Investing in early projects during bear markets is how you can make generational wealth📈

Here are 7 of the most innovative upcoming projects you should pay attention to👇

@SeiNetwork

We've seen a new wave of alt-L1s projects emerging during this bear market.

Among all of them, one of them stood out to me:

Sei Network, a L1 blockchain specialized for trading.

Some of the many features that set Sei apart:

twitter.com/0xFinish/status/1657023752784211972

• fastest time to finality for transactions (500 ms)

• Frontrunning Protection -Sei aggregates every order together at the end of the block to prevent front-running

• A built-in matching engine -this solves the scaling issues encountered by orderbook DEXs on most blockchains

It's also worth mentioning that Sei Labs raised $30M in funding.

Some of the largest VCs including Jump & Multicoin participated in the round.

Moving on, the Sei testnet is currently live.

It's been a few months since it went live, so I expect the mainnet launch soon.

twitter.com/SeiNetwork/status/1645955246173351936

@vela_exchange

Vela Exchange is one of the most anticipated upcoming perpetual DEXs.

It's clear that the perpetual DEXs space is getting crowded:

But with many unique features, Vela aims to offer a way better UX than its competitors.

These include:

twitter.com/SmallCapScience/status/1625289964148912129

• On-Chart Trading -view open position details on-chart & execute trades faster

• Advanced Notifications -custom alerts & notifications for trades

• Social Trading -learn from the top traders

• Upgraded Stats & Analytics -in-depth insights to enhance your trading strategy

twitter.com/vela_exchange/status/1654201444831207427

On top of that, new trading competitions are on the roadmap.

The official launch is expected to happen in the coming weeks👀

2 days ago, Vela also introduced Hyper VLP 2.0 - a massive incentive program that rewards liquidity providers with $VELA tokens

More about this here:

twitter.com/vela_exchange/status/1658925913067892736

@GammaSwapLabs

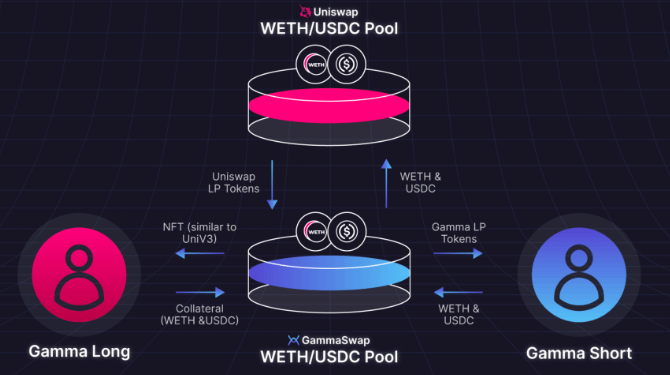

GammaSwap is described as a DEX enabling perpetual leverage trading on any token.

But it's more than that:

Using it, AMM liquidity providers will be available to short volatility to hedge impermanent loss.

Turning the impermanent loss into impermanent gain!

twitter.com/0xTindorr/status/1609888548995596288

GammaSwap has two sides:

• Liquidity Providers - those will be able to deposit their LP tokens from AMMs like Uniswap to earn an additional yield

• Borrowers - those will be able to take leverage to hedge LP exposure or speculate on prices

The protocol will launch on Arbitrum, with its beta testnet being already live.

In early February, the team announced a $1.7M seed round.

On top of that, the launch of a token is confirmed.

It's unclear when the mainnet launch will happen, but probably during the summer.

twitter.com/GammaSwapLabs/status/1622609745763762180

@eigenlayer

Eigenlayer is the first project that will enable 'restaking'.

With Eigenlayer, $ETH validators will be able to restake their $ETH to validate multiple networks.

This means that Ethereum stakers can secure multiple services at once and earn yield from new sources.

Protocols like bridges & oracles will be able to opt to be secured by $ETH validators by paying them a fee.

