The ultimate guide on how to make it in crypto.

One of the best 🧵 on secrets & strategies on how to find & invest in low-cap gems.

(1/110) 👇

This thread was written by @CryptoDamus411. I am posting it to help him gain a bigger audience, as I've done with others.

Please go to his page and make sure to follow him for more great content! Everything below this was written by him.

1/

There are 5 parts to this thread:

1. Strategy

2. How to find gems before anyone else

3. How to do research

4. When to buy

5. When to sell

2/

1.Introduction to my strategy

My strategy is fairly simple:

I buy projects with a small market cap (>50 million marketcap) with super strong fundamentals & a bottomed out chart before they go mainstream and I hold for 6 - 12 months.

3/

I sincerely believe this is one of the most profitable strategies out there.

Why?

1. Plenty of room for error:

Say I invest 5K in 5 different projects.

Project 1 goes to 0

Project 2 goes to 0

Project 3 does a 30X

Project 4 does a 10X

Project 5 goes to 0

4/

I now have 200K.

I put 100K on the side and instead of 5K, I now invest 20K into 5 different projects.

Repeat.

60% of my projects just went to 0 and I turned 25K into 200K.

In reality, because of the research I do, no projects go to 0.

And some do a 50 - 100X.

5/ You don't need a lot of money to make it.

Following the above you can:

Turn 5$ into 200$

Turn 50 dollar into 2000$

Turn 500 dollar into 20 000$

And repeat.

6/ Another advantage is I sleep better at night.

I don't need to check charts day in day out, check my stop losses or daytrade.

I can take days of.

It gives me peace of mind, which is worth as much as the money to me.

Learn to be patient and you will be rewarded generously

7/ The disadvantage?

90% of my time goes into research.

99% of the projects out there are trash.

I check every detail.

I check the top wallets for days.

I try to get in touch with the founders.

It's tiring sometimes, but there are no free lunches in this game.

8/ Why do so many fail following this simple strategy?

Not because of the projects they invest in.

I share them for free on my twitter and many others do as well.

9/ They get impatient and start jumping from project to project.

The ultimate route to disaster.

Patience is rewarded.

10/ Part 2. How to find gems early?

The key is to be REALLY early.

If everyone on Twitter is talking about it, you're too late.

You have to have the balls to invest in a project which nobody is talking about.

So how do I find gems early?

Let's take a look.

11/ Method 1:

Backtracking tickers on Twitter.

Think of a small-cap quality project which recently started gaining attention.

I will take $QUARTZ as an example.

Of course this is applicable to other projects as well, even to older projects.

