Missed the 2023 State of Crypto by @a16zcrypto?

{Here's the TL;DR}

- New tech, once impossible, is now very real.

- Next-Gen L1s are growing in users/devs.

- DeFi/NFT activity is on the rise.

Comprehensive Thread 🧵👇

1/20

If you enjoy this thread, follow @NFTomics {token} & my substack tokenthreads.substack.com/ for venture capital, nfts, crypto, & macro deep dives.

Market Statistics: a16zcrypto.com/stateofcrypto/

Full-Version: a16zcrypto.com/content/article/state-of-crypto-report-2023/

Source: @a16zcrypto @ElectricCapital @_Frictionless_

{State of Crypto}

1) Progress - New builders are entering web3 at a rapid pace & academic research is accelerating.

2) Setbacks - noise drowned out signal w/ negative events dominating headlines & high-profile collapses @FTX_Official

3) Regulation - a shifting reg environment.

{State of Crypto II}

Market cycles - The “price-innovation” cycle continues. Rising prices are a leading indicator for innovation.

Numbers generate interest, which spurs ideas and activity, which leads to innovation.

Opportunity - decentralized infrastructure, L1s & web3

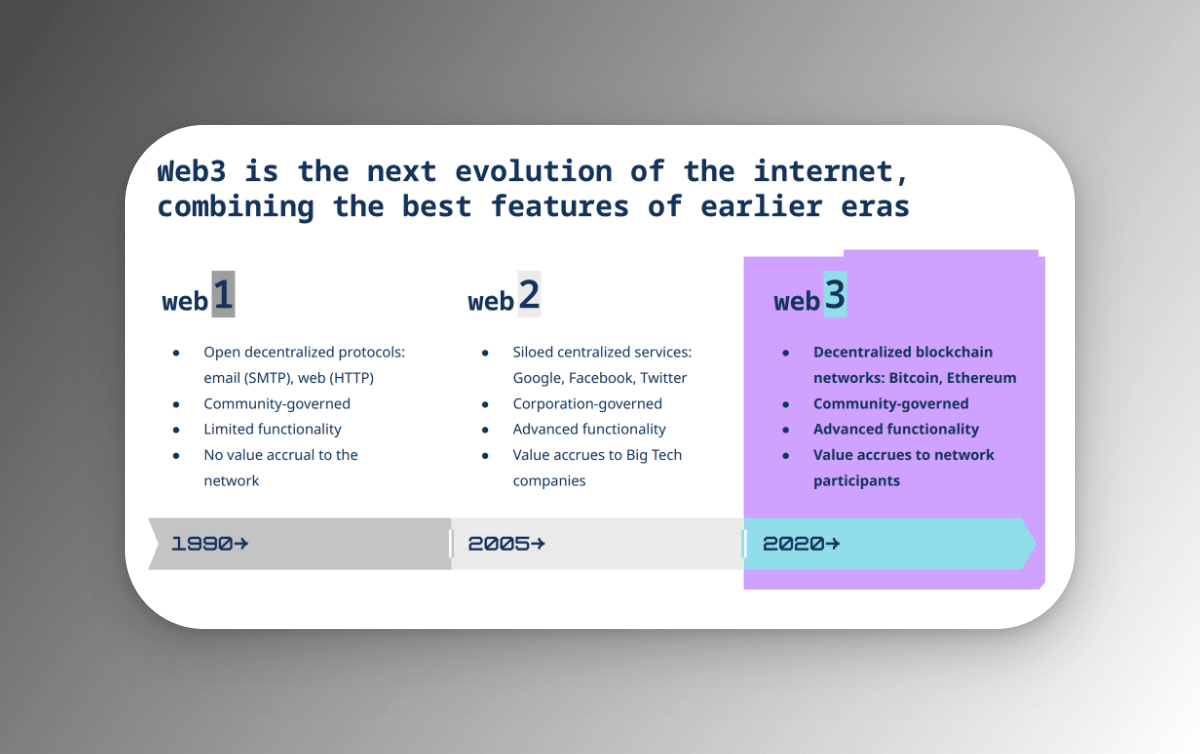

{Ownership & Democratization}

1) Web1 and web2 democratized information and publishing. Web3 democratizes ownership.

2) Users have more power, and earn a greater share of revenue, on web3 versus web2 platforms.

3) Web3 counterbalances the trend toward internet consolidation.

{Market Cycles}

It is a positive feedback loop = drives crypto market cycles.

2) there is apparent chaos has underlying order - as the market has undergone four cycles, each bigger than the last.

