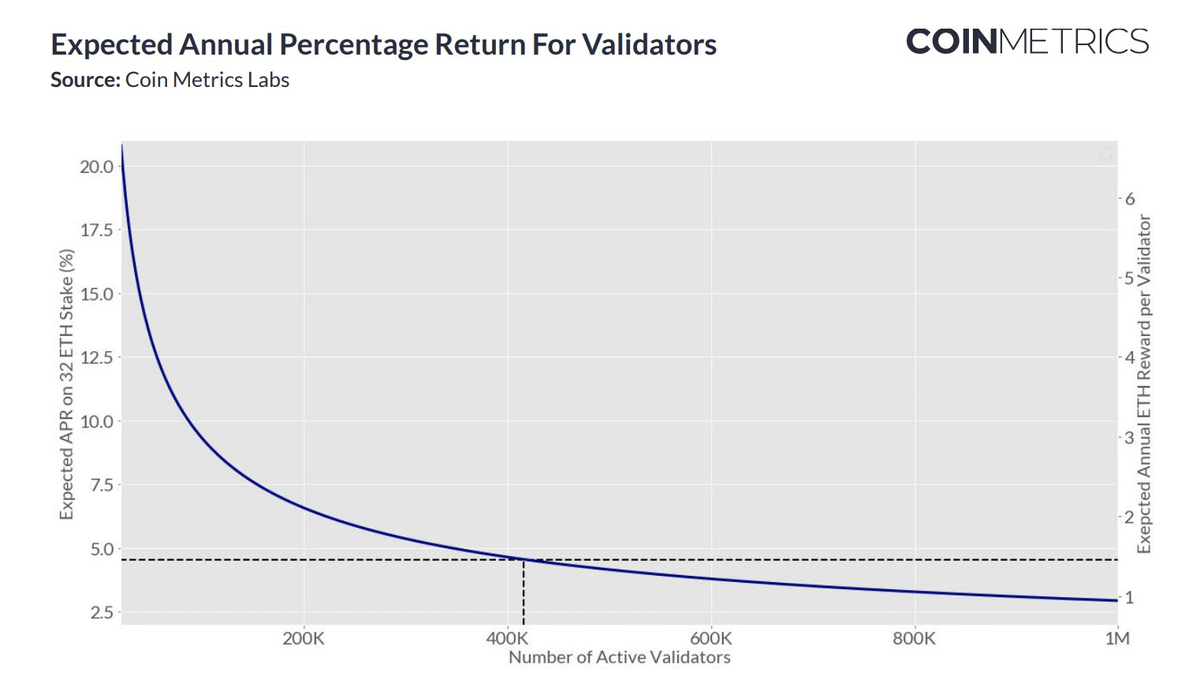

Under PoS validators will lock up their ETH in exchange for yield (currently ~4.5% APY) this feature seeks to incentivize large holders to secure ETH's network with yield rewards as payment

