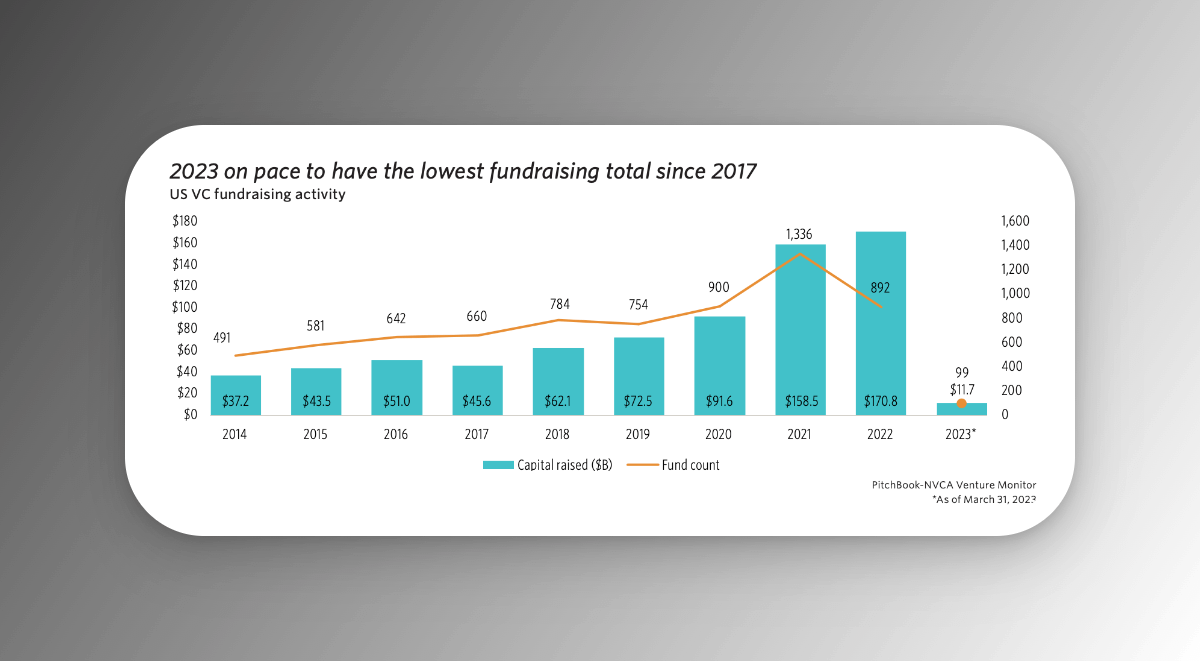

Struggling to fundraise? You're not alone, the entire market is screeching to a halt in Q1.

How to optimize your process so that you you can be one of the few who raises in this bear market.

