ETH has been performing very well past week.

Although, there is an interesting behaviour on FTX-Perp to take note of.

Let us dig into it in this thread.

Anomalies in markets are typically a sign of unsustainable price action taking place.

During ETH's seismic 60%+ pump over the past week we noticed one such alarming anomaly unfolding, and we found it on FTX's leaderboard...

What alarmed us was Eth-Perp futures contracts being FTX's most heavily traded product.

You see, BTC is not only the leader in crypto by market cap, it is also the daily leader in perp trading volume...most days.

This meant ETH-perp outpacing BTC-perp was an anomaly.

Anxious for answers and historical precedent for this outlier event we back-tested the data to get a better handle on what we should expect next.

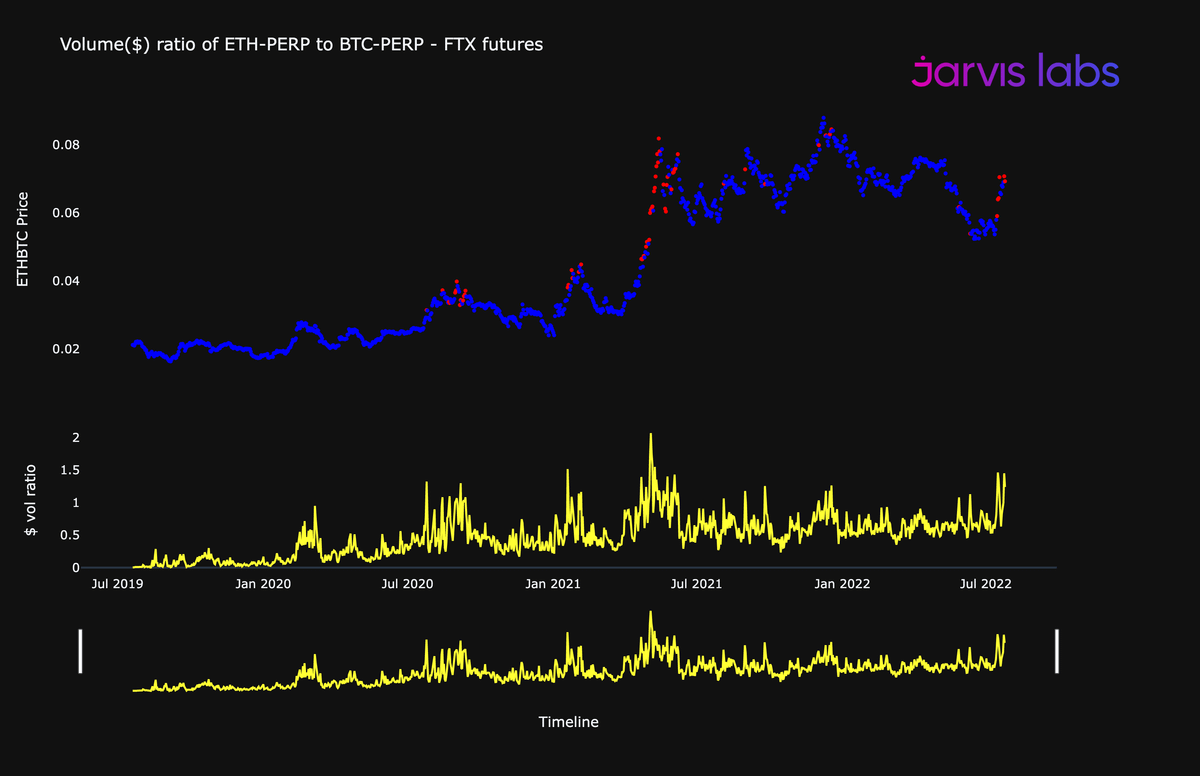

The result was this chart below which shows us ETH-perp ratio (yellow chart) laid below the ETH/BTC ratio price (blue chart)

The blue "ETH/BTC" chart shows us how much BTC a single ETH is worth, at time of writing this = ~0.07, which means 1 ETH buys 0.07 BTC.