3) with great products get built regardless of financial upswings and downswings

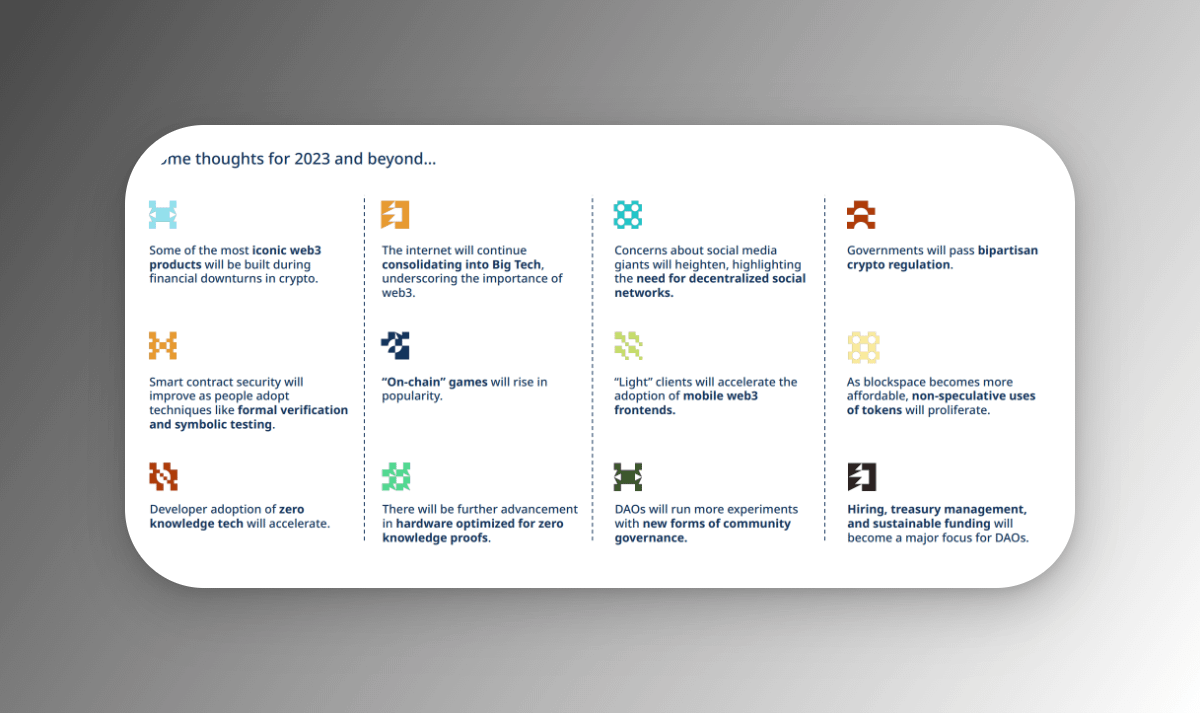

{Trends to Watch}

Blockchains are scaling through multiple promising paths including next-generation chains like @solana @aptos @SuiNetwork (w/ investors like @_Frictionless_ being at the bleeding edge).

++ applications like @xNFT_Backpack leading the charge on these chains.

{Trends to Watch II}

2) Many blockchains are extending rollups via scaling @Ethereum.

3) Staking transforms collateral into outsized economic security.

4) Uses for zero knowledge (@zk) proofs are becoming tangible.

{Trends to Watch III}

NFT creators have earned more than $1.9 billion in royalty revenues - but the battle for royalties via @tensor_hq @MagicEden @opensea @blur_io still is on-going.

The worlds biggest brands are exploring NFTs on @solana @ethereum & @0xPolygonLabs

{Trends to Watch IV}

Web3 games are a huge opportunity to welcome new users to crypto with @yugalabs leading the pack.

However, next-generation chains like @solana are built for handling high-throughput games - gaming adoption across chains is still up in the air.