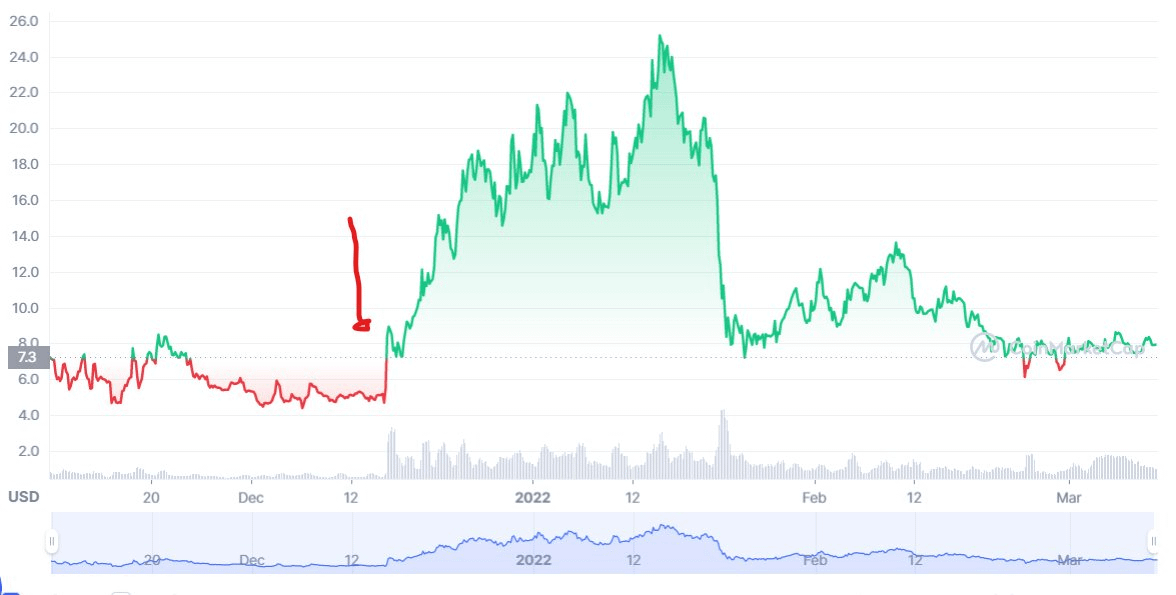

12/ $QUARTZ

You can see $QUARTZ started gaining serious attention on the 15th of December 2021.

We are now going to find people who were talking about $QUARTZ way before that.

They are the ones who were really early.

And we are going to keep a close eye on them.

13/ Type $QUARTZ in the upper right search-bar.

Enter.

Now click the 3 little dots on the right.

Click advanced search.

in 'These Hashtags' type $QUARTZ

Pics below

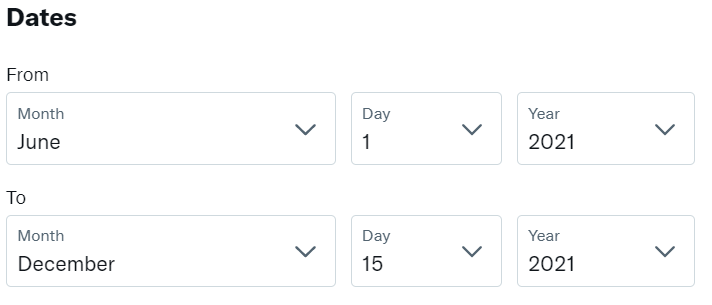

14/ Dates:

Let's go back 6 months before $QUARTZ went viral.

Set dates accordingly.

You can of course change this to your liking (longer/shorter).

Click search.

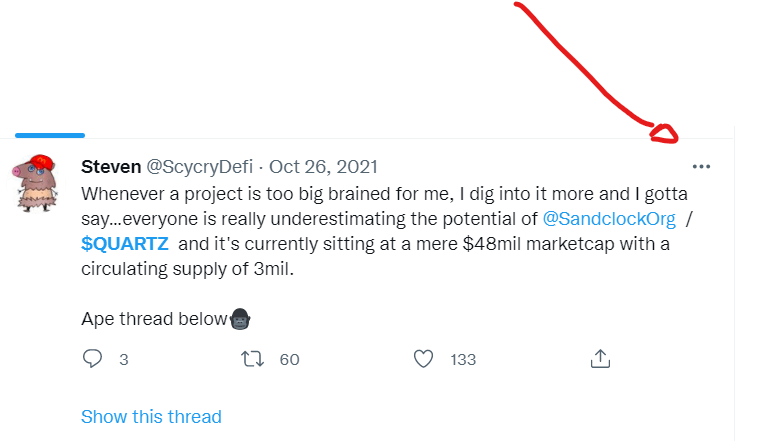

15/ Congratulations, you now found a bunch of people who probably do their own research and talk about gems before anyone else does.

Click the 3 dots next to their name.

Click 'add to list'

Create new list & add them to it.

Continue to do so.

Repeat for other tickers.

16. You now have a custom list of alpha seekers.

You can make 1 big list or make lists per ticker.

I regularly remove people from the lists as well.

I discovered plenty of gems this way.

17. Method 2.

Backtracking wallets on block explorers.

I will take $QUARTZ again as an example.