{market overview 🧵👇}

1/8

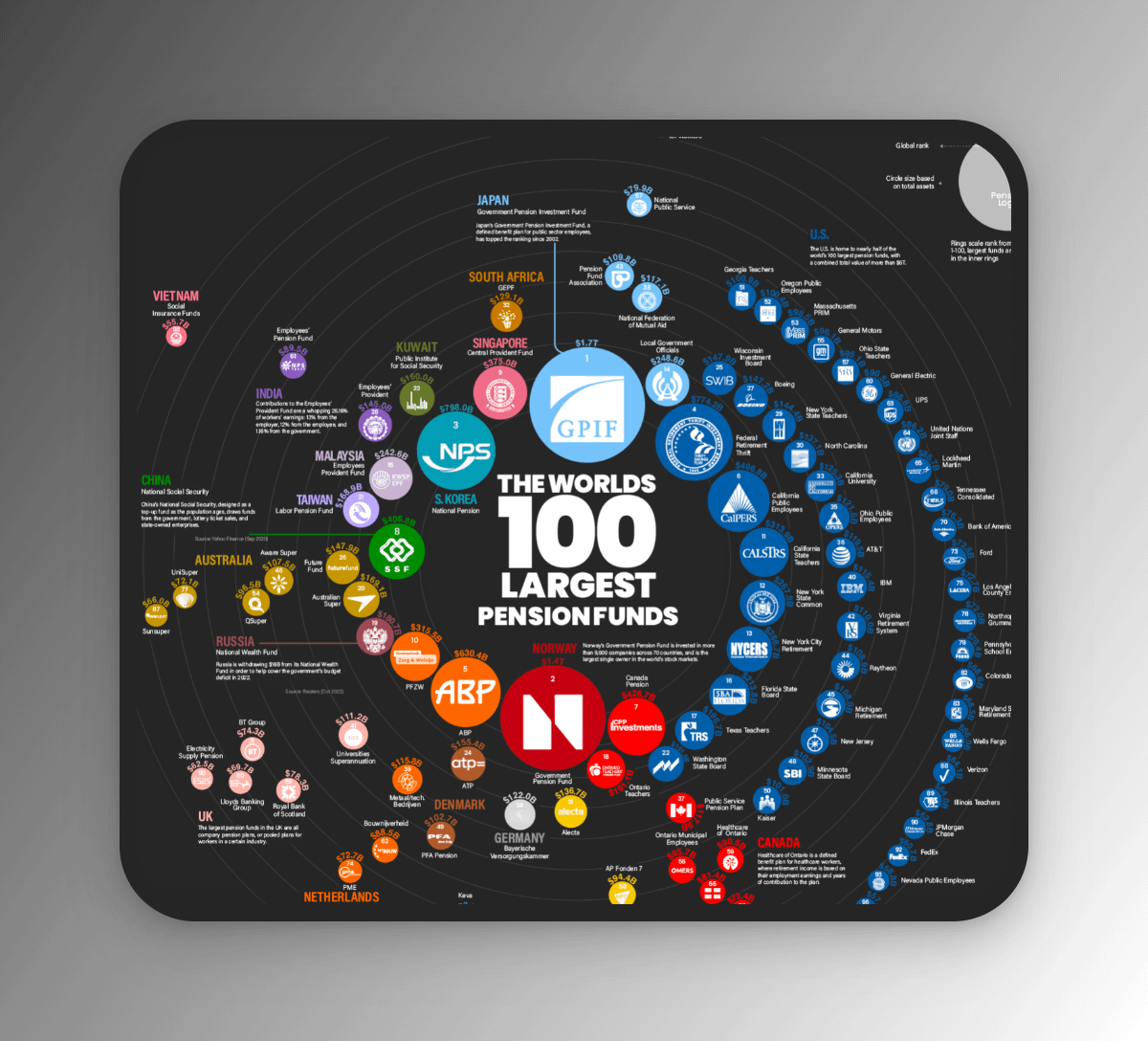

The TL;DR is public markets impact --> private late-stage which impacts --> private early stage = existing investors (pension, sovereigns, high networths) aren't deploying into funds who can't deploy into directs (cycle restarts).

Follow @NFTomics {token} for more like this.

{the great reset}

Let's talk about the “great reset" in Crypto (Tokens), Public (Stocks), Private (VC) Markets.

The fallout from the startup industry's exit slowdown continues into Q1, with managers and startups alike feeling the very real & painful "fundraising fatigue".

