Testnet v1 is on the cusp of going live! 🦺

We've announced our trading competition and the participants, but one thing is left to be said. Why are we doing our Testnet in stages, and why does the first one include a trading comp?

A short 🧵 on our goals

👇👇👇

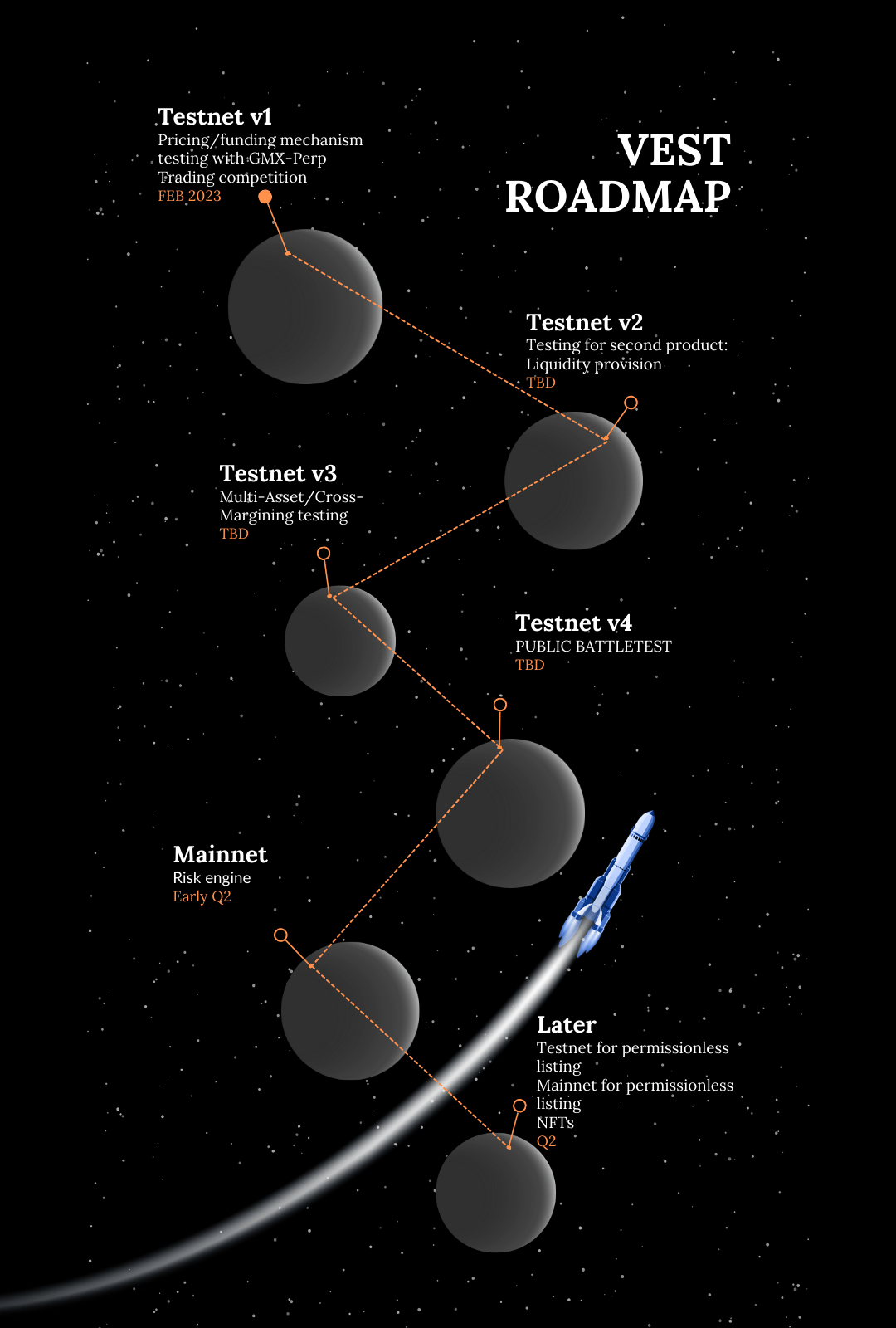

At Vest, we are focused on delivering 3 core features under our exchange. These are...

1. Long Tail/Permissionless Trading Functionality

2. Liquidity Provision Mechanism

3. Cross/Multi Asset Margining

We believe in the power of iterating on the design of our products to make them the best. As we've always said, at Vest we are 🦺community first 🦺.

Thats why we want community members to be part of this iterative process so that we can get live feedback.

Our first iteration of Testnet will be focused on our funding rate and pricing mechanism. This is at the heart of our exchange and will work alongside the risk framework we've developed to minimize the chance of our exchange defaulting.

What does this iteration mean for the end user?

They can stop worrying about the exchange getting rekt!

Why?

Our AMM addresses the marginal risk from the change in inventory using premium and rebate, while funding rates handle the risk caused by the change in the price process of the underlying asset.

All in all a more robust framework for managing the risk of trading perps, enabling us to list the long-tail!

In fact, the first asset we will be using for this Testnet version is the @GMX-Perp! 🔎 (🦺 x 🫐)

We are incredibly grateful for the patience and enthusiasm of our community with getting Testnet v1 out.

We love how you put the Vest on, let's keep the construction going!