L2's have picked up steam due to cheaper fees, more builders, and constant bridge hacks.

$METIS is next up to explode with DeFi bluechips on the way, a $100M incentive program, a new smart ecosystem, and multiple small projects launching new versions. Don't fade it.

Details 🧵

$METIS recently announced their #MetisMarathon Campaign which is a $100M incentive campaign spread over 26 weeks for projects to build on $METIS.

$METIS is $150M MC but offering $100M in incentives, builders will flock in due to the bear market

twitter.com/MetisCharter/status/1552652574733373440?s=20&t=iP52tPEG24vogQ_r5p3UHw

Large Projects have already began taken notice with $SUSHI being the first to launch.

$SUSHI is due for a redemption arc of their own with their new Trident AMM.

Great piece on what SUSHI brings to METIS by @apollo_wayne - medium.com/@apollowayne/what-sushiswap-brings-to-the-metisdao-ecosystem-ed95e1879530

twitter.com/SushiSwap/status/1552302623562268672?s=20&t=iP52tPEG24vogQ_r5p3UHw

$LINK also announced they would be coming to $METIS which is massive for ecosystem builders and DeFi markets. They actually went live on $METIS today...

It's happening...

twitter.com/chainlink/status/1554844539478761472?s=20&t=8UU2j0PstMC0EkQqOeI1Wg

$aave also has recently been confirmed on a @Blockworks_ Twitter spaces as being the third large project to build on $METIS. The launch should be in the next week or two...

Nothing like @StaniKulechov going full maxi and adding the 🌿 to his name...

twitter.com/ElenaCryptoChic/status/1551609561697718275?s=20&t=8UU2j0PstMC0EkQqOeI1Wg

If you have noticed, $METIS is branded as the first "Smart L2" by working to pioneer SoulBound Tokens for onchain governance.

It is the idea of an on-chain social score and credit system. @VitalikButerin wrote SBTs are the future of $ETH

Overview -twitter.com/PastryEth/status/1529130859814600705?s=20&t=Ilgp621ElVcATddclZBmSQ

With Soulbound Tokens and $AAVE both coming, there is a good chance $METIS becomes the test bed of undercollateralized loans.

Don't forget, @VitalikButerin's mother works with the $METIS team. They recently announced @RPSMatrix with a countdown of 5 days on their webpage. 👀

Now that you are bullish on $METIS, let's dive into the ecosystem.

The biggest issue with the ecosystem is by far liquidity. Hopefully, it will be the first thing fixed as the #MetisMarathon incentives are paid. With that said, I'm taking some positions.

Most projects went on a slight run this week but are coming off rock bottom and still below VC/Seed entries. Do your own research on each project and make sure you are aware of lower liquidity investing.

My strategy is LPing to build positions and hedge macro market risk.

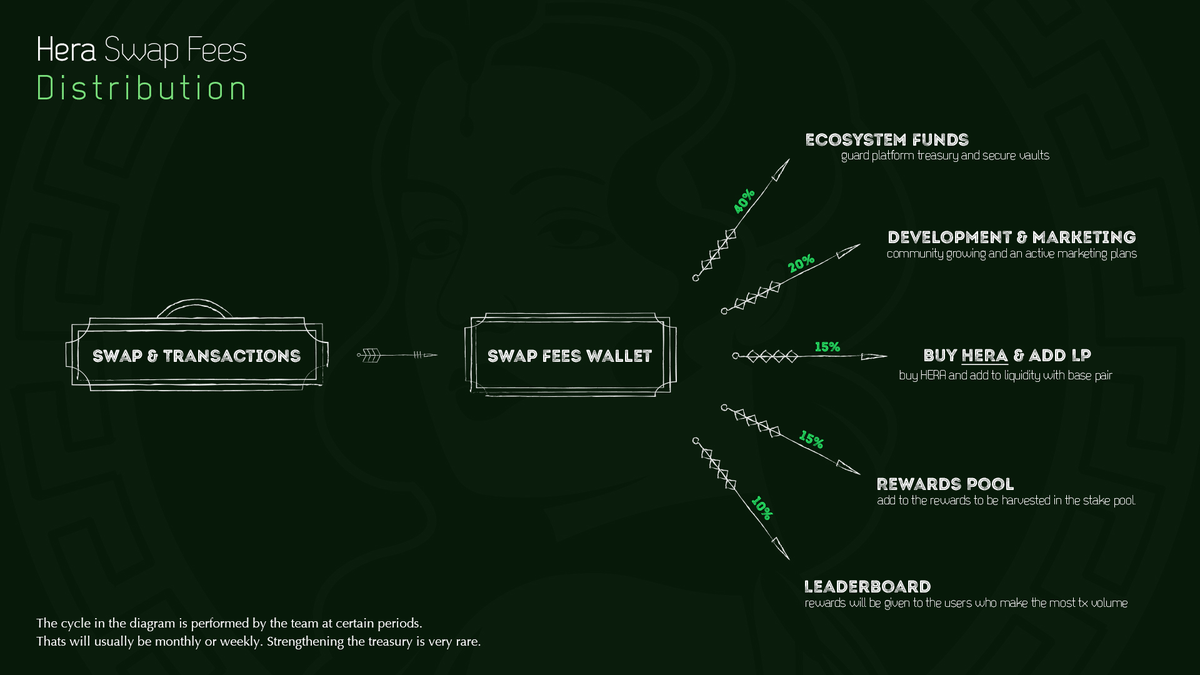

A DEX Aggregator first brought to my attention by @billybobbaghold is @HeraAggregator. $HERA is a DEX aggregator and not just another random fork.