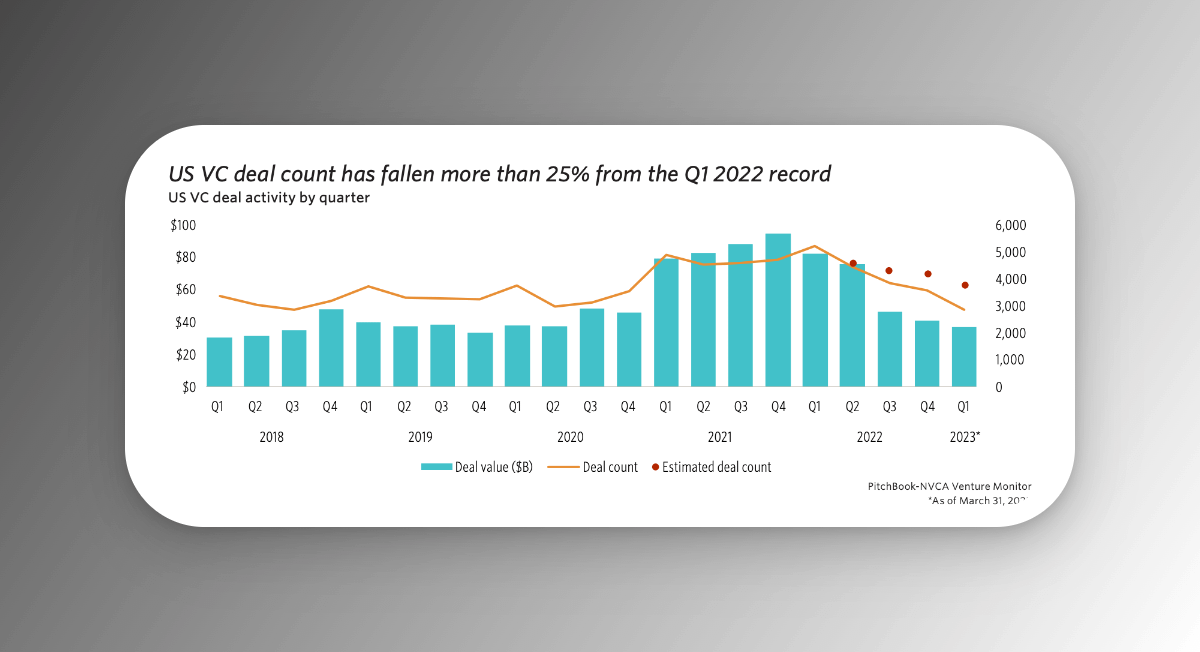

{late-stage is starting to crack}

Late-stage deal value is nosediving, declining for the 7th straight quarter to $11.7 billion.

When stocks that were trading at 35x --> are now 10x (EV /RR), which trickles down into what late-stage VC investors are willing to pay (Series D+).

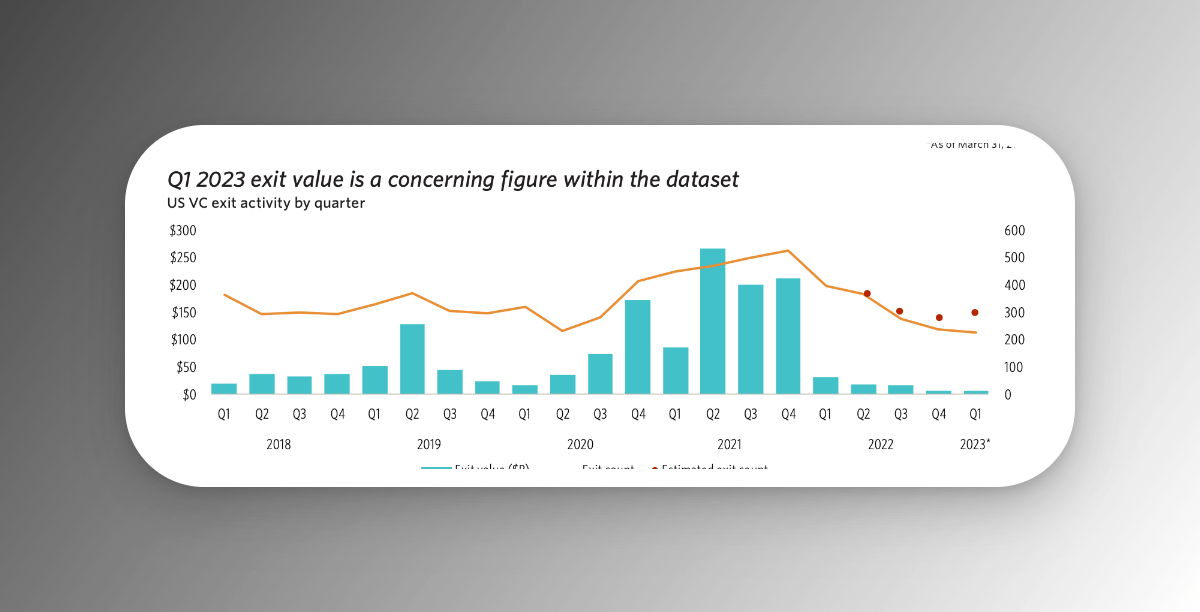

{exit environment}

Just $5.8 billion in exit value was closed in Q1. That is less than 1% of the total exit value generated in the record year of 2021. With IPOs unattainable (only 20 public listings in Q1) according to @pitchbook.