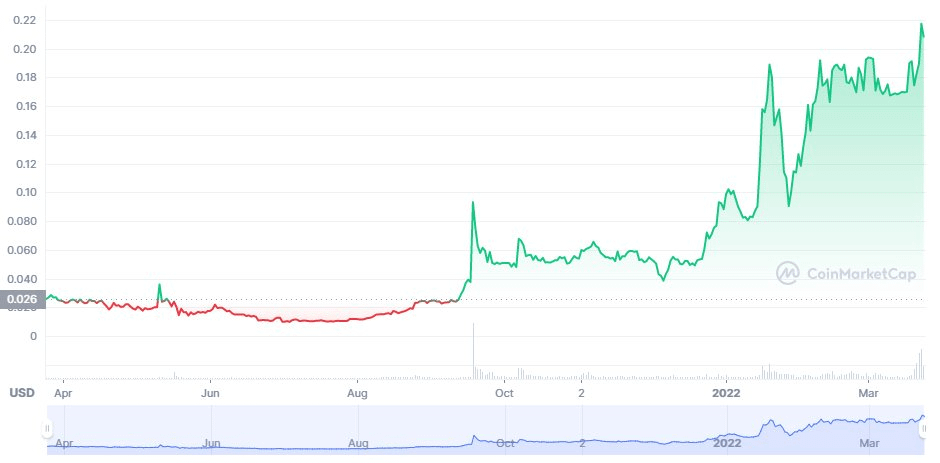

After doing research, I have decided for myself that $QUARTZ is a quality project.

18. It would be safe to assume that people who hold $QUARTZ are holding similar quality projects, right?

19. But how do we find these people, except from on twitter? We look at their wallets on block explorers.

I will use etherscan as an example. On the blockchain, all the info is publicly available.

You just got to know what to look for.

20. Go to coinmarketcap.com.

Look for QUARTZ at the top right corner.

Click on the Etherscan adress (this can also be BSC, solana,...).

Scroll down a bit and click on 'Holders'

You now have an overview of all the wallets holding $QUARTZ.

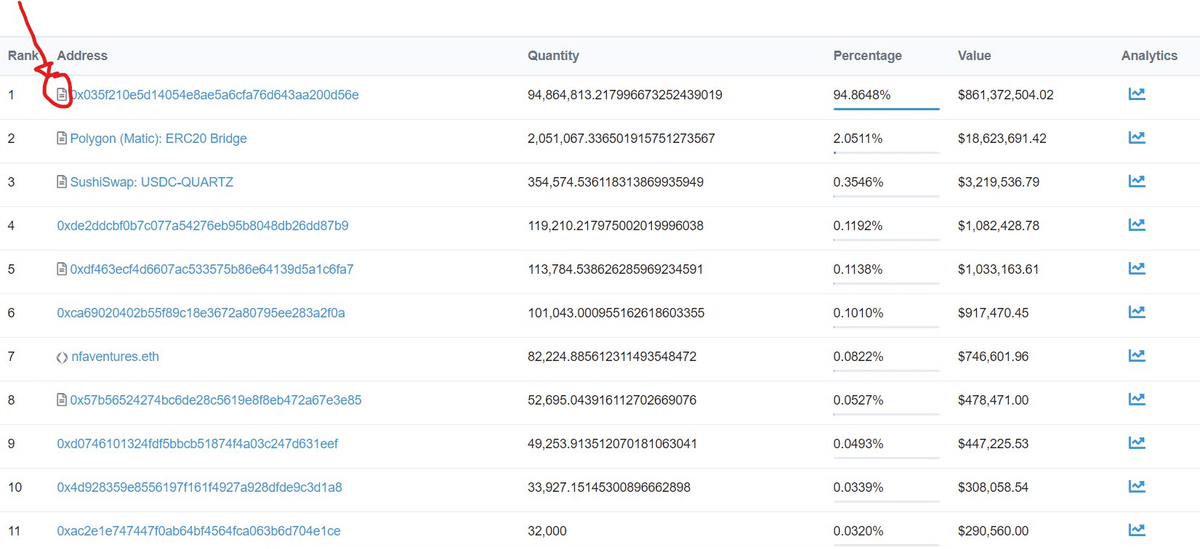

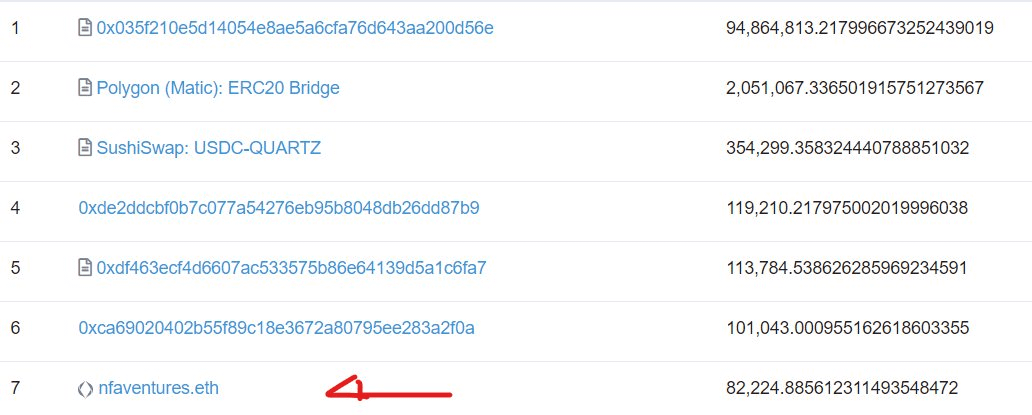

21. See the little piece of paper next to the wallets?

Those are smart contracts, so they are not private wallets. Those you can skip. Let's take a look at the other private wallets.

