"A path to profitability"

It's what investors are demanding in this climate.

hims & hers is actually doing it:

hims & hers operates in telehealth.

It gets people video chat doctor's for stuff they may not otherwise want to talk to a doc in person about:

· Erectile Dysfunction

· Hair Loss

· Mental Health

Then it gets them subscriptions.

It's shown 5 main drivers on its path to profits:

Driver 1: Subscriptions are growing nicely

Growing subscribers is the number one engine of its growth story.

They are up 87% year over year.

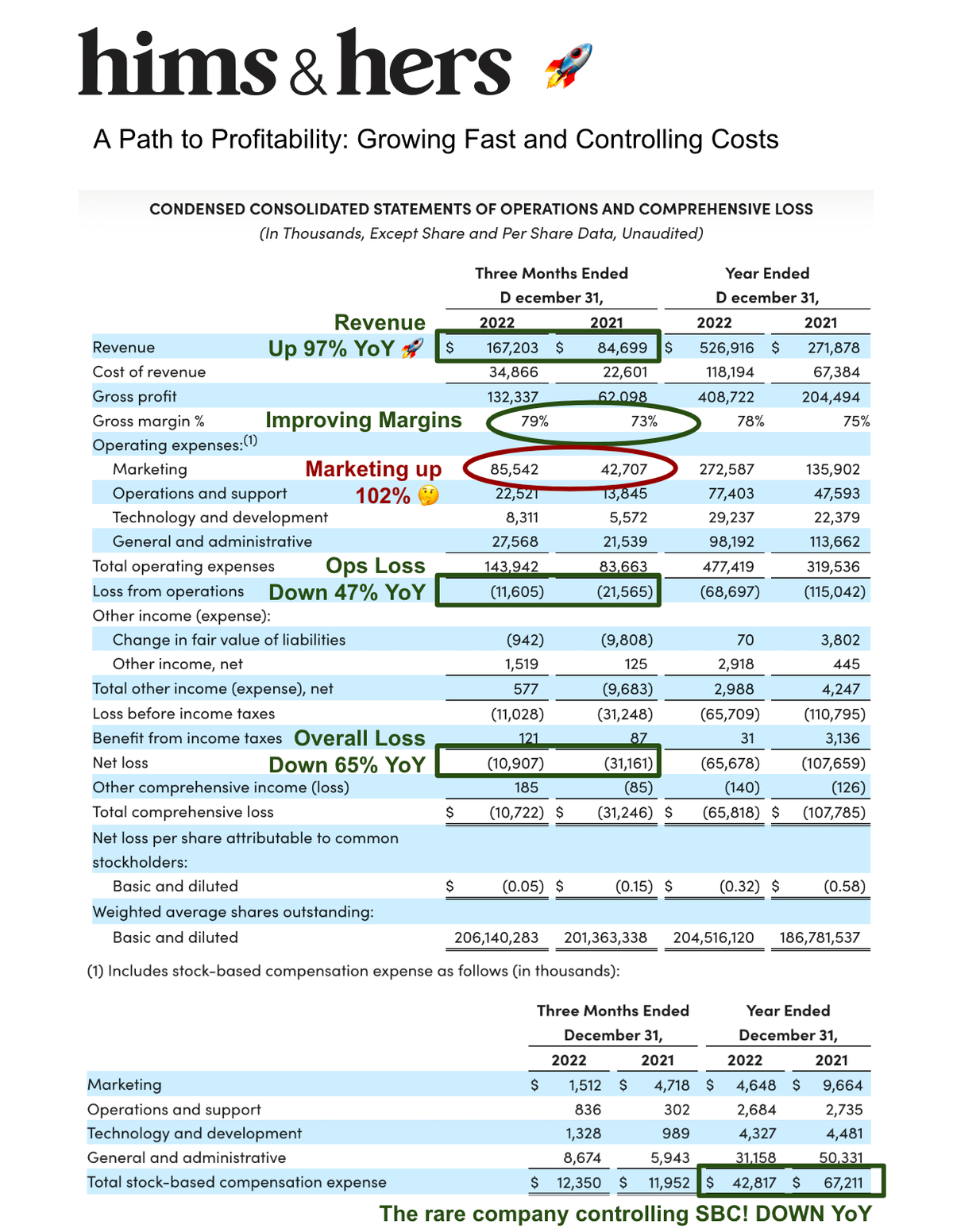

It continues to grow them via marketing (up 102% yoy).

It's also grown rev / sub 10%.

Driver 2: It's kept a lid on costs

Many of the other 2021 newly public companies have seen ballooning stock-based comp and other operating costs.

hims & hers hasn't.

SBC was actually down yoy.

That's far different from other 2021 market entrants.

Driver 3: The company is showing leverage

Revenue was up 97% but operating costs were only up 72%.

For every operating dollar spent, it's able to generate more revenue than last year.

This fundamental operating leverage is driving the company toward profitability as it scales

Driver 4: The economics for these products is quite nice

Many of the drugs hims & hers sales are generics.

These are proven products, like Viagra, that work.

But it's able to produce them without R&D.

Gross margin of 79% enables the company to re-invest in marketing.

Driver 5: It's building for a specific audience

hims & hers is a smaller niche player in telehealth.

It's building for millenials and city-folk who like its simple, modern branding.

By staying true to its core, it's able to eat away share from the leader, Teladoc.