Welcome to the one stop shop for top-tier Crypto VCs.

Founders have an impossible time navigating who they should even reach out too for their fund raising.

Let's get you introduced, bookmark this 🧵👇

1/18

If you enjoy this thread, follow @NFTomics {token} for venture capital, nfts, crypto, and macro deep dives.

P.S leaving out a top top tier few names like @variantfund @PanteraCapital @Collab_Currency @standardcrypto & more because i've highlighted them recently.

{Paradigm}

@paradigm backs disruptive crypto/Web3 companies and protocols with as little as $1M and as much as $100M+.

They have a deeply hands-on approach from the technical (mechanism design, smart contract security, engineering).

@FEhrsam @matthuang

paradigm.xyz/

{CMT Digital}

Founded during the genesis of the electronic trading era, the CMT Group has grown from an equity options market maker to a global investment firm.

@samiam2194 @CharlieSandor

cmt.digital/

{@slow}

Slow is an early-stage focused Venture Capital firm based out of SF/NY. They are generalists who invest in early stage teams and ideas ranging from Social Networking to Consumer Brands to SaaS, and Crypto.

@KevinColleran, @lessin

slow.co/

{@DCGco}

They are the capital engine supporting emerging talent & crypto tech. On its mission to accelerate the dev of a better fin-system.

@DCGco, parent of @Grayscale @GenesisTrading @CoinDesk @TradeBlock @LunoGlobal

@BarrySilbert

dcg.co/

{@Maven11Capital}

Maven 11 is a global blockchain and DA investment firm. Launched by a diverse set of serial entrepreneurs, investors, and blockchain builders, on a quest to solve most exciting problems.

@jochemwieringa @JCvdPlas @BalderBomans

maven11.com

{@a16zcrypto}

They back bold entrepreneurs building the next internet. a16z crypto is a venture capital fund that invests in crypto and web3 startups.

@cdixon @AriannaSimpson @alive_eth @jasonrosenthal

a16z.com/crypto/

{@polychain}

Polychain is an investment firm committed to exceptional returns for investors through actively managed portfolios of these emerging digital assets.

@zxocw @niraj @_caoimh

polychain.capital/

{@sequoia}

Sequoia partners a the earliest stages {even ideas}. First decisions can have an exponential influence on the curve of success.

Their style is not for everyone, they push when we see potential.

@charliecurnin @jimgoetz @divyahansg

sequoiacap.com

{@ElectricCapital}

Electric capital is a partner that has a deep understanding of community governance, token economics, cryptography, and distributed systems.

Founders can lean on them for technical support/ideation.

@AvichalGarg, @jubos, @puntium

{@multicoincap

Multicoin is a thesis driven investors that make long-term, high-conviction investments in category defining crypto companies and protocols across public and private markets.

@KyleSamani, @TusharJain_ @johnrobertreed

multicoin.capital/

{@paraficapital}

ParaFi employs a deeply technical approach to investing, leveraging the protocols & infrastructure. They've develop smart contracts, token economics, & backed top-tier founders/innovators.

@anjan_vinod @kyedidbotton @TraderNoah

parafi.com/

{@animocabrands}

Animoca Brands is working to deliver digital property rights to the world's gamers and Internet users, thereby creating a new asset class, play-to-earn economies, and a more equitable digital framework.

@ysiu @jennyqcheng @alanlau999

animocabrands.com

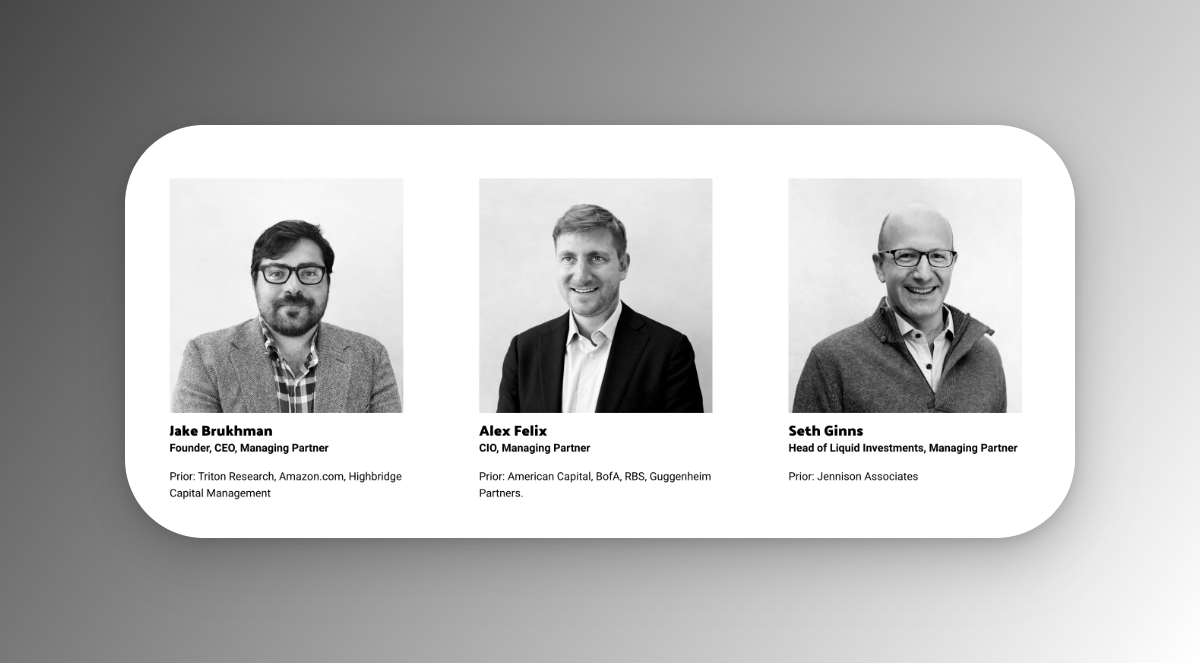

{@coinfund_io}

CoinFund partners with top leaders across seed, venture, and liquid. The team specializes in token design, decentralized networks, research, trading, market structure, engineering, brand strategy, law, & regulation.

@jbrukh @flexthought

coinfund.io

{@hiFramework}

Framework partners with founders and teams to build token-based networks. They are deeply technical on cryptoeconomics, governance, and community to scale.

@pythianism @im_manderson

framework.ventures

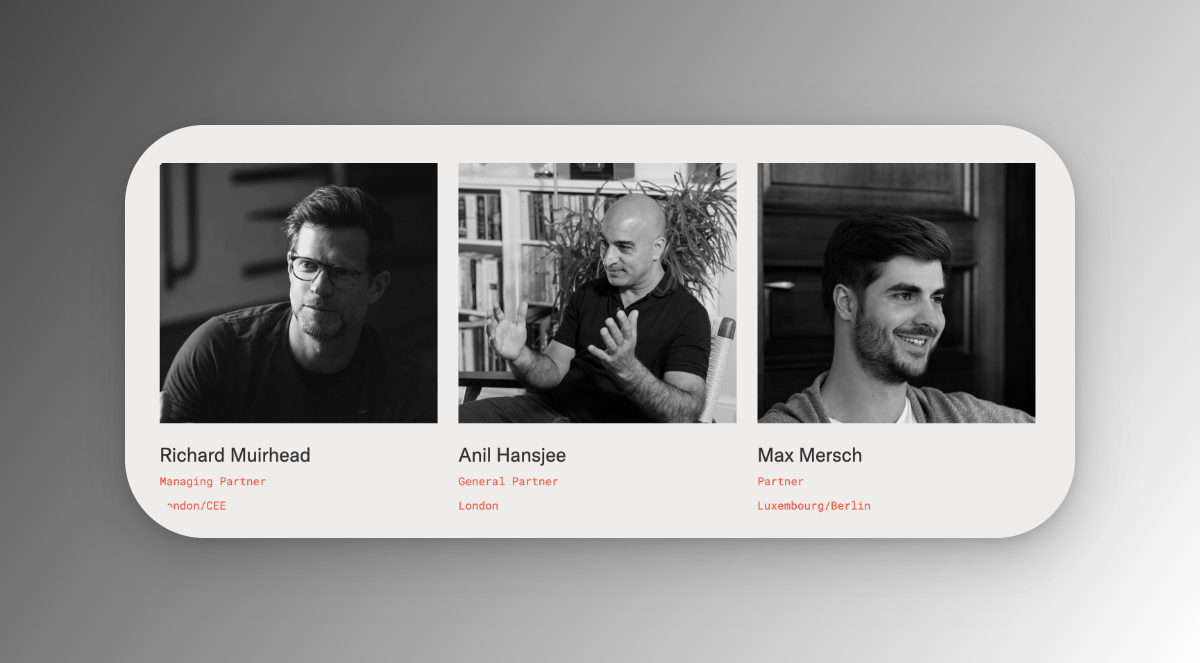

{@Fabric_VC}

Fabric have been investing in builders, businesses, and networks

from inception to scaling since 2012. The team has a keen focus on open-networks, decentralized eco, and founders who can scale rapidly.

@richardmuirhead @ahansjee @MerschMax_

fabric.vc/

{@1kxnetwork}

1kx helps exceptional founders bootstrap token networks. Their community focus is second to none, and they are hands-on advisors to the creation, design and iteration of token models.

@pet3rpan_

1kx.network/

{@jump_}

Jump is composed of builders, partners, and traders, inspired by the possibilities of open, trustless, and composable environments. They are deeply technical on multiple front / in the weeds building.

@KanavKariya

jumpcrypto.com

{@placeholdervc}

Placeholder is a venture capital firm that invests in decentralized networks and web3 services. They invest/think in terms of funding teams, & funding networks:

placeholder.vc/blog/2019/1/10/funding-cryptonetworks

@cburniske @jmonegro

placeholder.vc