#Budget2022 Crypto tax: 194S TDS at 1% on Sale consideration. There seems to be a lot of confusion on what it means.

Let's put the Tax hat 🎩on & start digging :)

Note: I will try to simplify and cover in detail along with images/videos

#reducecryptotax @CryptooAdy

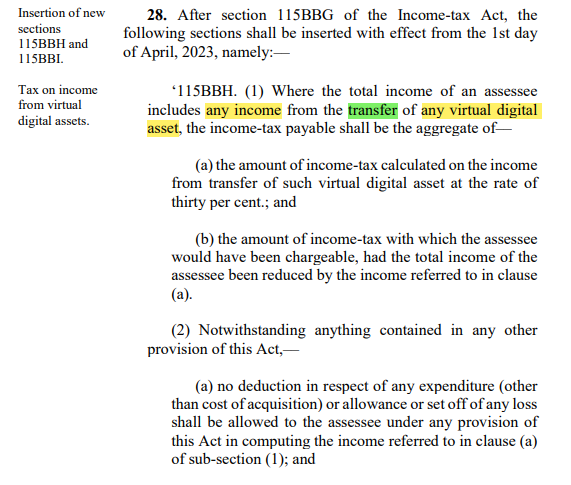

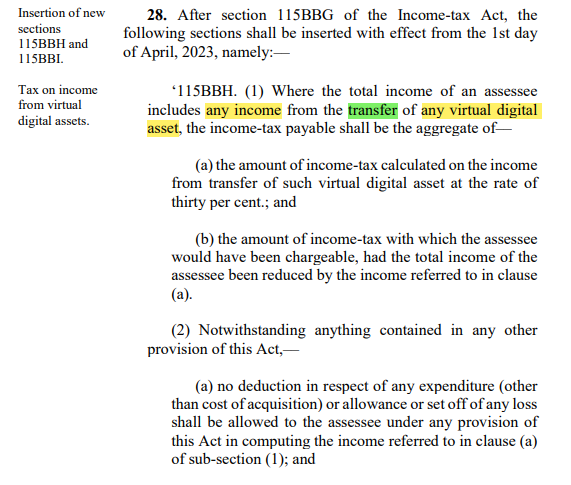

Section 194S as per Finance bill (Ref: Image)

So, there are 3 main points in this section,

1. Any person

2. Paying to a resident

3. Transfer

Let us understand with example the meaning of these points.

(2/21)

Ex: Mr. Vinod wants to purchase 1000 USDT. He paid Rs.80K his friend Mr. Rishi & acquired 1000 USDT.

Ref: Image for explanation of each point.

So as per Section 194S, Vinod (any person) paying to Rishi (resident) for purchase of USDT (transfer). –

(3/21)

In this case, Vinod will have to deduct TDS at 1% on Sale value & pay balance amount to Rishi.

TDS deducted & paid to Govt. by Vinod = Rs. 800/-

Payment to Rishi = Rs. 79,200/-

(4/21)

Next Question is,

Will TDS apply on trading in exchanges & if yes, how will we deduct TDS since we don’t know the details of the seller.

- Yes, TDS will be applicable on trading in exchanges. (how to deduct is covered in - (15/21)

Let us understand why TDS will apply:

(5/21)

There are 2 parts to this,

1. Decoding section 115BBH & 194S

2. Finance minister’s comments

First let’s decode the sections:

1. Section 115BBH & Section 194S both are applicable only when there is “Transfer” of Crypto assets

(Ref: image-115BBH, 194S covered in (2/n)

(6/21)

