/1: Funding rates went negative. Now analysts are saying its time to go long and a reversal is coming. Is there any truth to this?

Today we see what the data says and showcase a strategy you can employ to grab some alpha. #BTC

/2: To start off, funding rate is defined as the cost to hold a perpetual futures position open. Each exchange has subtle nuances to this, but generally speaking it updates periodically throughout the day and has a baseline where long positions pay short positions.

/3: Now when funding rate goes negative, it implies that traders going long are actually getting paid to keep the position open by those going short. This is not normal in the market.

/4: Because of this anomaly, it means funding rates can act as a gauge of trader sentiment.

The more crowded a particular trade gets, the more extreme funding can become. In bull market it's not odd to see 0.2-0.3% funding every 8hr, which translates > 300% on an annual basis.

/5: What this all means is the funding rate mechanism creates a bit of mean reversion. As rates goes negative, they should revert back to their normal positive funding rate.

Which is why we wanted to test whether or not there is a way to make repeatable profit on this - alpha.

/6: To test, we assumed a trader opened a BTC long position the moment funding rates turned negative. Then assumed the trader held the position for 48hrs.

The results showed lots of time below 0% returns, not ideal.

/7: But what if we reduced the time the position was held? Say 8, 16, and/or 24 hours?

The chart below shows these three windows. As you can see, substantial improvement. So just how substantial?

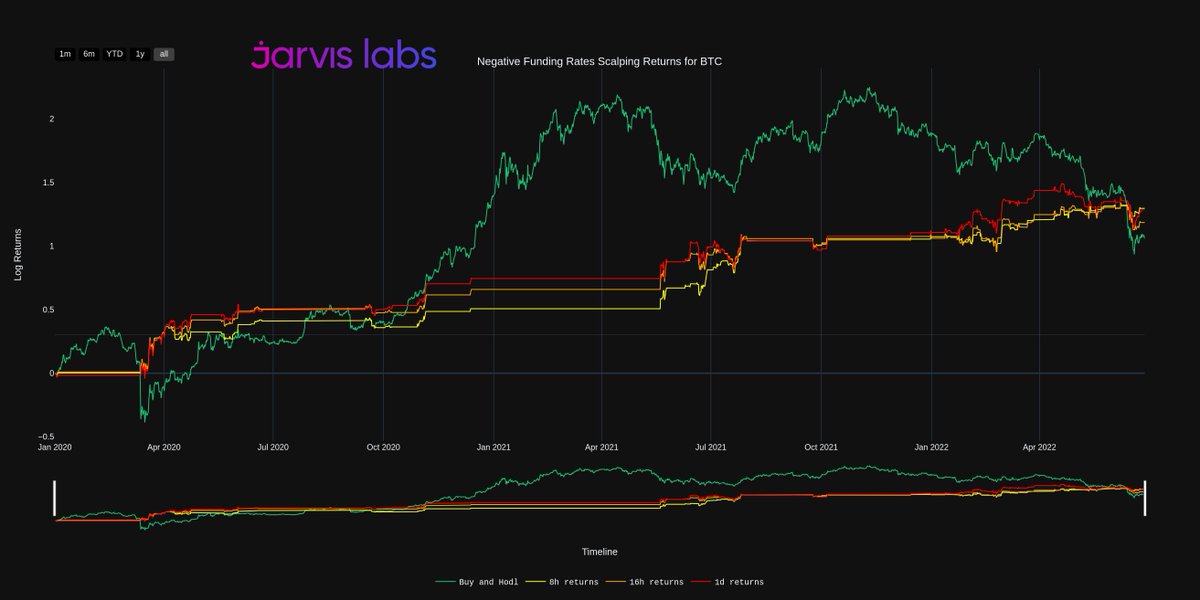

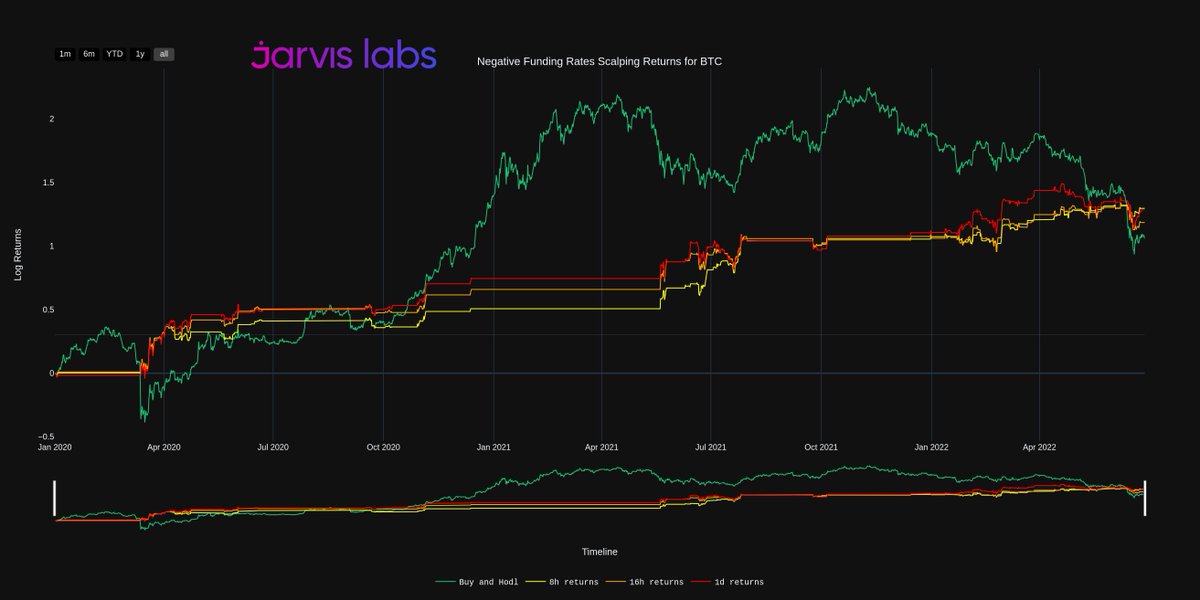

/8: The chart below is the backtest results of each strategy since 2020.

Green = buy and hold

Yellow = 8hrs

Orange = 16hrs

Red = 24hrs

Winner -> 8hrs

/9: Just how big of a winner was it over the second place 16hr strategy?

Here is the 8hr stats

Sharpe: 0.84

Time in market: 14%

Total Returns: 227.67%

Max Drawdown : -14.77%

/10:

16hr stats

Sharpe: 0.7

Time in market: 20%

Total Returns: 186.36%

Max Drawdown : -19.67%

/11: 8hr strategy is the winner. What we also see is what we term greater capital efficiency.

The trader only needs to deploy capital in less than six of the 24 months in this backtest.

/12: What should be noted here is even in March 2020, these long-only strategies provided their best returns. You can see this in the heatmaps for both strategies.

The returns in March 2020 for the 8hr strategy was over 31%.

No leverage, just spot. medium.com/crypto-alpha-drip/the-signal-in-bitcoins-funding-rate-e19abee4842e

/13: Moral to the story here...

No need to dismiss negative funding the next time you read about it on Twitter or from your favourite analyst. There is hidden alpha in that indicator. The key is in knowing how to squeeze it out. Next 12 months is going to be interesting.

/14: If you enjoyed this thread, you can read the full post here:

Subscribe to our newsletter Espresso (link). We are restarting Espresso to regularly bring you market updates and crypto insights using our newly built on-chain data infrastructure. jarvislabs.substack.com/