Want to take your crypto trading skills to the next level?

Start by learning about these key chart indicators, click below for tips! ⤵️⤵️

1/n

DISCLAIMER: This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

2/n

1. Moving Average: Smooth Out the Noise

The moving average indicator helps to smooth out price action and filter out short-term fluctuations.

Read more:

twitter.com/YouHodler/status/1602229025044254721

3/n

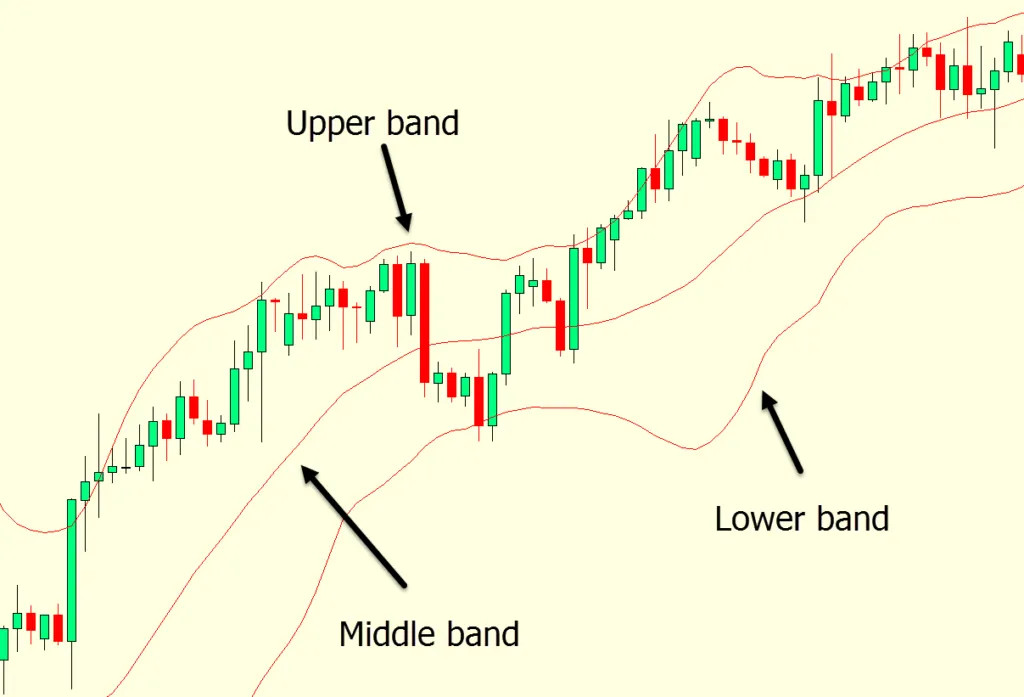

2. Bollinger Bands: Find the Perfect Entry & Exit Points

Bollinger Bands can help you identify overbought and oversold conditions, as well as potential breakout points.

4/n

3. Relative Strength Index: Measure Market Strength

The RSI indicator measures the strength of a crypto's price action, helping you spot potential trend reversals!

5/n

4. Stochastic Oscillator: Spot Overbought & Oversold Conditions

The stochastic oscillator is another tool for identifying potential trend reversals, particularly in overbought and oversold conditions.

6/n

5. On-Balance Volume: Track Buying & Selling Pressure

The on-balance volume indicator tracks buying and selling pressure, helping you spot potential trend changes.

7/n

Chart indicators are useful tools to help you strategize your trades to know when to enter or exit trades!

Use your new chart indicator knowledge at app.youhodler.com/multihodl and see your portfolio soar!

8/n