Markets run on trends and momentum.

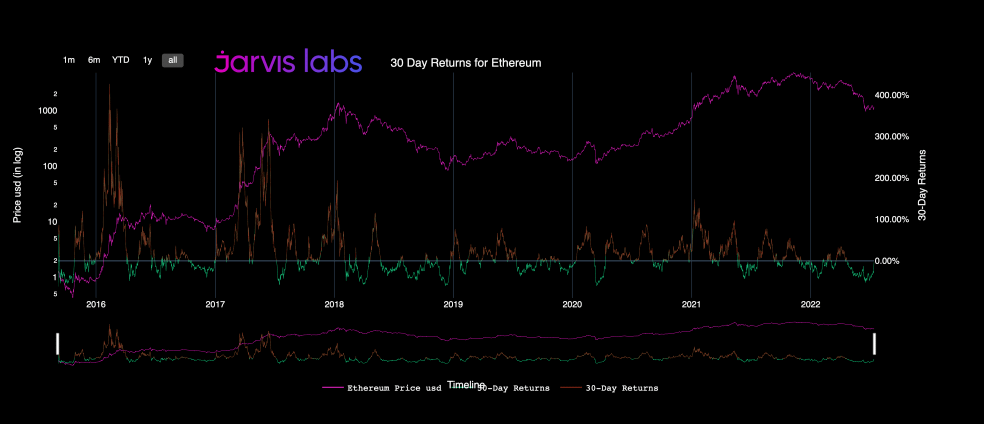

We can measure both with 30d returns. A metric that shows the short-term profit & loss of the market as a whole.

This chart shows ETH's 30d returns moving towards 0% after being deeply negative since April & below we unpack the idea...

Quick explainer: 30d returns measure the short-term profit and loss of the aggregated market at a given time.

% returns reflect the PnL one would get assuming they bought 30d prior & held.

When this metric trends >0% = bullish pa

When this metric trends <0% = bearish pa

In bull markets, 30d returns dip below 0% are prime buying opportunities and in bear markets, the flips above 0% are ideal selling opportunities.

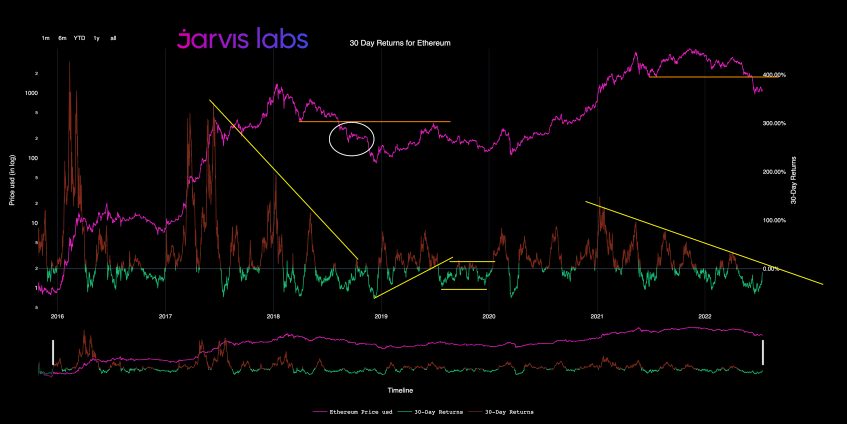

We compare current ETH 30d returns structure to Q4 2018

That fall ETH consolidated in the low 200s, before falling to near $82 in Dec. Additional 60% drop that sent it down over 90% from ATH on the year

A repeat of this fractal now would bring ETH to the 400$ range by Dec 2022

Another look at the same chart shows more symmetry

In 2018 there was 30d diminishing return resistance, and a key price resistance level at ~$350. This resistance held firm for 28mos until Q3 '20

In 2022 we again see diminishing 30d returns and a key lost support level ~$1700

If this fractal were to replay itself all pumps up to the $1700 level will trigger sell-offs for the next 1 year.

Conversely, a flip of 1700 from resistance back to support would be equal to summer 2020's flip of ~$350 and could signal the start of a brand new bull run

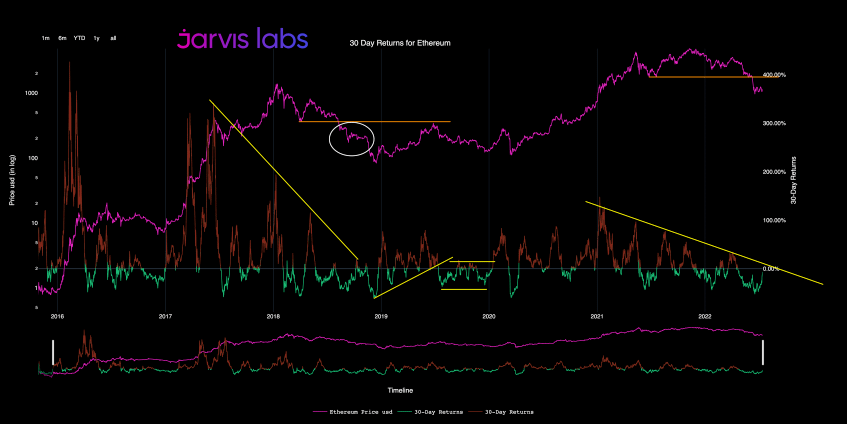

However, charts as badly damaged as ETHs will not repair themselves overnight

A reconquer of $1700 will require many months of consolidation

Short-term rallies to the 1400-1700 range are possible but should be viewed with caution as they're likely to be met by strong selling

Please keep in mind, this analysis does not take into account of ETH 2.0 merge event. That is a wildcard.

If and when these levels are flipped we'll hope to see confluence from our A.I. & quantitative metrics -- none of which are signalling that a macro ETH bottom is in yet

As soon as this changes, our readership will be the first to know

Join us in patience and subscribe below

Check out @MrBenLilly's latest espresso update.

jarvislabs.substack.com/p/the-missing-bucket