A custom dex aggregator and their MC is only $2M seems wrong. Seed entered at $.55 I believe, $.80 today.

youtube.com/watch?time_continue=77&v=gmEvyLCFvV4&feature=emb_logo

Currently launched on $METIS, $AURORA coming soon (I'm a big AURORA fan), and $CRO + $AVAX + $FTM are all planned.

This team has been impressive thus far and it seems low risk compared to the potential upside.

twitter.com/HeraAggregator/status/1553369645738086406?s=20&t=Za9T7PGpJd_5pd-GDW7hMA

Their current model generates fees on swaps that go to buying back $HERA which is given to $HERA stakers or added to LP.

This model will be changing as they move to v2 in the near future but currently finding ways to pay $HERA stakers is a win.

Next up, @HermesOmnichain and @MaiaDAOEco! $HERMES is a solidly fork (think $VELO) and $MAIA is the aggregator ($CVX) and they are built by the same team.

This one had a ton of hype when it first launched and the team has continued to build with v2 coming for both projects.

Starting with $HERMES, V2 will also be an omnichain AMM and liquidity market leveraging Uni v3.

They will also be simplifying their gauge/bribe system, cleaning up the UI/UX, and making shifts to tokenomics.

twitter.com/HermesOmnichain/status/1549145899967909895?s=20&t=Za9T7PGpJd_5pd-GDW7hMA

They will change from the $veCRV model of locking for 4 years to permanently burning the underlying $HERMES to earn $bHERMES.

I am still undecided on how the model will play out but I love the experiment and am excited to see it happen.

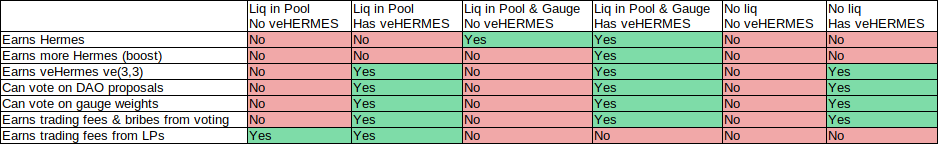

The current model gives a ton of flexibility for users vs. projects when bribing, voting for gauges, or just collecting protocol fees.

I'm expecting more projects to start accumulating $HERMES for emissions with them being the only bribe market on chain... for now.

