Polygon zkEVM is a sleeping giant.

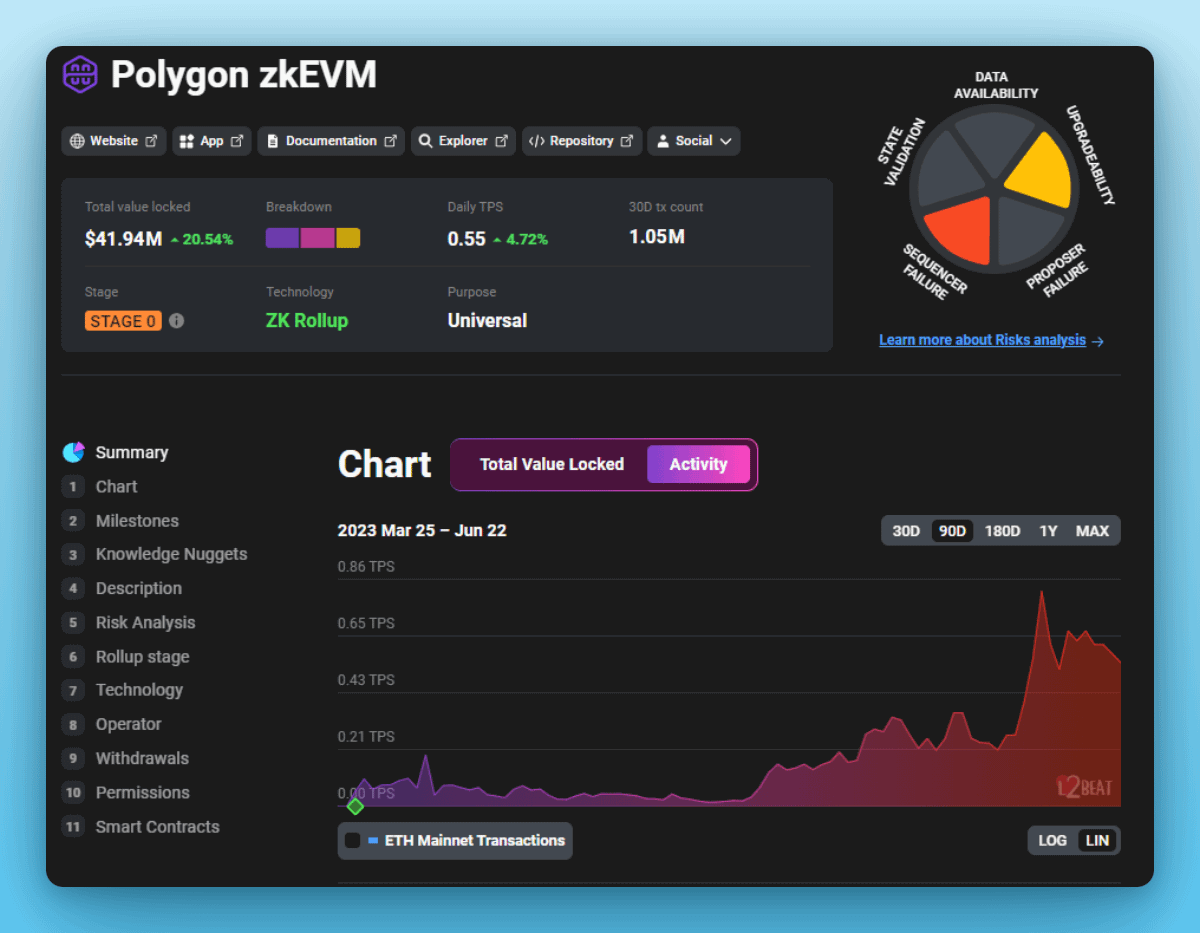

It currently has $40M in TVL, but I believe that it has the potential to surpass $1B in TVL one day.

Here's why & how you can take advantage before it takes off👇

Polygon zkEVM mainnet beta went live in March 2023.