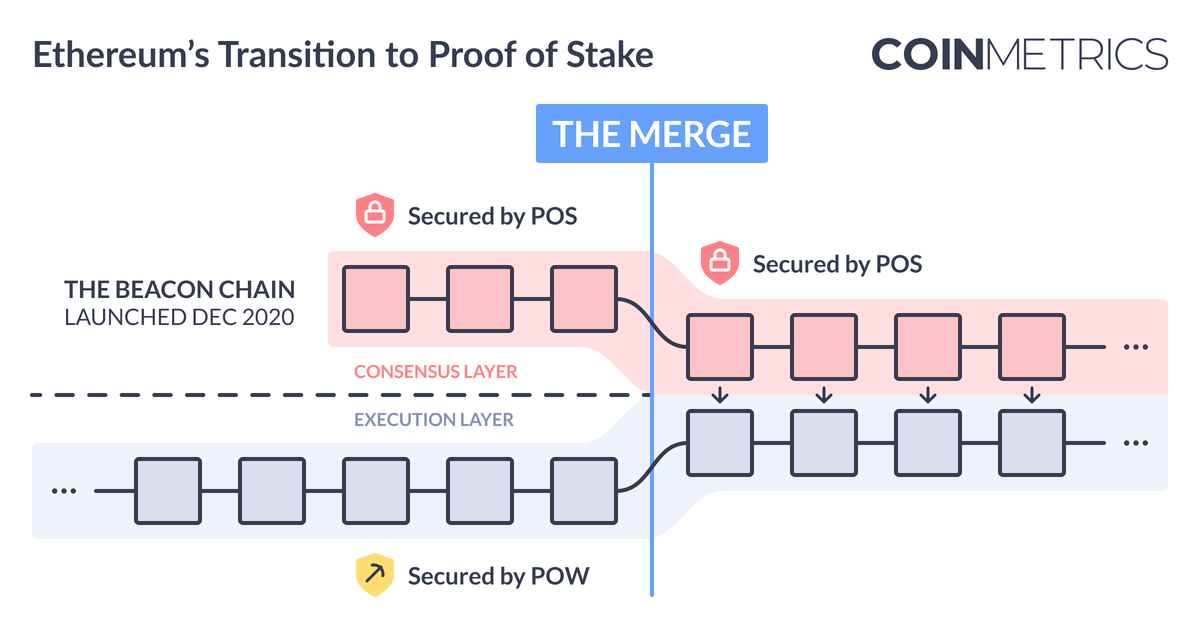

The Coinmetrics graphic below brings the literal merge behind "The Merge" to life nicely

This event will fuse ETH's Beacon PoS chain (running in parallel since 2020) with the PoW chain (running since 2015 inception)

After, these two separate chains will become one

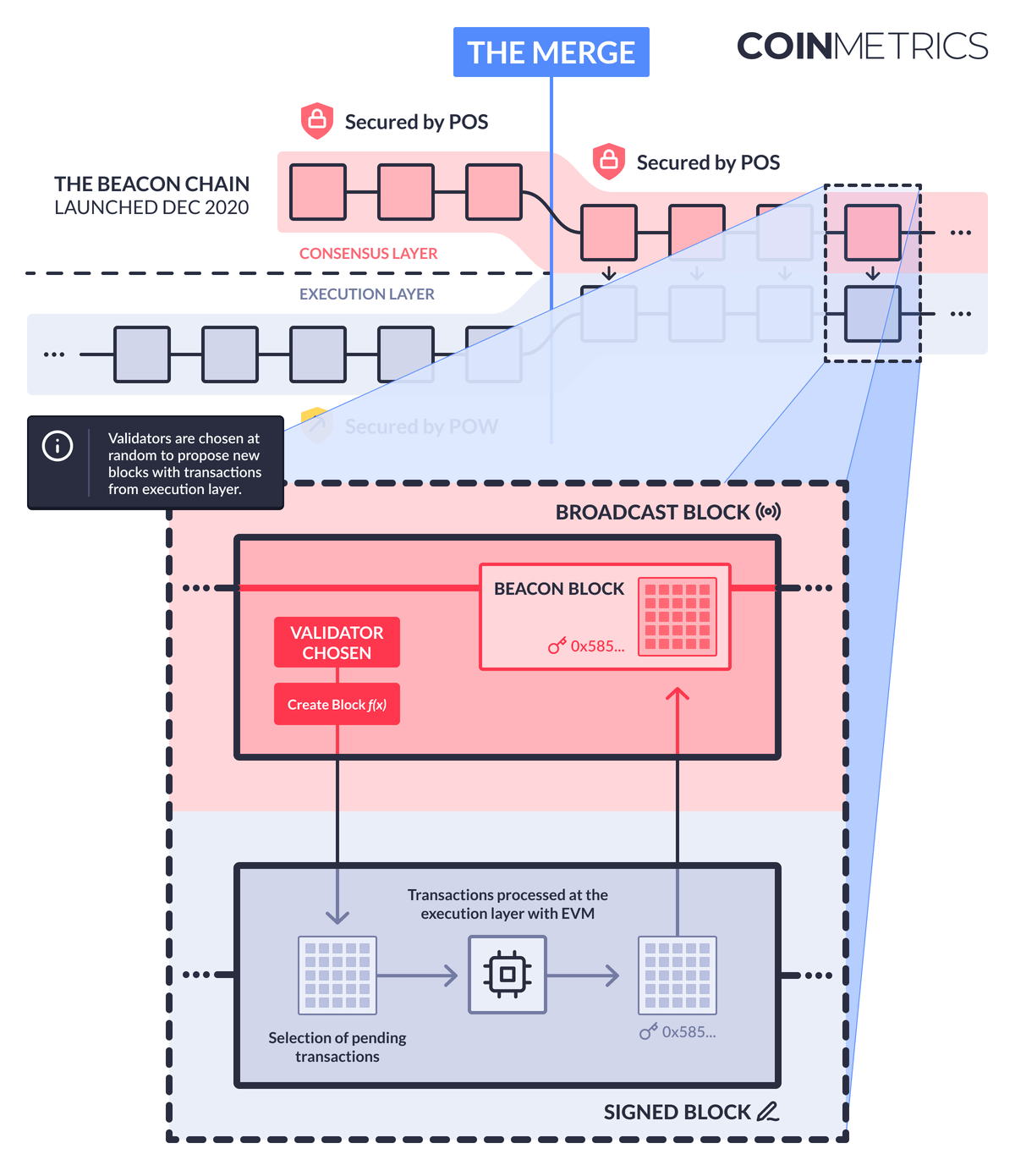

Following The Merge there will be be 2 layers operating in unison to help Ethereum's efficiency:

