Most people suck at cutting losses.

They either sell too early or are holding onto tokens that underperform.

Here's a framework for Cutting Losses in Crypto🧵 👇

(so you don't become exit liquidity)

Taking profits can be hard.

But cutting losses at the right time is even harder.

But with the right systems in place, you'll be able to overcome this problem.

Based on the amount of time I want to hold a token, I have 2 different strategies:

Short-medium term Bets

If you trade narratives/catalysts/news, timing is crucial.

Not only the moment when you enter a position but also when you exit it.

Generally, there are two kinds of situations when I cut losses and close short-medium term trades:

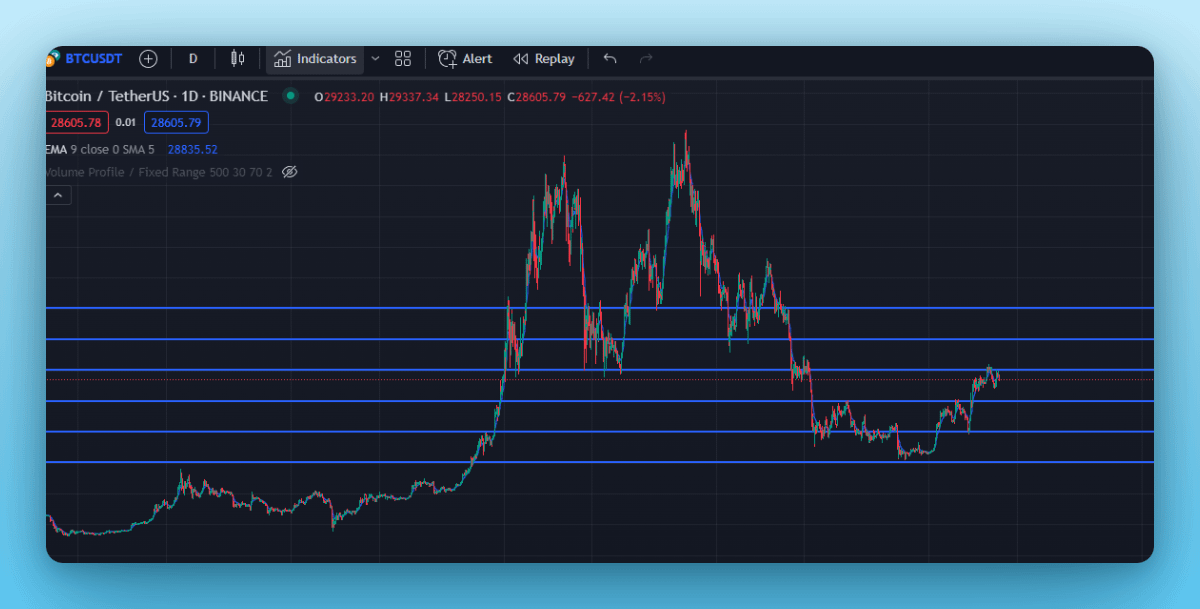

• $BTC Is Showing Weakness

Monitoring $BTC performance is crucial as it often impacts the entire market.

And that's why I mark important $BTC resistance zones on the daily timeframe.

When $BTC fails to break one of these levels, I'm taking measures to protect my capital.

My playbook is simple:

→if $BTC fails to break the resistance, I close my short-term trades & open them again after it reaches a support zone on the daily timeframe

→if $BTC does the opposite, I open new trades after it consolidates for a few days above the resistance

If $BTC breaks the resistance after an initial failure, my bearish thesis is invalidated & I open new short-term trades.

So sometimes I end up buying at higher prices.

But that's ok.

Because in the long run, this strategy saves me way more money than it loses.

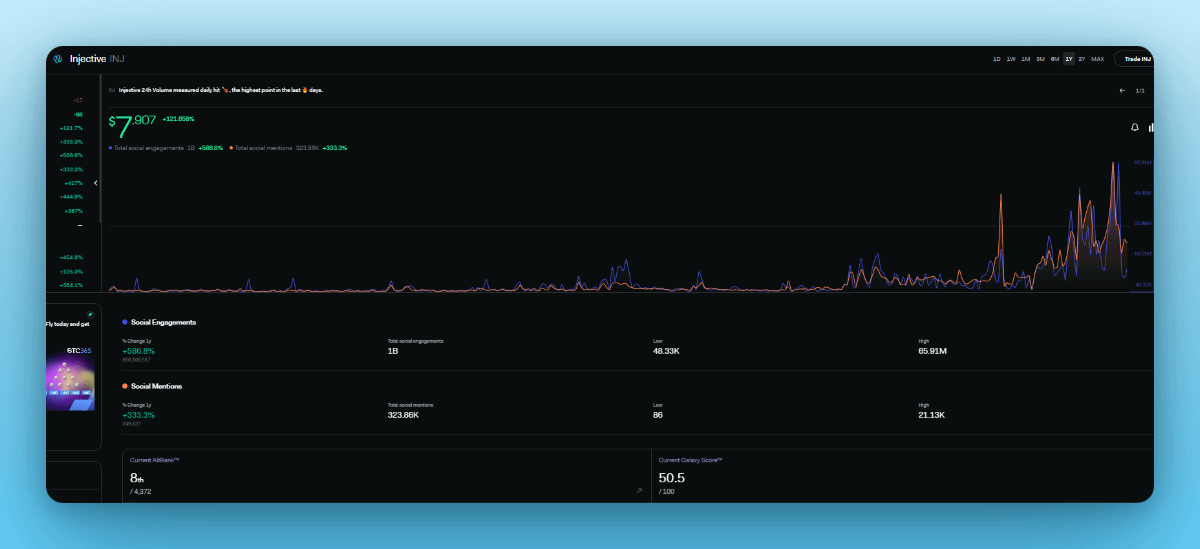

• The Narrative Is Losing Momentum

When a narrative you bet on shows weakness, you should sell and don't look back.

As a trader, your goal is to minimize losses & bet big when the odds are clearly in your favor.

How to determine when a narrative is no longer trending:

• Use tools like @LunarCrush to gauge social engagement and mentions of certain tokens

• A major decrease in social engagement over several days for 3+ coins related to a narrative usually indicates diminishing interest, signaling that it's time to sell or take profits

Long-term Bets

Before I buy a token for the long run, I write down 3 main reasons why I do this.

An example for @traderjoe_xyz's $JOE:

→ Team - The project has been around for ≈2 years, and the team has been shipping continuously since the beginning

→ Product market fit - Trader Joe's Liquidity Book AMM has seen a surge in trading volume despite low inflationary incentives for liquidity providers

→ Marketing - Trader Joe's marketing team has shown numerous times that they know how to create hype around their products

If at some point one of the main reasons why I bought a token no longer exists, I consider exiting the position.

There are 2 more scenarios where cutting losses and closing a position can be a smart move:

• a Superior Competitor Emerges

Long-term potential relative to competitors is crucial.

It doesn't matter if the project you invested in still builds cool stuff.

If another one is building a much better product than the one you are supporting, it may be time to sell your tokens.

Bet on the fastest horse.

• Better Risk/Reward Opportunities Arise

There's an opportunity cost to holding.

If you believe in a project but find another opportunity with a better risk/reward ratio, it makes sense to sell your bag & bet on the 2nd one.

Closing Thoughts

In the end, achieving success in crypto is all about following this playbook:

Make bold bets when the odds are clearly in your favor.

And be proactive in cutting losses when your thesis is invalidated or better opportunities arise.