{Trends to Watch V}

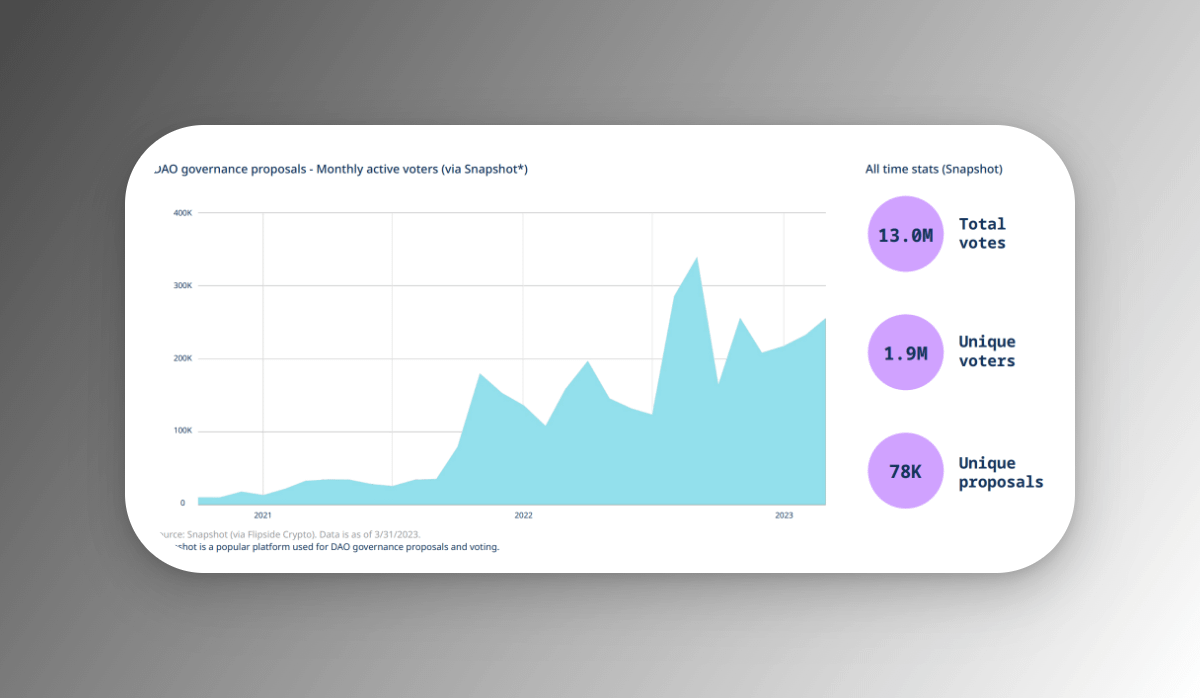

Participation in DAO governance is growing on both the DAO & sub-DAO front - think @n00unsdao @FLAMINGODAO @nounsdao

{Trends to Watch VI}

The U.S. is losing its lead in web3 & regulation is looming.

1) Banning new business models or technologies undermines American values.

2) Agency guidance may protect consumers & help web3 grow.

3) Legal businesses deserve access to data privacy.

{Market Metrics}

Tech markets are a function of supply and demand, or innovation & adoption.

1) Bull markets attract new developers who are sticking around

2) 50K+ devs interact with crypto-related Github repositories monthly

3) NFT tooling has driven exponential dev growth

{Market Metrics II}

Verified smart contracts are at an all-time high, indicating a robust pipeline of product launches.

1) Core crypto dev library usage is increasing.

2) Significant increase of academic research.

3) Rising crypto prices generate interest in crypto jobs.