22. Let's click on NFAdventures.ETH

This wallet address has a name, it's a paid service some people use.

It doesn't mean anything else, it's a private wallet.

Click on his address.

23. Open the drop-down menu.

You now have an excellent shortlist of projects to research.

Repeat for wallet 10, 11,12,etc etc.

But there's more.

I always look for similarities between wallets.

Take a look at the pictures below.

Are you seeing what I am seeing :)?

24. Not only does this method give you shortlists of projects to look for.

You can easily spot similarities between whale wallets, which is usually a good sign for a project.

This is how I found $XFT.

25. Method 3. Check.Every.Ticker.

I can't tell you how many times I saw a project pass by on Twitter, ignored it only to find out 3 weeks someone called it.

If you do like everyone else, you will get the same results as everyone else.

26. A lot of the tickers I see, I quickly check on CMC.

Usually after 10 seconds I see it's trash.

But 1 out of 30 - 50 will be good.

And I will be early.

Where most people ignore shilling, I do a 10 second check and look up the project.

27. Method 4: Share & connect

This might be the most important tip i can give you.

Found a gem using method 1,2 or 3?

Got some alpha?

Share it with other people.

For free.

Don't ask anything in return.

Do it again and again.

28. I reached out, and still reach out to numerous people I don't know. They all got more followers than me & have more experience than me.

How? Very simple:

Hey, I saw you like 'X' type of projects on your twitter. I found a project which you really might like, check it out.

29. And I continue to do so, again & again.

I share everything I know. For free.

Why?

After a while people start returning the favor.

They add you to their Telegram chat with other alpha seekers.

Instead of 2 eyes, you now got 20 eyes looking out for projects.

30. Contribute more to the group than others.

Now people start to take you seriously.

They'll invite you in other groups.

They'll send you alpha on Twitter.

They"ll trust you.

31. Some of my favorite Telegram channels for quality alpha: @ElonTrades 's Patreon community. 100$/month, but the best group out there.

I'm not affiliated in any way nor do I get money for saying this. I genuinely think this is the best value for money you can get.

32. @wavejumpers 's Telegram has quality projects as well. It's free to join, and they focus on qualitative projects.

There's an announcement channel and an open chat.

I suggest to join several TG groups and if you don't like the vibe, just leave.

33. Reaching out helped me build a network of strong, reliable alpha seekers who give me alpha before anyone else is talking about it. Want to stay in these groups? Keep on contributing. A big part of success comes from giving without asking for something in return, remember that

34. I also reach out to founders of different projects a lot.

How?

'Hey, I love your project, let me know if you need some help one way or another. I have a small Twitter community and know some well connected people'.

So what if they don't reply?

35. If you focus on quality projects it will show, and founders will be glad you will promote their project.

In return you might get some early access to alpha, beta-testing, updates,...

Don't be afraid to put yourself out there.

36. Method 5: Follow the money

When a project gets an investment from a top-notch crypto investment firm, it's usually a good sign.

Often (definitely not always) it means they have a promising roadmap ahead.

All VC firms have different strategies.

37. Andromeda for example invest in a lot of different projects.

Too many if you ask me. Their investments mean little to me.

Some VCs which I like:

Alameda

Coinbase Ventures

Binance Labs

Jump Trading

Pantera Capital

38. I often google 'Alameda'(can be any firm) and filter for the most recent results first.

Often you can scoop a nice project before it goes mainstream.

Be sure to follow the big VC firms on Twitter as well.

39. Part 2:

Framework I use to evaluate projects.

Throughout the years I developed a methodology which helped me evaluate projects of all kinds.

My framework is always the same for each project.

I review the following elements:

40.