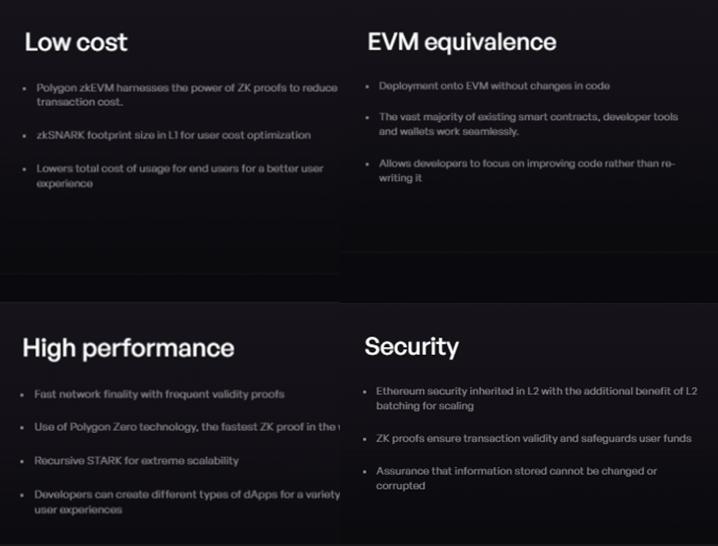

It's an Ethereum L2 ZK scaling solution with EVM equivalence - this means that smart contracts that run on Ethereum L1 can run on Polygon zkEVM as well

Vitalik Buterin himself did the first transaction on the new Layer 2.

Yet despite all the initial hype around it, its TVL currently sits at $40M.

So, the question is, is Polygon zkEVM another dead blockchain or the next Arbitrum / Optimism?

Here are a few reasons why the latter seems more likely:

Polygon zkEVM is still in BETA

Major upgrades & new additions are still yet to come:

• new security features (an implementation of forced transactions to L1, and upgrades with a 30-day timelock)

• oracle infrastructure (Chainlink is coming)

• UX improvements for developers

On top of that, the transaction fees have been reduced a lot over the past months.

Initially, the transaction fees on Polygon zkEVM exceeded a few dollars, but in the meantime, they significantly decreased.

And the team continues to work on gas optimizations.

twitter.com/sourcex44/status/1666149078819012613

Moving on, as ZK rollups are more complex than Optimistic rollups, the existence of undiscovered bugs is more likely.

Thus, developing a secure & decentralized zkEVM takes time.

Rushing to onboard a large number of users before the network is 100% ready can be a risky move.

@0xPolygonLabs's major partnerships

• in 2021, AAVE chose Polygon as the first chain for deployment after Ethereum

• popular brands such as Starbucks started NFT loyalty programs on Polygon

• last year, Reddit released NFT avatars on Polygon and had a striking success

twitter.com/milesdeutscher/status/1577288188141662208

This is to show that Polygon has a great BD team.

In bull runs, making big collaboration announcements is an excellent way to attract retail attention.

If big brands start building on Polygon zkEVM as well, this would likely have a positive impact on driving further adoption.

Incentive Programs & Airdrops might be coming🎁

A tweet posted by Polygon Founder hinted at potential rewards for the early users of the new L2.

As we've seen in the case of many L1s during the previous bull run, incentive programs can be very efficient at attracting new users.

twitter.com/sandeepnailwal/status/1656262074950094850

$MATIC has a whopping $6.2B market cap.

23.33% of its supply is allocated to the ecosystem, so the team could use some of the remaining funds to launch a massive incentive program.

On top of that, Polygon raised over $450M in a funding round last year.

twitter.com/ETH_Daily/status/1592864761758089220

All the above points make me think that Polygon zkEVM will easily hit $1B TVL at some point in the next 2 years.

Until this eventually happens, we have a great opportunity to take advantage of the early state of its ecosystem.

How? Let me show you:

As the TVL of Polygon zkEVM is currently low, the valuations of many protocols build on top of it are very small as well.

If you believe that the future of Polygon zkEVM is bright, a good way to take advantage of this is by buying gems within its ecosystem.