{Adoption Indicators}

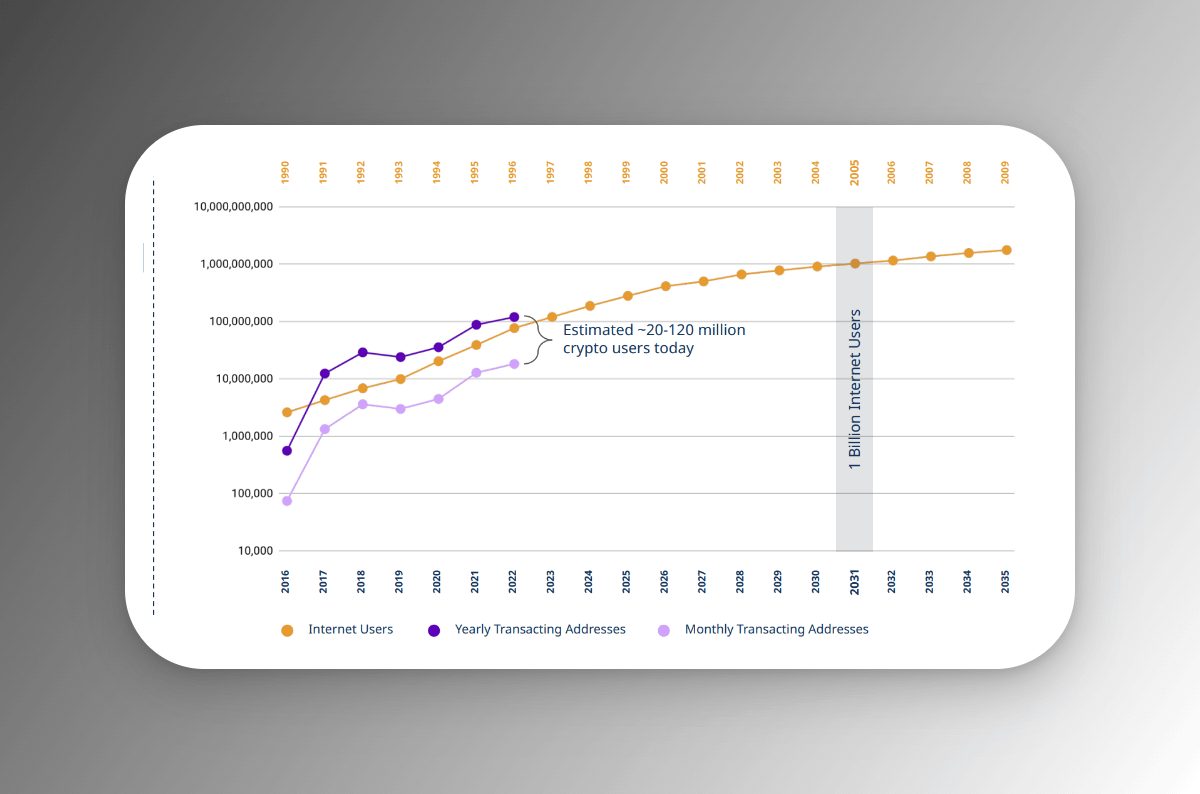

1) Active addresses are growing steadily as web3 adoption increases.

2) Blockchain transactions exploded as scaling technologies reduced transaction fees.

3) Fees increase as demand rises, but decrease as scaling tech supplies more blockspace.

{Adoption Indicators II}

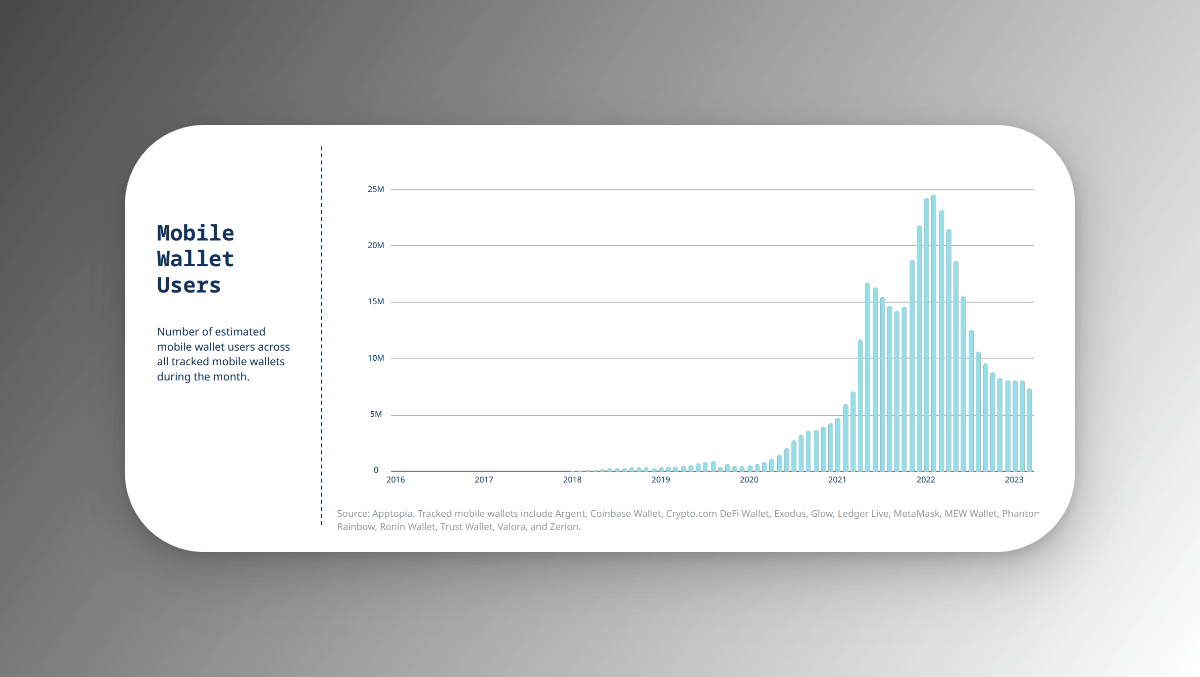

The number of mobile wallet users has declined over since early 2022 - however, next-gen blockchains @solana are moving into the mobile space via @solanamobile.

With 1000s of applications to the solana.com/news/solana-grizzlython-winners

1st Tap

2nd AquaID

3rd dReader

{Adoption Indicators III}

1) Decentralized exchanges are trading over $100b monthly amid market volatility

2) After a speculative period, the number of NFT buyers appears to be rising again

3) Despite market fluctuations, the demand for stablecoins remains high

{Conclusion, What's Next}

It's early: Internet users vs. unique active addresses (log scale)

{Conclusion, What's Next}

How @a16z / @a16zcrypto sees this playing out.

If you enjoy this thread, follow @NFTomics {token} for venture capital, nfts, crypto, & macro deep dives.

Make sure to follow my substack/threads here: