Fundraising is hard:

How to supercharge your Web3 fundraise 🧵👇

12 step from planning to pitching a "founder friendly guide".

(1/16)

Fundraising is all about shots on goal, and strategic introductions.

How does one build a robust fundraising strategy: You need to have enough investors in the pipeline, a great pitch, and some prudence in navigating VC.

Let's talk about the secret sauce of venture capital.

1. Create a Target List of Investors

Use free tools like Airtable.com to put together a target list of investors, put these investors in three buckets:

1. Priority (10 names you die to have)

2. Tier 2 (20 names you like)

3. Tier 3 (30 names you like)

2. How to find investors?

Network with fellow founders, example (didn't actual happen but), I hit up my friend @armaniferrante because they raise from @multicoincap / @_Frictionless_ & more.

He may introduce me to @SolanaLegend or @LoganJastremski who may lead my round.

2.5 How to find investors?

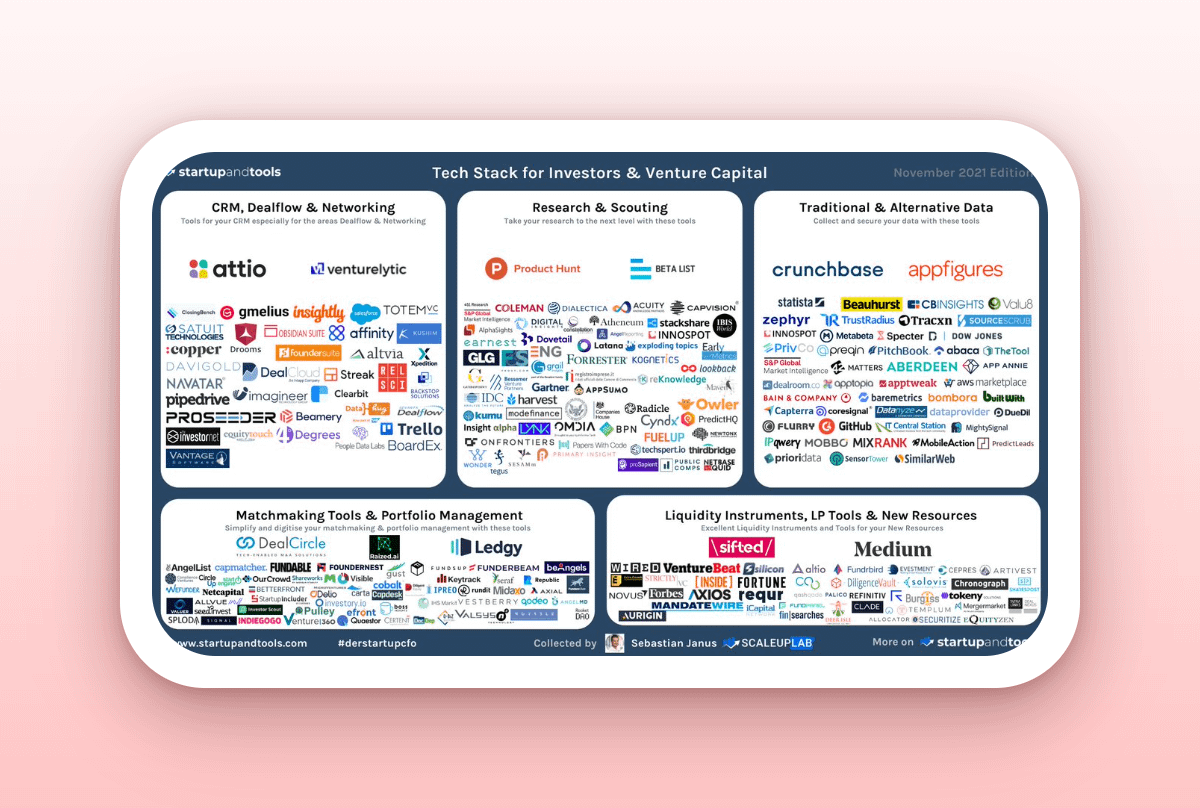

You can also utilize @Pitchbook, @Crunchbase, @Preqin (don't have them, ask a friend).

If the institutional route isn't for you consider high net worths or syndicates.

@n00unsdao @MonkeVentures @ABCV3NTURES @Meta_Cartel @solBOOGLE ... DM for more.

3. Diligence Your Investors

Once you find potential names for your list, what's next? Sounds simple, but visit their website b/c every VC has a list of portfolio investments (filter by sector) - see if you'd be a fit.

Examples: greycroft.com/ initialized.com/companies

4. Getting Ready to Pitch

I know what you're thinking, let me hit up my priority (10 names). Many founders do this, and maybe you'll get an intro but those pitches are the roughest.

Cut your teeth on the 30 tier-3 names, get feedback, refine your pitch (you'll be yuga one day).

5. Getting in the Groove, Master the Subtleties

Every investor call starts with small talk, intros, then founder dives into the pitch.