1. Innovation/Unique Selling Point

2. Tokenomics

2.1 Token allocation

2.2 Token vesting

2.3 VC/Seed price

2.4 Token Utility

2.5 Wallet distribution

3. Team

4. Narrative

5. Catalysts & Marketing

Point 1 & 2 are definitely the most important ones.

41.

1. Innovation

What makes the project unique?

I avoid projects who are slight improvements of previous projects.

Let me give you some examples of unique projects below

42. The below are all projects I invested in:

$QRDO: The ONLY project which offers decentralized MPC

$KADENA: The ONLY POW project which solves the blockchain trilemma

$QUARTZ: The ONLY project which offers dynamic yield redirection

See where I am getting at?

43. A staking project which offers higher APY than previous projects is not unique.

A game with 100 000 users instead of 25 000 users is not unique.

A payment app with a 0.3% transaction fee instead of a 0.6% transaction fee is not unique. Those are temporary USPS.

44. Don't fall for unique features nobody will use. Look for disruptive projects which try to change the industry. Look through the marketing crap most projects try to sell you.

Ask yourself:

What makes this project unique and is there a need in the market for this feature?

45.

2 Tokenomics

I value tokenomics the most of all elements when I do research.

It's the single most important tool to help estimate the selling pressure (VC price/seed price/vesting/..) vs. buying pressure (token utility) which ultimately determines the price.

46. Tokenomics is the topic of understanding the supply and demand characteristics of a project.

It's similair to the shares of a company.

If you don't know what tokenomics is, there is plenty of free content on the internet.

47. The following 3 subcategories help determine the possible selling pressure:

1. Token allocation

2. Token vesting

3. VC/Seed/private price

48.

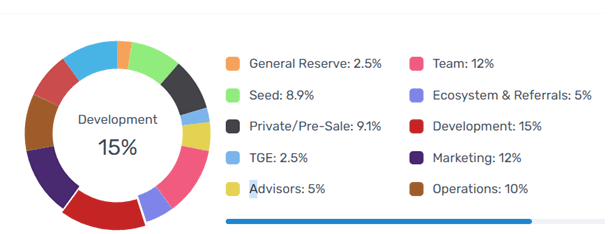

2.1 Token allocation

Each project allocates tokens to different holders.

The tokens are often allocated during different phases in time.

Some are being allocated behind closed doors, before the project launches, some tokens are sold publicly.

49.

Not all tokens are allocated to either companies, private or retail investors.

An overview of the most common token allocations:

1. Team - Tokens reserved for team members

2. Seed/VC - Investors (usually bigger companies) who got tokens at a discounted price

50.

3. Private sale - semi-private sale to a limited number of people, often community related

4. Public sale - sale to everyone

5. Foundation/marketing - a fund for the team to run the business/market the business

51.

6. Liquidity pool - tokens allocated to provide liquidity on DEX's

7. Staking-mining reward - rewards to people who stake or mine

52.

I can not tell you an allocation % for each point which is acceptable.

You need to look at the global picture and ask yourself if it makes sense that entity has that % of tokens.

The more tokens VC/seed & private have, the bigger the possible selling pressure can be.

53.

Staking/mining rewards are also important metrics.

Check if tokens have been allocated for this, or if they are being created.

The latter is a red flag since this causes inflation & negative price impact.

54.

Below an example of a horrible token allocation schedule from $KASTA.

If you look closely, you can see that only 2.5% of the tokens were available publicly.

They hide it, using different words like marketing/development/operations which actually all mean the same.🔥

55.

Look at their chart: Constant dumping each token unlock.

Take-away: Avoid projects with dishonest allocations which happened behind closed doors.

56.