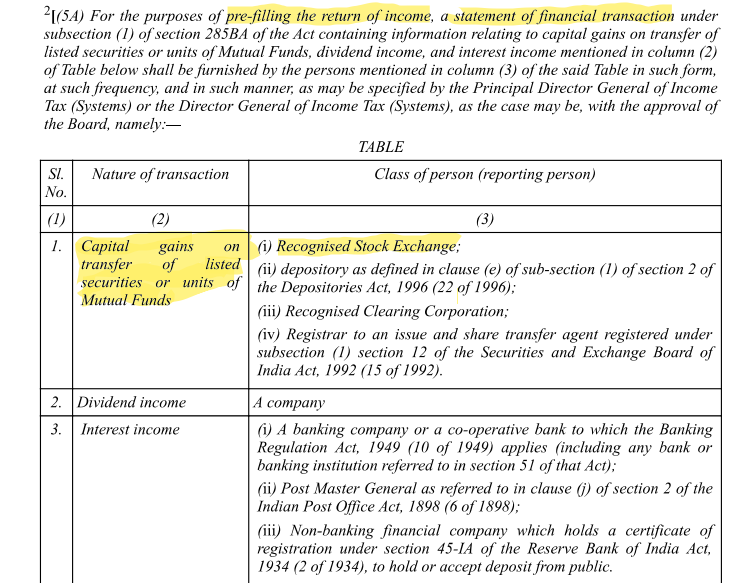

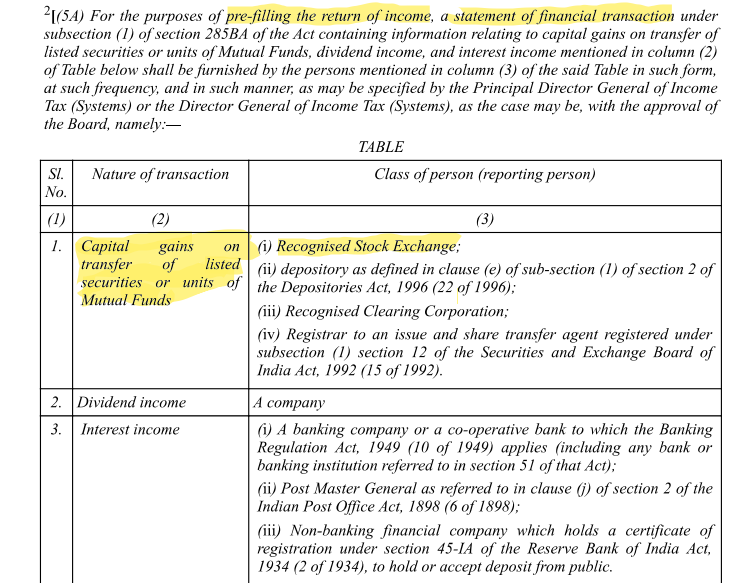

2. Transfer means Sale or Exchange or Surrender of crypto asset. (Section 2(47) - {Ref- Image}

3. When trading on exchange, there is a “transfer” of crypto assets. TDS @ 1% will have to be deducted on sale consideration.

(7/21)

Why is 194S even required?

- 2 reasons.

1. Currently, Crypto exchanges have “no legal obligation” to disclose trading activities of users to IT dept. unlike Stock exchanges (Ref: Sec 285BA, Rule 114E)

Hence, it is necessary to have a mechanism to obtain trading data.

(8/21)

Reason 2:

Users are engaging in lot of P2P transactions, the information of which may not be available with IT dept. nor is it easy to track down such activities from banking channels.

Hence, TDS is brought to have a trail of transactions.

(9/21)

Let's analyze FM's comments:

1. Budget speech: youtu.be/1wFAR58EuV8

“To capture the transaction details, I propose to provide for TDS on payment made in relation to transfer of virtual digital asset at rate of 1% of such consideration above a monetary threshold”

(10/21)