1) The pre-Merge execution layer,where users will make transactions

2) The Beacon Chain consensus layer,where validators will process new transactions and build new chain blocks

To become a validator one must stake 32 ETH

Given this high capital lock up,but necessity for ETH security, greater staking rewards (>20%APY) were offered to Beacon's early adopters

Below we see this dynamic of rewards decreasing as the # of validators grows, ~4.5% @ present

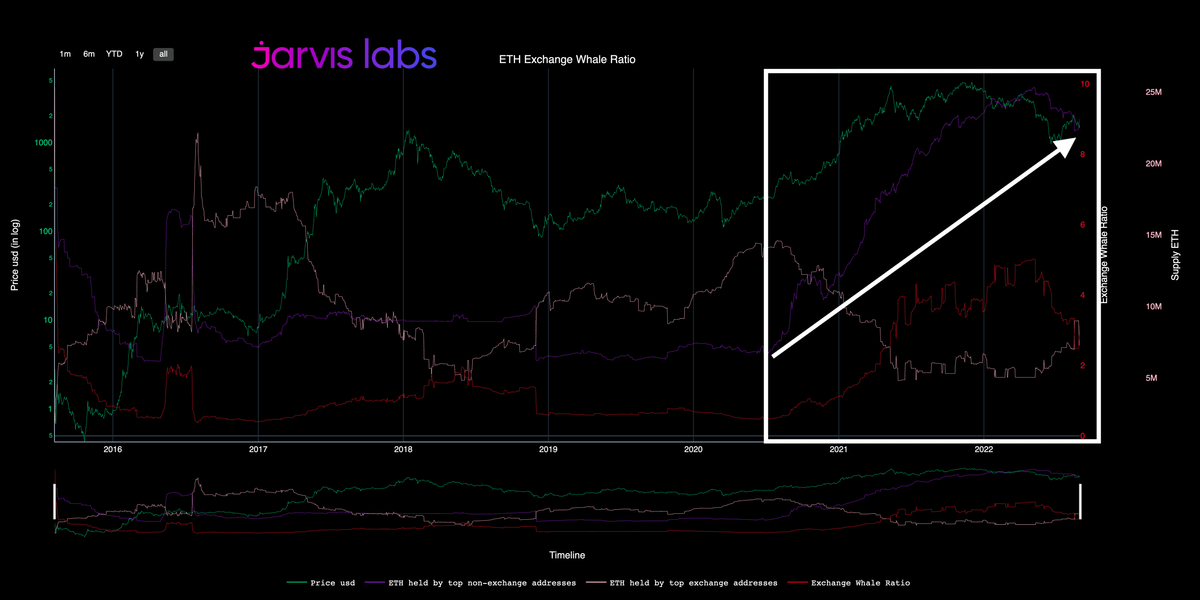

This has confluence with our onchain view too

The purple line below shows the rise in ETH holdings by top non-exchange addresses, the white box indicates when Beacon PoS chain launched in late 2020

This ETH2.0 yield staking catalyst sent whale holdings+ETH price parabolic

In addition to staking for yield, post-Merge validators will also earn yield from user-paid transaction fees on the execution layer and MEV

Previously such fees went to miners, now they will be split amongst any and all who stake a validator

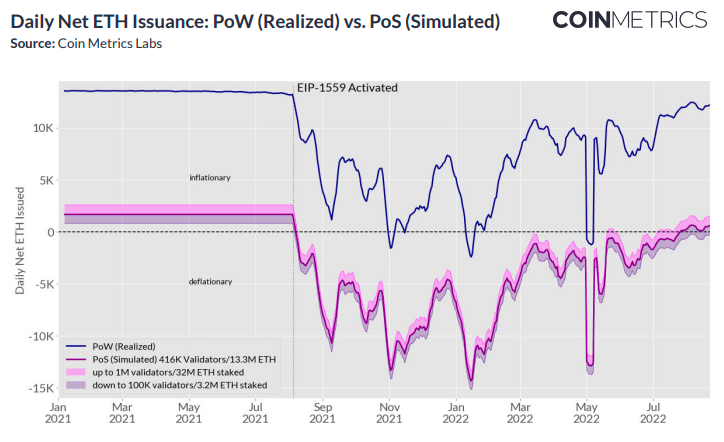

This staking consensus mechanism will also drastically change ETH's supply schedule...

PoW supply schedules are predetermined, under PoS this will vary depending on the amount of ETH staked

The greater the amount of ETH staked, the greater the supply increase & viceversa

Currently ETHs supply increases by 5m coins p.a under PoW supply schedule

But under PoS, there's currently ~13m/122m ETH supply staked

Assuming this staked amount remains static it will result in just 600k new ETH coins being created over the next year, a >90% decrease

When we also account for EIP-1559 burning transaction fee costs, it is likely the amount of ETH supply created p.a will be less than the amount of ETH burned

Making it a deflationary asset

The pink line below simulates the PoS supply difference vs PoW (blue line)'21-now

All of these potential benefits are not without their trade-offs however

Merge is far from a risk free event, as any number of things could go wrong on the event just from a technical standpoint

And while it improves ETH scalability it doesn't fully deliver this on day 1

There is also the elephant in the room issue of supply centralization

As we saw in the early chart ETH's supply is now extremely concentrated amongst large holders

Under PoS whales will become validators, granting them ability 2 conspire and alter ETH for their own benefit

While this centralization + other risks may be outlier scenarios the possibility of them happening is far from 0%

As such investors should study CoinMetrics report in it's entirety then weigh the risks vs rewards before before making any decisions to allocate capital

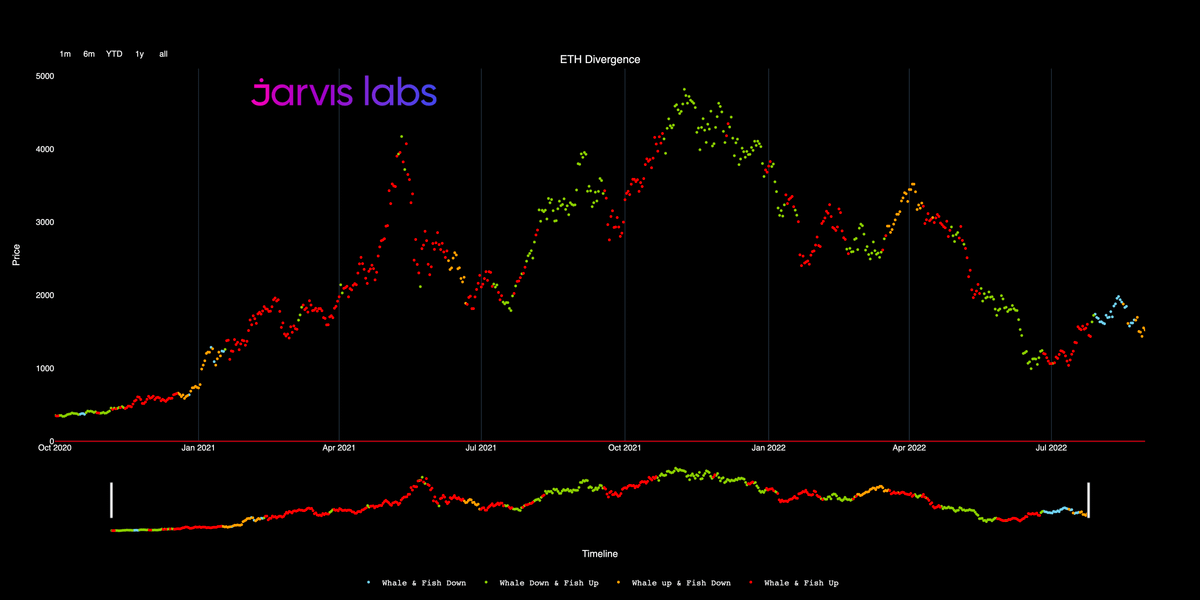

And for a final data set, we have our ETH divergence chart which highlights the direction of whales bias

We see they've added relentlessly since late 2020

Though they were selling earlier in August, they have been viewing this recent correction to accumulate more

We hope you enjoyed this thread be sure to follow @coinmetrics and subscribe to our Espresso newsletter below for weekly market analysis and updates jarvislabs.substack.com/