When the yellow "$ vol ratio" chart > 1 it means ETH-perp dominating market volume -- an anomaly that generates the red dots you see below

As we can see judging off historical data above, previous instances of ETH-perp leading the market have been a bearish signal for the ETH-BTC ratio

It has consistently been a strong indicator of the alts market becoming exhausted while reaching euphoric peaks vs the BTC pair

Not only is this ominous for the ETH/BTC ratio, it may mean a potential correction on BTC too.

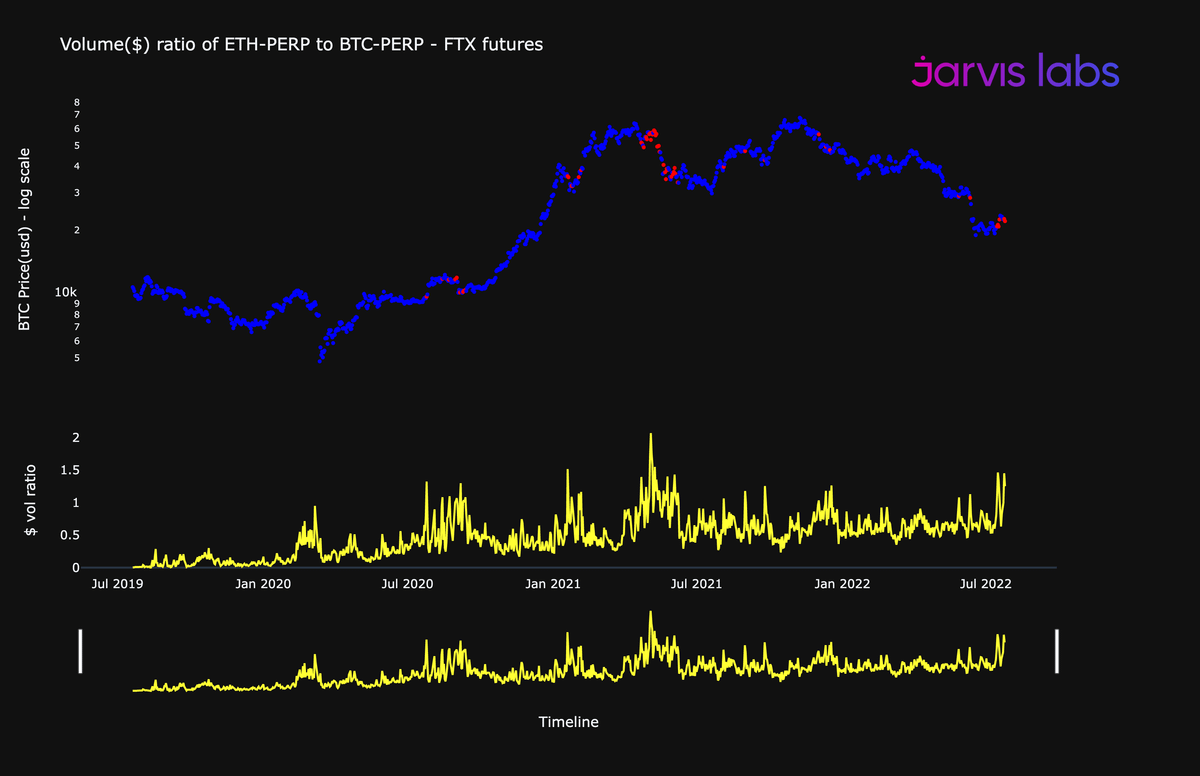

The chart below shows the same yellow "$ vol. ratio" chart laid below BTC price. Last week it generated it's 1st "sell signal" since early May, just prior to the Luna/UST crash

And while this alone isn't a sign of a perfect top, its an indicator that warrants extreme cause for pause. and look for further confluence of indicators

Consider this a good caution to take profits or hedge, or resist FOMO if sidelined until macro uncertainty settles

You can read the unrolled version of this thread here: typefully.com/Jarvis_Labs_LLC/V0GcJLK