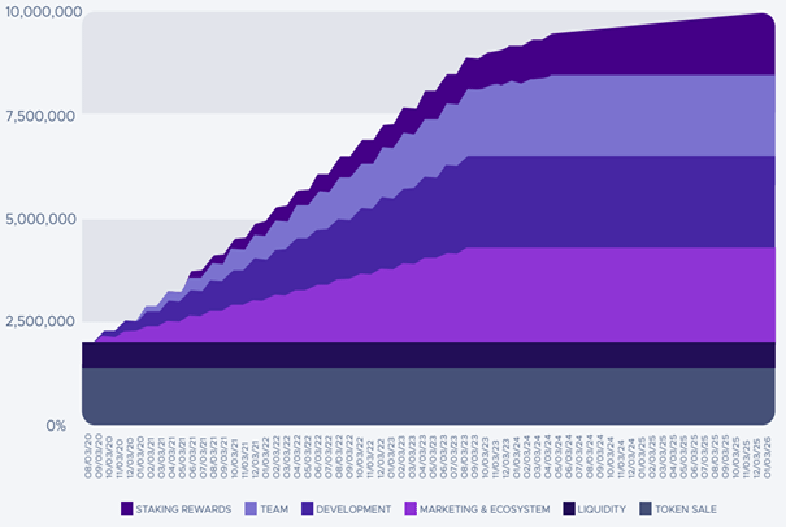

2.2 Vesting

Tokens are always subject to vesting, meaning they are released to tokenholders during different phases in time. Why is this important? Ideally tokens are released in small % and gradually. The longer vesting & the smaller the releases,the smaller the price impact

57. I prefer linear vesting, where during a fixed period of time, the same amount of tokens are released.

This way you know what's coming.

Big token releases tend to have a negative price impact, although projects often tend to release bullish news in the days before the unlock

58. I don't anticipate these unlocks by buying/selling.

They're often unpredictable and difficult to trade.

I just hold through them and I suggest you do the same.

59. Below an overview of a pretty typical vesting release schedule.

I particularly like that the private sale tokens have been released immediately, often a good sign.

This means that people who wanted to sell, often already sold.

60. Take-away:

Look at the vesting schedule & check if big unlocks are coming.

If a big price dumps happened and you don't know why, look at the vesting schedule if a big unlock happened.

61.

2.3 VC/seed price

Central question:

At what price did VC's get their tokens and what is the price now?

Why is this important?

An example below

62. Let's say a Venture Capital firm got 30% of the tokens of project ABC at 0.10$, before the public sale.

We are now 2 years later and you can see on the vesting schedule that the VC tokens will be released next week.

Coin ABC is trading at 5.00$.

63. If a VC firm invested 20.000$, they now have 1 million $.

You can rest assured they will lock in profits and sell a big portion of their tokens.

But what if the token was currently only trading at 0.25$?

VC's will be reluctant to sell at 'only' a 2.5X.

64. I can not stress how important it is to:

1. Check the VC price & compare it to the current price

2. Check when they will get access to their tokens

The above are the most important elements when evaluating the possible selling pressure.

65. You can usually find the info on VC price in the whitepaper.

I use cryptorank.io a lot as well.

They have a tab for most projects which shows the allocation & VC-price.

If I don't find it, I just ask it in the Telegram or via Twitter DM's.

66. Take-away:

Avoid projects where VC's are up big time and have big allocations which are yet to be released.

67.

2.4 Token utility

Central question:

What utility does the token have to the holder?

What incentive would a holder have not to sell?

A lot of excellent projects have poor token utility.

68. The worst stand-alone utility?

Governance. It's basically saying you can't come up with a utility. Utilities I like:

1. Staking/boosted APY

2. Discounts (on transactions for example)

3. Validation: you need to hold a % of tokens to validate the network and get rewards

69. Take-away:

Use VC/seed/private price & allocation (selling pressure) vs token utility (buying pressure). Preferably, buying pressure outweighs the potential selling pressure by a lot. There are other elements determining the buying pressure which I will discuss later on.

70.

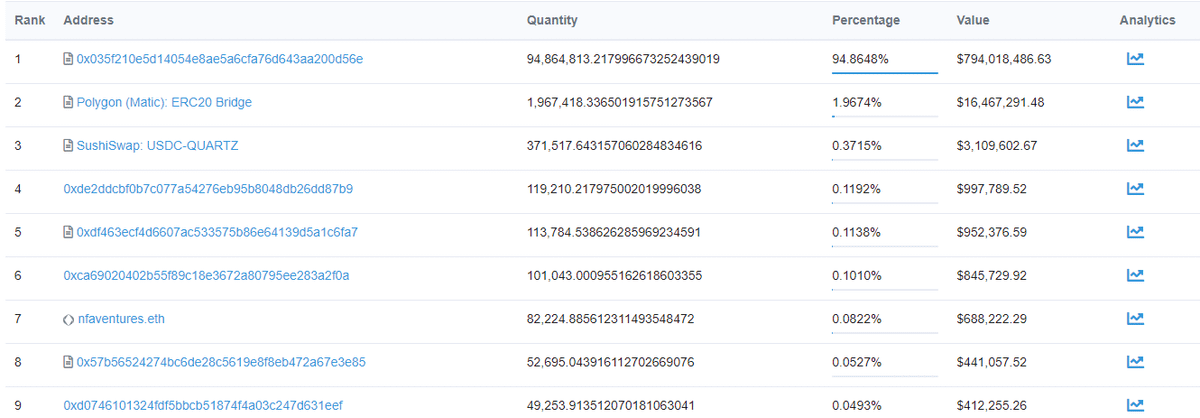

2.5 Wallet distribution

On block explorers you can see the wallet distribution.