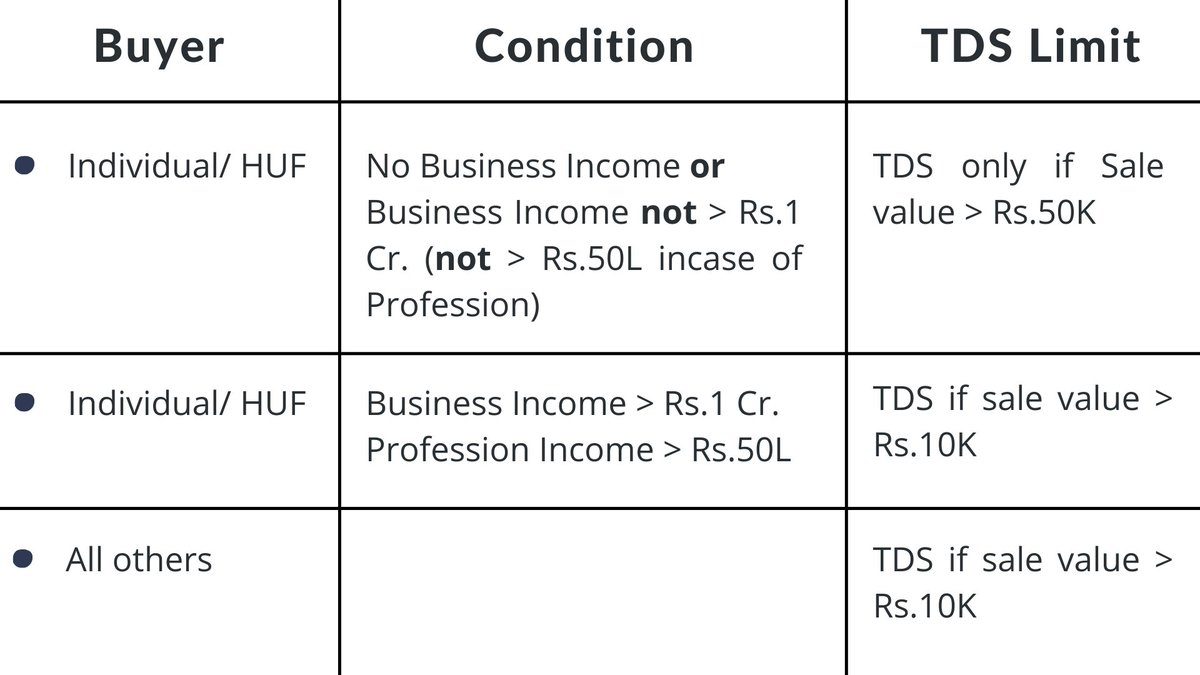

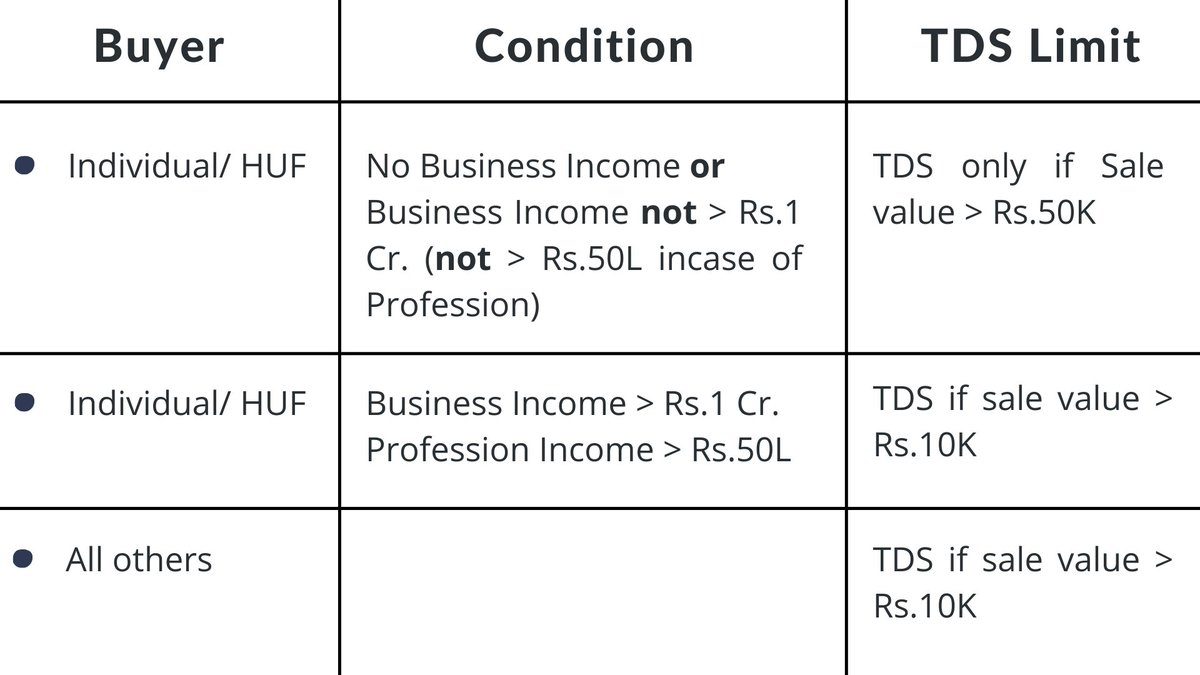

Meaning: TDS will have to be deducted on every transfer of Crypto above a certain limit.

(Ref: image for TDS limits)

*Limit: Sale value check is per transaction or in total, if it exceeds limit then TDS.

(11/21)

2. Post budget Interview: youtu.be/0y2EI0H0kew

“Transacting that asset, if profits are being made we are taxing profit at 30%. We are also tracking every trail of money in that by saying *every transaction will be 1% TDS* imposed on every transaction in crypto world”

(12/21)

Meaning: Every transaction will be at 1% TDS

3. Interview with a Sansad TV:

“Profit earned on transactions made in private cryptos will be taxed at 30% and TDS at 1% also on that.”

{I have translated: hindi to english}

Meaning: Every transaction will be at 1% TDS.

(13/21)

Now that, we have discussed at length what both, the Section is trying to convey and what the FM has conveyed in various Interviews and also budget speech.

Let us discuss the last part, How will TDS be deducted for trading on exchanges.