Eigenlayer will act like a marketplace that connects projects looking to rent security w/ $ETH stakers.

Wen mainnet launch? According to the team, in the next months.

twitter.com/OlimpioCrypto/status/1610013658125328384

@derivio_xyz

Derivio is one of the most interesting projects building on zkSync.

Its team is building a decentralized derivatives ecosystem, with a wide range of products for all traders' needs:

- perpetual futures

- options

- zero coupon bonds

- index derivatives markets

To provide liquidity, LPs can deposit funds in Derivio vaults.

The protocol generates yield for LPs through market-neutral market-making strategies.

Its first products (perpetual futures & options) are already live on testnet, about which you can find more details here:

twitter.com/derivio_xyz/status/1641518329549688832

@parallaxfin

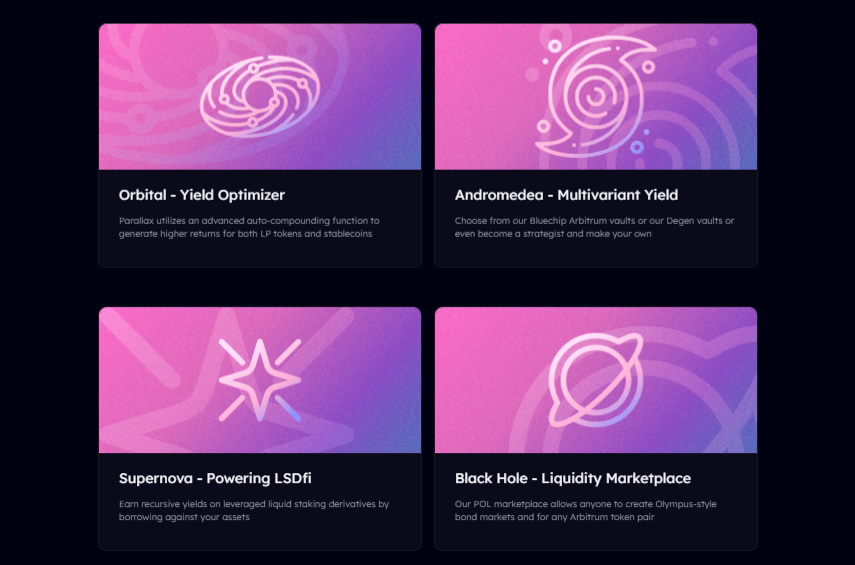

Parallax is a new protocol that's building composable yield strategies.

Its team is building 4 products, of which 2 of them caught my eye:

• Supernova

An LSD Meta-Strategy that generates yield by investing in a basket of LSDs. (liquid staking derivatives)

twitter.com/wacy_time1/status/1658789525223780353

With Supernova, anyone can gain exposure to LSD yields from multiple products in one transaction.

The strategy auto-compounds users' rewards to maximize their returns.

On top of that, Supernova V2 will also allow users to apply leverage to increase their yields significantly.

•Andromeda

Andromeda consists of multiple index strategy vaults.

Not only do these vaults offer exposure to multiple assets, but they also generate yield across DeFi protocols📈

Even more, Parallax's strategies will be chain agnostic.

The protocol is live in the alpha phase.

@tapioca_dao

Tapioca is the first omnichain money market that leverages @LayerZero_Labs's technology.

Using it, users will be able to lend, leverage up, and borrow assets across all the top chains.

twitter.com/Rancune_eth/status/1655977352369942528

Apart from being the first cross-chain money market, Tapioca is also the issuer of $USDO.

$USDO is the first decentralized stablecoin that can be easily moved to another network.

Think about being able to move your stablecoin holdings across chains with no:

- long wait times

- slippage

- fees

Tapioca will be the first protocol to make this possible.

$USDO will be fully collateralized by assets such as network gas tokens & LSD tokens.

The protocol is currently live in beta, and the mainnet launch is scheduled for Q2 2023.