It shows who holds what % of the token supply

Go to 'Holders' on any project and you can see all wallets with the amount they hold.

This is an additional selling pressure check.

71. Below the QUARTZ holders.

Only looking at private wallets, the distribution is fairly light.

The biggest holder is holding 0.10% of the supply, second biggest 0.08% which is reassuring.

No red flag, standard distribution.

72. Now let's take a look at the Kasta wallet distribution:🔥

There is 36 million $ sitting in 2 unlocked wallet accounting for over 7% of the supply.

I don't have to tell you what will happen if they decide to sell.

Who says they're not the same person?

73. I highly suggest you start using Etherscan if you don't already to check out the wallet distributions before investing.

Also verify if everything which is stated in the whitepaper is correct (team allocations, locked liquidity).

Explorers don't lie :)

74. If you come across a project, just go to etherscan and check the wallets.

Repeat a couple of times and you will start to get a good idea of average wallet distributions.

It's not possible to tell which wallet belongs to which holder.

75. 3. Team

Who is the team behind this project?

Are they public?

Why not?

Public teams have a huge advantage for me, which doesn't mean that anonymous teams are always a red flag.

76. Look up the team on Linkedin. As in business, elite teams usually deliver elite products. What previous experience they have? Look at their Twitter. Who do they know? Who are they following? Do they tweet from time to time? Type their name in Google etc, what do you find?

77. I often see CEO's/founders with limited crypto experience but often surrounded by a strong team of developers.

CEO's who lack experience is not exceptional and is definitely not a red flag.

A public team with experience in crypto is a big plus of course.

78. When I see things which are not clear when researching a project, I reach out to members of the team.

To get clarity on the subject, but also to see how they react.

How do they reply?

Are they trying to hide something?

How professional is their reply?

79. When I ask a question and I get replies like:

Lol, fudder.

Why do you want to know?

Jeet

...

I'm out immediately

I also avoid smaller teams (like 3 people) making huge promises, they usually fail to meet expectations.

80. Take-away:

Big, public & experienced team are very nice to have and a big plus to any project.

Team is an important criteria for me in my evaluation, but not the most important one.

81.

4. Narrative

Defi-summer

NFT season

Gaming & Metaverse

Layer 1's

During the peak of the above 4 narratives of 2021 you could launch any projects which fitted the narrative and people would buy them.

82.

There were games with a 2 billion $ valuation which didn't even had a working game.

I don't invest in projects only because they fit the current narrative.

I avoid investing in projects which don't have a strong narrative.

83. An example:

$RAZOR

Razor is a decentralized data oracle, a project with strong fundamentals and a promising product that can compete with Chainlink. Do you know what a data oracle is? Not many people do, which is exactly the reason I didn't invest.

84. A lot in crypto is driven by hype & narrative.

Even projects with the strongest fundamentals will fail to gain traction because lack of narrative fit.

Ask yourself: Do you see thousands and thousands of people buying into this project for an extended period of time?

85.

5. Catalysts & Marketing

Catalysts:

I invest in both new and existing projects.

It doesn't make sense to invest in older projects if they don't have any catalysts coming.

What else could cause them to gain traction again after all this time?

86.

Some common catalysts are:

1. Product/Mainnet launch

2. Central Exchange Listing

3. Collaborations with other projects

If a project has been dead for several months and it doesn't have any catalysts coming, it will stay dead.

87. Marketing. The marketing of a project is often underestimated. I always monitor the following channels closely:

1. Twitter

88. Do they post regularly? When was their account created & how many followers do they have? How much interactions do their tweets get? Who is following them?

89. Older projects with few tweets/followers are always a red flag to me.

You can have the best project in the world, if you don't spread the word regularly, your project is doomed to fail.