(14/21)

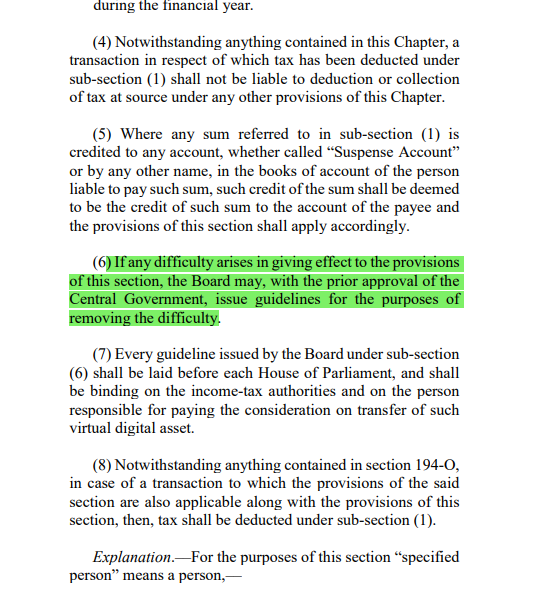

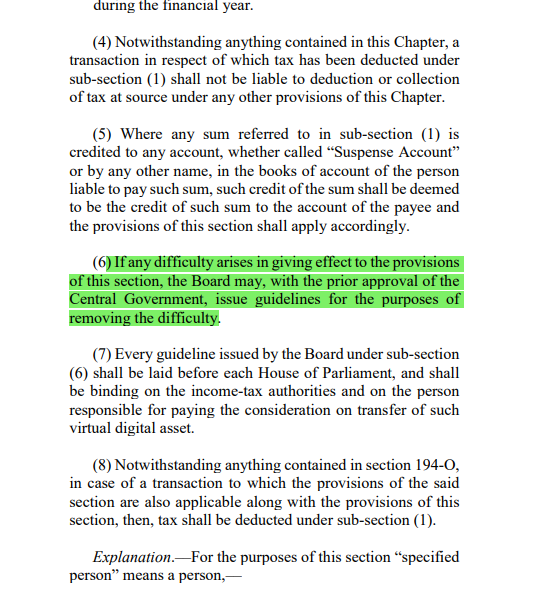

Sec 194S(6) provides IT Dept. to issue guidelines if any part of section cannot be implemented. (Ref: Image).

Imo, IT Dept. will ask exchanges to deduct TDS on behalf of Buyer & remit to Govt. This is the easiest way out.

Note: Requires parliament approval.

(15/21)

We have completed the analysis.

I will summarise the discussion:

“every” transaction exceeding TDS limit, & where seller is resident, TDS at 1% on Sale value is applicable.

TDS will have to be deducted on both, Crypto-INR and Crypto-Crypto trading pairs.

(16/21)

community Q's:

1. TDS will not apply on trading. It is only on transfer of Crypto

- Transfer means Sale, Exchange or Surrender of asset

Ex: Aditya buys 1 BTC at $36K & sells at $40K.

Sale at $40K is a transfer of asset (bitcoin). Hence TDS to be deducted.

(17/21)

2. Can TDS on trading in crypto exchanges be exempted?

- Yes it can be.

Since, Budget is "yet to be passed" by parliament, Government can make changes to section 194S to exempt crypto exchanges from TDS.

(18/21)

Process for exemption may be as below:

1. New “Transfer” definition to be included in Sec. 194S to exclude "on-exchange" transactions.

2. Alternative mechanism like SFT (similar to Stock Exchanges) be implemented to ensure trail of transactions.

(19/21)

3. Can IT Dept. guidelines provide for exemption to TDS on exchanges?

- Imo, No. Since, Transfer definition has to be changed, guidelines can't do that.

Guidelines can aid in interpreting the law. But they cannot define the law in itself.

(Like how runner cannot bat)

(20/21)

With this, I have tried to explain the whole Section of 194S as it currently is.

Remember, Nothing is final until budget is passed by Parliament.

This is my view and not substitute for legal advice. I am a CA Finalist & specialise in Direct tax.

(21/21)

Ser's pls help share with the community :)

@simplykashif @PushpendraTech @acryptoverse @sumitkapoor16 @ImZiaulHaque @defi_india @crypto_hanuman @Ruch_9 @CryptooAdy @CryptooIndia @NischalShetty @BuddhaSource @gauravdahake @darshanbathija @smtgpt @eth_us

If you are Interested in Law. Here is a bonus tip:

Whenever there is uncertainty about interpretation of any section and there are no guidelines. The Budget speech of FM can be used as a basis for Interpretation of the "Intention" of law.

:)