Lack of exits = pressure on late=stage

{mega-rounds}

Just 19 mega-rounds occurred in the Q1 2023, compared with 98 in Q1 2022

This has widened the funding gap between startups seeking capital and investors willing to provide it, which is putting pressure on $

This is also driven by the concerning exit environment👇

{late-stage}

In Q1 2023, the median late-stage VC pre-money valuation fell 16.9% from the 2022 full-year figure to $54.0 million, while the average pre-money valuation declined by more than $100 million to $159.1 million

lower valuations that correlate w/ a falling deal count👇

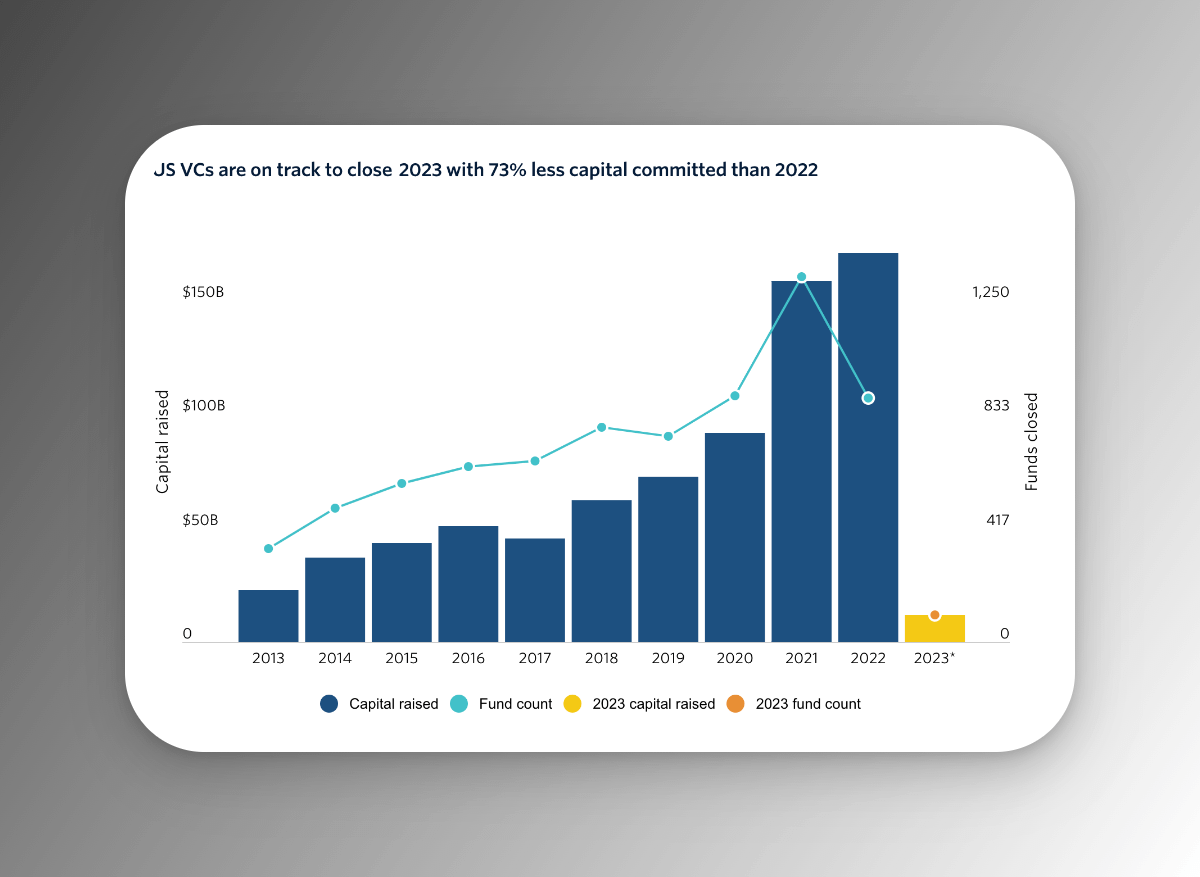

{how does this impact fund managers}

Remember the largest backers of funds are pensions, sovereign and endowments. Most are exposed to public markets & direct investments.

They are cautious to deploy into new funds, due to existing performance & a poor direct environment.

{first-time fund managers}

FTFs are in for a particularly tough run if they're hoping to raise this year. Debut VC fund closures plummeted from $21.6 billion in 2021 to $10.3 billion in 2022. They're on track for an even steeper drop.

public > mega > late > pensions > FTFs

{What should you do?}

Here's my advice👇

twitter.com/NFTomics/status/1638661858378010624?s=20

twitter.com/NFTomics/status/1636125136951869440?s=20