Last month we covered the funding rate model and how it can be deployed as a potential trading strategy. That led to few enquiries on longer holding period and returns. Let's cover that in this thread.

To recap, when funding rates go negative, analysts discuss about a possibility of reversal. So we dug a little deeper.

twitter.com/Jarvis_Labs_LLC/status/1541768903474532353

The conclusion earlier was that, keeping the holding period tighter (8 hours) yielded the best combination of returns and max drawdown.

twitter.com/Jarvis_Labs_LLC/status/1541768938320805894?s=20&;t=W-FikhicvlQ6dkHp2H2ryQ

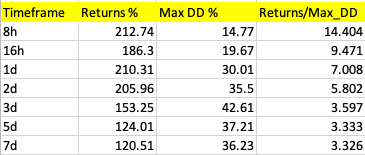

To quantify this a step further we used this information to create a ratio which measures each strategy's cumulative profits since Jan. 2020 vs their maximum drawdown during that same period

The higher the ratio, the greater potential reward vs historical risk potential

Here we saw the best performing strategy was again the 8h trade

Not only were 8h cumulative returns highest @ 212.74%, they also had the lowest max drawdown of only 14.77%

This resulted in an 8h return/drawdown ratio of 14.40, ~35% higher than the 2nd place 16h strategy

We also observed that in each time frame beyond 8hr cumulative profits diminished while max drawdowns increased

So longer the trades were held, the risk probability increased as reward probability decreased

A bad combination which resulted in lower ratio scores

We hope this thread brings more clarity to the debate of trading negative funding

It is our data based belief that negative funding presents profitable opportunities, but opportunities on specifically short timelines which need be carefully managed by traders