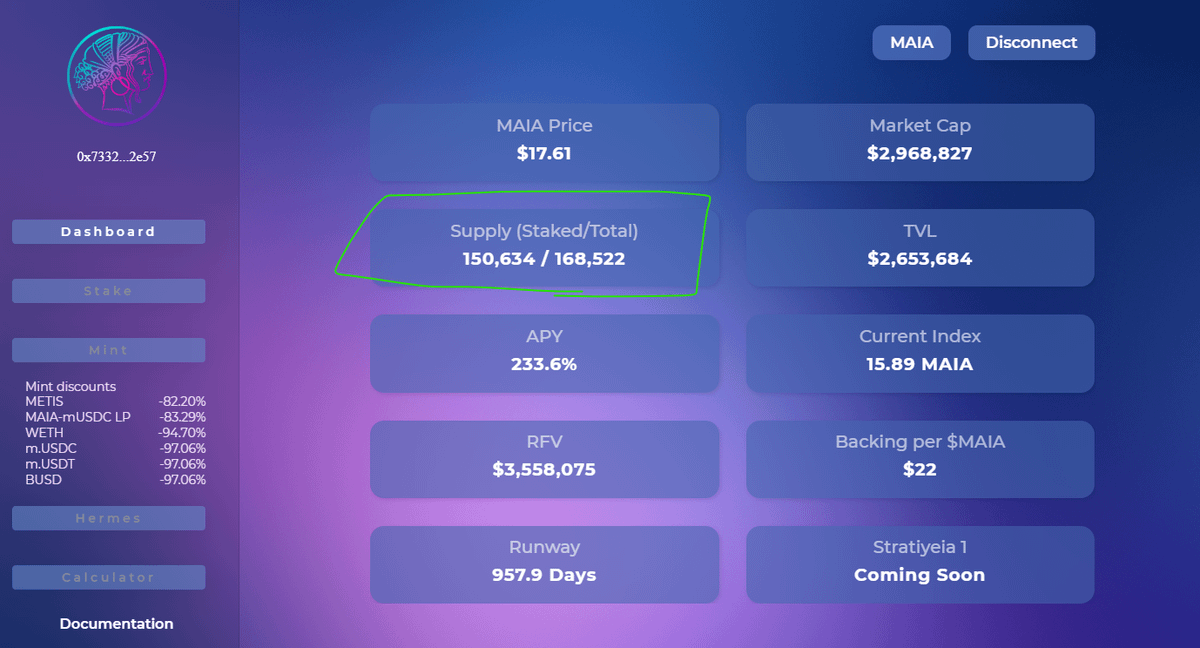

If you don't want to lock for 4 years, @MaiaDAOEco is the $CVX of HERMES. They started as an OHM fork and now own 31M veHERMES which accounts for about half of all locked veHERMES.

Similar to $HERMES they are also launching v2.

twitter.com/MaiaDAOEco/status/1536351072721244160?s=20&t=Za9T7PGpJd_5pd-GDW7hMA

Currently, $MAIA is $500k below "RFV" although holders don't have treasury access.

They also are at 150k circ supply and quickly approaching 168k hard cap they will be putting on the project with v2. I'd expect $MAIA to do well due to HERMES complexity.

$VELO finance on Optimism leverages a similar model to $HERMES and it proves there is demand as it is up nearly 1300% in 30 days.

$VELO at $34M FDV compared to $HERMES at $4.5M FDV. 📈

The 🐐 leaked it early... @Cryptoyieldinfo

twitter.com/Cryptoyieldinfo/status/1549534082702495745?s=20&t=4-DHQRB6hh9m2JDgG3xbnQ

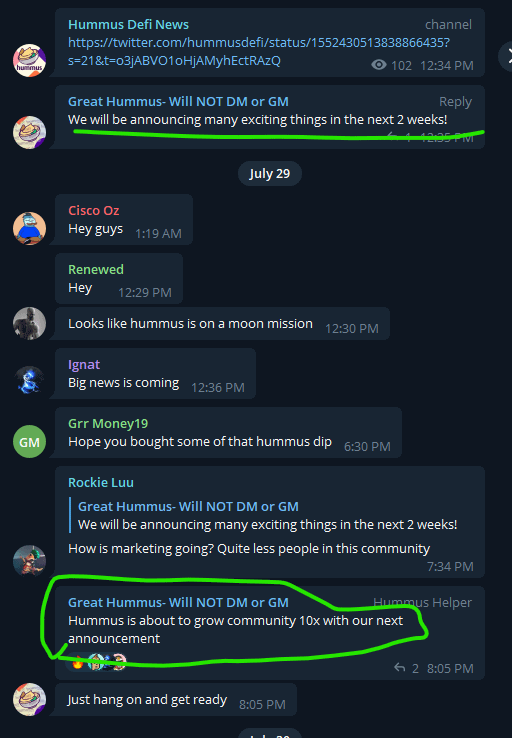

Project 3 is @hummusdefi is a @Platypusdefi licensed fork and the main stable swap on $METIS. $HUM team has been hinting at some large announcements upcoming, I'm expecting some sort of fee/revenue sharing model for $HUM holders.

Yields are also huge for $veHUM holders.

I'd also assume there will be some sort of integration with @QiDaoProtocol now that they have launched on $METIS this week.

More stables = more volume through $HUM. They have also integrated with $HERA who trades through their stable swap.

twitter.com/hummusdefi/status/1554204916754878465?s=20&t=Za9T7PGpJd_5pd-GDW7hMA

Only made concentrated bets myself but other projects that are worth looking into include:

@tethysfinance - $TETHYS

@netswapofficial - $NETT

@RevenantGamefi - $GAMEFI

Added Bonus - @LidoFinance should be launching this week!

Worth considering how $OP exploded due to incentives and #MetisMarathon should be more powerful due to the $METIS token having more utility.

$OP without utility has 3x the $METIS MC and 25x+ higher FDV, insane comparison.

$METIS is also one of the few L2's with a token, meaning if $METIS even 3x's, most of the small cap projects LP'd with it have the opportunity for 1300% gains like $VELO.

Assuming the macro landscape doesn't rekt crypto, $METIS is one of the safer bets IMO. DYOR, of course.

The @MetisDAO team has also made a massive push with retail accessibility.

KuCoin, Coinbase, Crypto .com, and Binance all have been listed lately, are announced, or are rumored to be coming in the next few weeks.

All major CEX's being onboard with #MetisMarathon!

TDLR (Allergic to DYOR) -

1. L2 narratives exploding with Optimism leading the charge

2. $100M Ecosystem fund for developers w/ METIS being $150M MC.

3. $LINK, $AAVE, and $SUSHI all are launching.

4. Recently listed on CoinBase, Crypto .com, and KuCoin

Disclaimer -

None of this is financial advice and please do your own research.

This is for my own research records. These can be complex trades including macro risk, exploits, and low liquidity positions.

GL! 📈