- practice your intro

- practice your transitions

- hold your questions for the VC till the end, it's your time to wow them, not ask questions.

6. The Honest Truth

Everything is narrative based, and you need to get past the intro call.

If the associate/vp you're meeting w/ doesn't understand your value prop instantly or if they can't regurgitate your story to their team on a weekly call, you're not getting a second one

7. Bulk of the Pitch

Use the deck as a guide and not a crutch, don't read word for word but use the slides to help weave a story/narrative.

- Length: Keep the deck less than 15 slides.

- Intro: About your company/fund

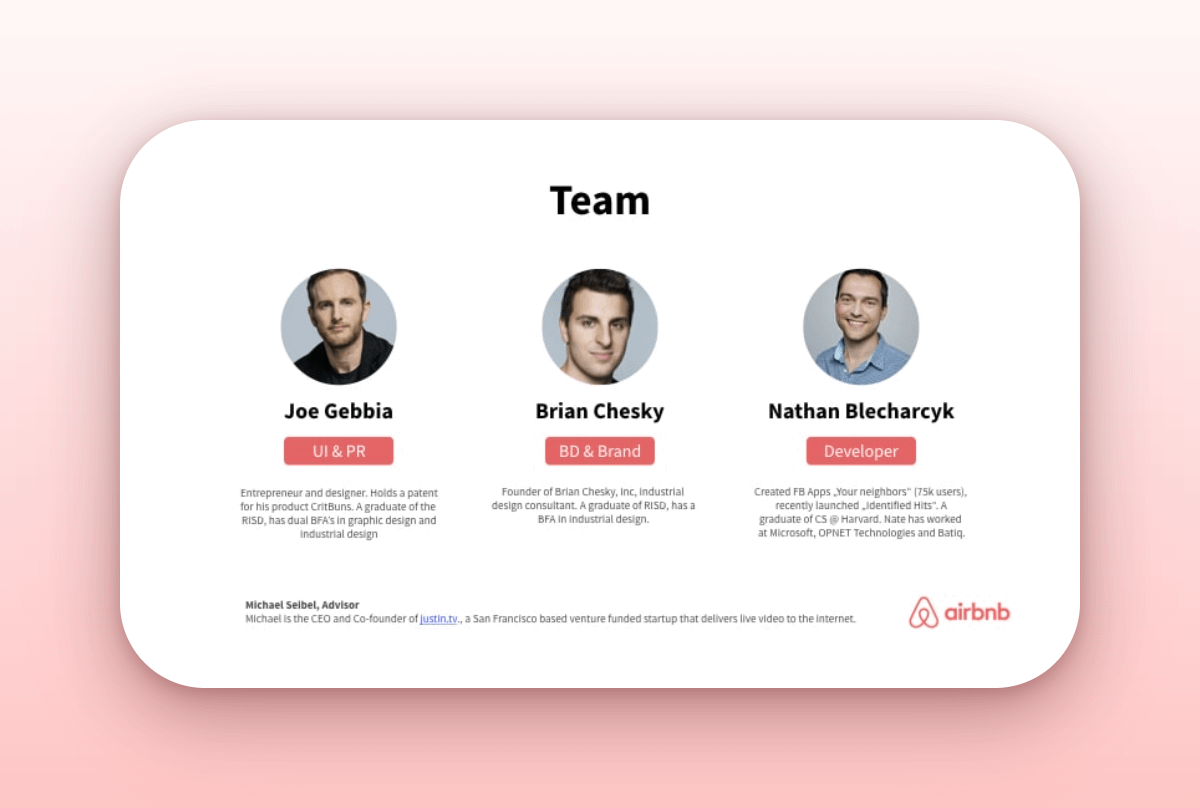

- Team: Background/headshot

- Market: Explain the story

8. Timing of the Pitch

One thing you need to remember is the time of the meeting drastically effects your ability to tell the story. Have three different versions of your pitch:

- 30 minute pitch (the basics)

- 45 minute pitch (more detailed)

- 1 hr pitch (the full story)

9. Closing the Pitch

End with terms (if you are a fund) or target raise (if you are a company), this is your time to:

- highlight who else is in the round (bullish signal)

- explain that you're looking for a lead or already have one

- ask questions about ticket sizes & more.

10. Following up

Every VC will tell you to give them a few weeks so they can circle back with their team.

The reality is, if you meet on a Tuesday it's likely your POC will present the deal to the team on Friday or Monday.

If they like you they'll follow up the next week or 👇

11. Following up (pt 2)

If they need some more time to convince their team it could be (2-4 weeks) but don't lose hope, after a week reach out via email, thank them for the meeting & send them some interesting news about your company.

Another week passes, try again. But don't👇

Don't be too pushy as you never know if now is just not a good time, I've seen investors ghost only to come in to your round (series A) because you KILLED it over the last two years.

Don't burn bridges or be an over-pushy company - patience is a virtue.