Remember, crypto is driven by hype, not utility.

90.

2. Telegram

Is there activity in the TG?

Is the team active?

Do they sound professional?

Are the mods up to date on the latest developments, or are they random strangers?

Does the team avoid certain questions?

91. I always spend a couple of days in the TG, just to get a feel of who's in there and what's being said. Thirdly I also check the website:

Is it professional? Clear?

Or does it look like it's made by a 5 year old?

If the first thing I see is a 'BUY NOW' button, I'm out.

92. Summary - doing research:

The above should give you a solid framework to start with. The best thing you can do now is start applying it to different projects, qualitative or non-qualitative. You'll start seeing similarities between both good and bad projects.

93. If you're lost, and I see you are doing your best and are not being lazy, I'll be happy to help.

Just please don't ask me questions like: what are your thoughts on ABC :).

94. Some things can only be learned with experience & experimenting.

I can not tell you how an acceptable wallet distribution or token allocation looks like for example.

It varies from project to project and depends on multiple factors. Stop reading & start doing.

95. The fastest way to learn? Each time you read a term you don't understand, look it up on youtube until you find the answer and fully understand the matter.

Keep on doing so. Don't be lazy, but don't hesitate to ask for help.

96.

3. When to buy

I always assume that worst case, a project goes to it's all time low. It's a very simple hypothesis which is very easy applicable which helps me estimate the potential to the downside.

Let's apply this hypothesis to 2 different projects as an example.

97.

1. Project 1

Look at the chart below.

Let's say the market goes to shit, or some FUD around the project spreads.

Most people who wanted to sell this project, already sold.

Sure it might go down another 10 - 20%.

But it's rather unlikely it goes down another 80 - 90%.

98. This thesis, and my whole strategy, is build around asymmetric betting.

Asymmetric betting is when you put your eggs in different baskets and win infrequently, but when you win, you win big.

In other words: Investing with limited downside and huge upside potential.

99.

2. Project 2💥

Now let's apply the same hypothesis to the chart below.

If the project below goes to it's ATL, you'll be down 80%, simply because all the people who bought before you are already in profit and might sell.

100. The above is a general rule of thumb which helped me a lot. Simple, easy, straightforward:

How far is the project from it's ATL?

I do make exceptions but try to limit them. The exceptions to this rule I make are usually on newer which reach ATH's more frequently.

101. From a macro point-of-view, my preferred buying periods are periods like the period we are in now: When there is no interest in crypto and everyone thinks the market is boring, it's usually a good time to start buying. Buy & sell before everyone else, it's as simple as that.

102.

4. When to sell

The number 1 regret.

Not taking enough profit.

Let's look at an example on why you should take profit below.

103.

Your portfolio is 10K. You take risks with small parts of my portfolio by investing into projects which can do multiple X's.

104. Say I invest 1000$ in a strong, bottomed out project. I have a small % of my portfolio in a project with huge upside and limited downside.

Good R/R

105.

Within 6 months, the project pulls a 10X. I now have a big part of my portfolio (100%) invested in a project which just did several X's and possibly can go back to it's ATL. The complete opposite of the scenario where we started from. The risk should be managed differently.

106. Alway take projects gradually on the way up, never all or nothing. Here is how I usually take profits:

Between 2x & 3X: take out 20 - 40 %

Between 5x & 10x: take out another 20% - 40%

If I believe the project has the potential to 50 - 100X I usually let the rest ride.

107. There is no general profit taking strategy which can be applied to all projects. Each project needs to be looked at individually.

Never marry your bag.

Take profits and move on.

Always keep 10% - 30% in stables to buy the dip.

That's how you get those monster gains.

108. Always monitor the socials of the projects you are following. If you start seeing a strong decrease in updates, milestones, communication it's probably a good time to start taking profits.

109. From a macro-point of view, when the market turns delirious, start selling. Last year we had projects pulling multiple X's daily, we had memecoins which entered the top 100 and we had games with a billion dollar valuation without a working game. These are strong top signals.

110. That was it :)

The above was a simplified introduction to my strategy.

I'm sure, on a long enough period of time, you can make lifechanging money if you apply it correctly, bull or bear market.

It's my thank you to you, my followers.

111. I've shared all my strategies but rest assured:

I will continue working hard, look for gems & share them on my twitter.

I'll continue to put out quality content in order to help you become a better investor.

/end