Buying $MATIC might be a profitable strategy as well.

But investing in new projects native to the Polygon zkEVM is like a high-leverage bet on its growth.

Now let's talk about how you can discover new protocols built on this L2 early 👇

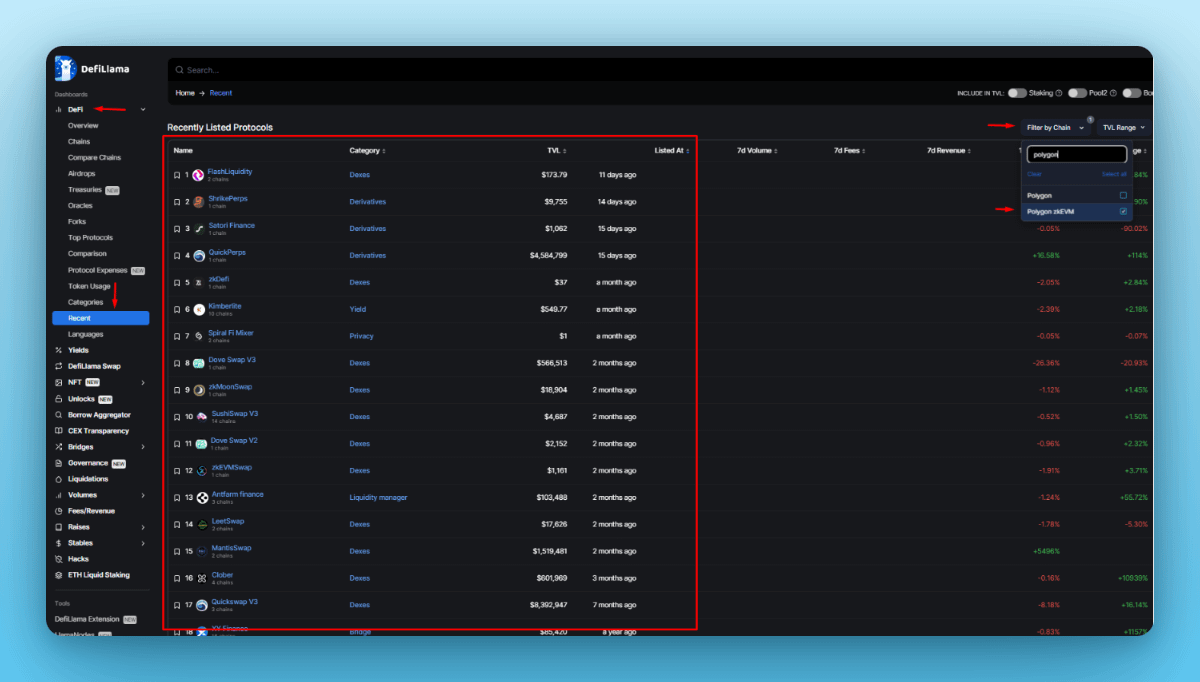

• Using DeFillama

"Recently Listed Protocols" is one of the best DeFiLlama dashboards.

You can access it by following these steps:

• Go to "DeFi"

• Click on "Recent"

• Click on "Filter by Chain" and select only Polygon zkEVM

Voila.

You'll see a list of the most recent protocols that have been deployed on Polygon zkEVM.

Now your goal is to find the ones that have the most potential.

Generally, for medium-long term bets, I'm looking for projects that meet these criteria:

• a competitive edge (either the first mover advantage or unique products/features that set them apart)

• decent tokenomics (fair token distribution and no insanely high token emissions)

• social media presence ( >5 tweets posted every week, or plans to ramp up on marketing)

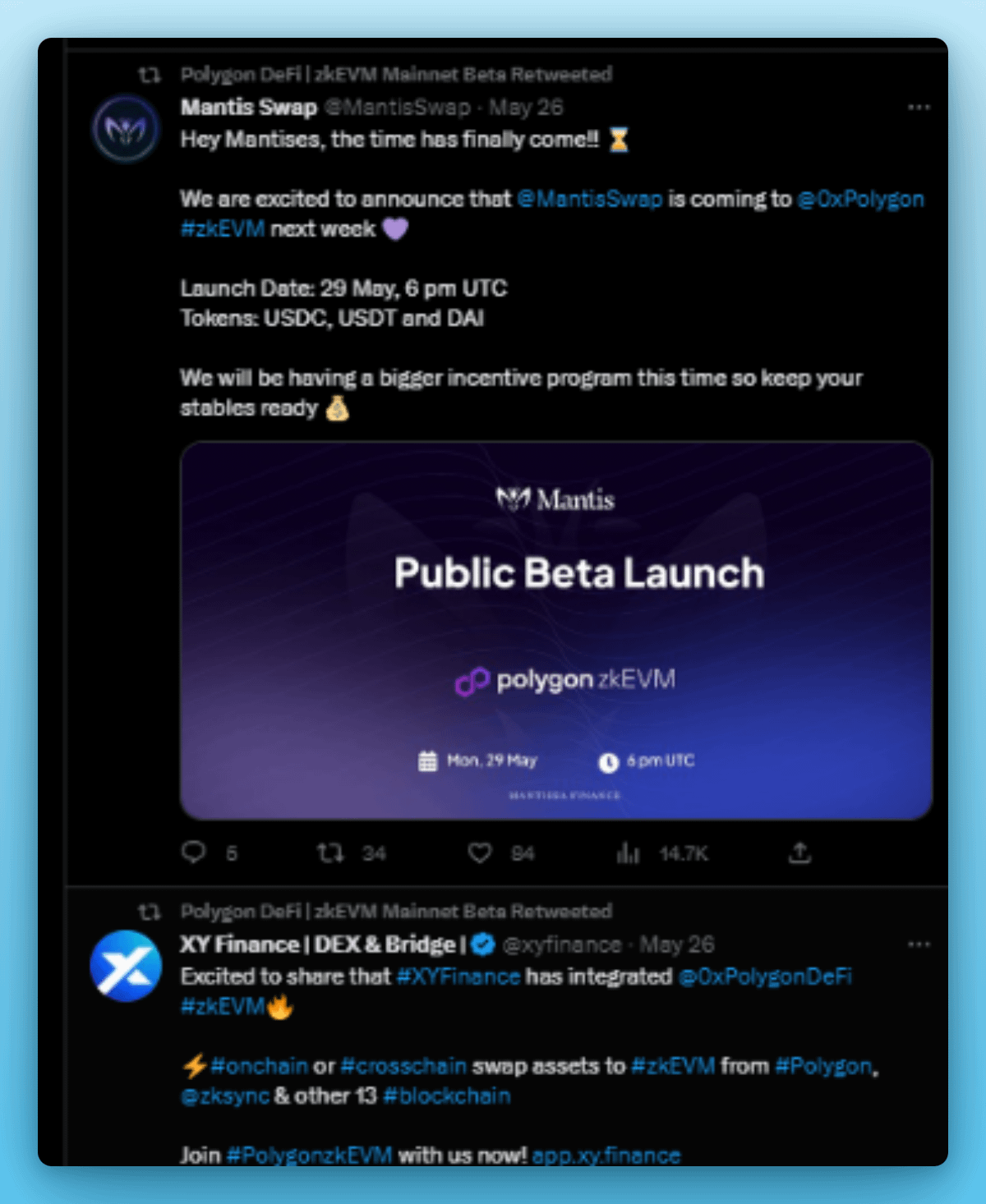

• Using Twitter

@0xPolygonDeFi Twitter Account covers the most important developments on Polygon.

Product launches, ecosystem announcements, and milestones, & everything DeFi.

Reading its tweets on a regular basis can help you stay on top of the latest ecosystem developments.

Every Thursday I send a new newsletter issue where I share:

• on-chain insights

• my crypto watchlist & thoughts on the market

• a summary of what happened in DeFi last week

Join 3800+ others here for free👇

twitter.com/TheDeFinvestor/status/1664574597117669376