$HERMES is a high conviction play for me.

Solidly fork on $METIS (+ @arbitrum soon), multiple protocols aggregating/locking, proposal for millions of $'s in grants, incoming supply crunch, and could soon become the leading liquidity hub on $METIS. 👀

The details ⬇️ 🧵

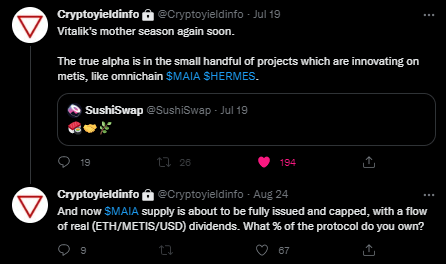

I'm not the only one bullish on $HERMES and its aggregator $MAIA. @Cryptoyieldinfo has been bullish as well, both are a ticking time bomb IMO.

$MAIA supply is about to be fully diluted and owns 50% of $vlHERMES. $HERMES has an upcoming v2 and a possible supply crunch coming.

$HERMES released their v2 whitepaper with their go-forward as a multichain AMM and liquidity platform based on Uni v3.

In their new model, instead of locking for 4 years, you burn HERMES forever for $bHERMES. $bHERMES earns bribes + protocol fees

twitter.com/HermesOmnichain/status/1549145899967909895?s=20&t=a-ZzMBBq1a1tM4a8-Oy1BA

The goal is to launch in late Q3 or early q4 on @arbitrum.

This means not only will they benefit massively from the ongoing #MetisMarathon but with Arbitrum Nitro rumors swirling about an $ARBI airdrop, they could benefit from both narratives.

The new model of burning tokens forever means the tokens are actually out of circulation forever.

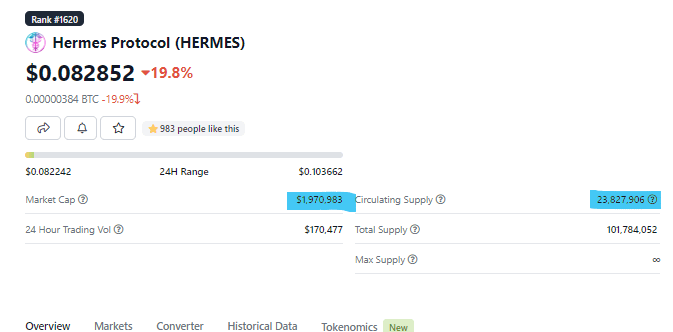

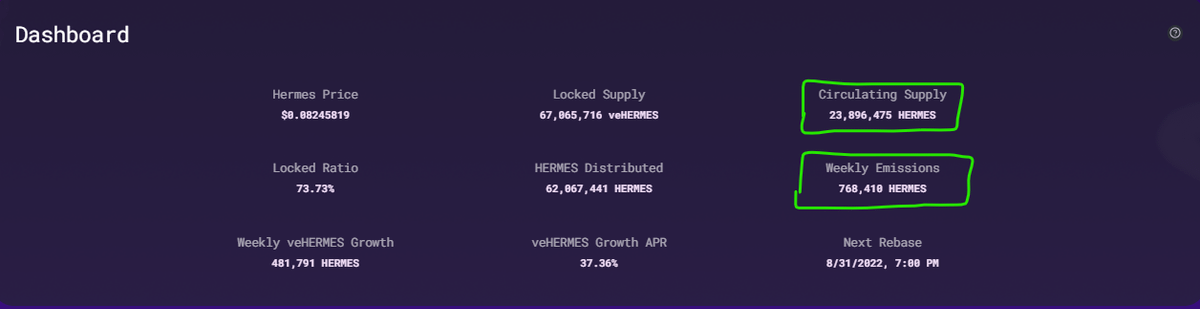

CG + Dexscreener have finally corrected to show the actual circulating supply of 23.8M and circulating MC of only $1.9M. Very undervalued IMO.

$VELO which is also a Solidly fork on Optimism reached $70M Circ. MC with a somewhat similar model and $OP incentives.

$HERMES would be ~$3 and is 35x away from the levels $VELO reached at peak while also having upcoming chain incentives.

The burning mechanism is one of the reasons I'm so bullish on $HERMES. Current circulation is ~24M $HERMES which is down a few million already this month. With only 750k HERMES emissions weekly, supply has often been locked at a higher rate than they are emitted. Supply 📉

Imagine 12M of those 24M HERMES in circulation get locked, either the Circ. MC drops to $1M or the price would have to double to $.17 to keep the current MC of $1.9M.

750k weekly emissions would take 16 weeks with zero locking in order for supply to get back to 24M HERMES circ.

"If there is a supply crunch coming, why would anyone lock"

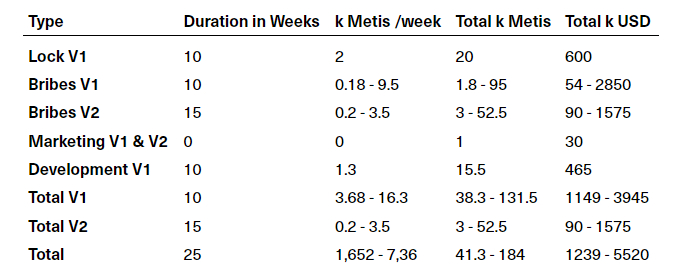

Great Question. What about a #MetisMarathon Proposal they put together that has $600k USD worth of METIS incentives to lock your $HERMES and another $144k-$4.42M requested bribes? 😮

The entire proposal is from anywhere from $1.2M-$5.5M USD worth of rewards and would need to be approved as part of the $METIS CEG process.

You can take a look at the whole proposal here:

commonwealth.im/hermes-omnichain/discussion/6728-hip01-hermes-metis-marathon

Locking incentives and v1 bribes alone total between 654k-3.4M if approved. Locking 12M HERMES doesn't seem far-fetched if rewards are higher than circulating MC.

Governance approved the proposal and its been sent to the METIS team for review.

twitter.com/HermesOmnichain/status/1564028788601651205?s=20&t=YFCgTxmoT0-F4RD2YjWKXg

$HERMES has 39 gauges right now from different liquidity pairs across $METIS. As more $HERMES are locked, the price rises, APRs for all 39 LPs rise, and liquidity flows into the entire ecosystem.

Bribing votes with $144k-$4.4M means protocols will accumulate $HERMES to earn

Currently, $MAIA and $AERA both aggregate HERMES with MAIA controlling over 50% of $veHERMES supply currently and their supply will be capped within the next 30 days.

$AERA is pushing to aggregate HERMES farms and give even further boosted rewards on LPs while owning 2-3%...

Having protocols already building on HERMES is massive for supply.

It means all their farmed rewards go straight into $veHERMES so emissions are actually lower than 750k weekly as these protocols lock immediately. 👀

On top of multiple aggregates protocols including @hummusdefi are beginning to go through the process of applying for $HERMES gauges.

$HUM has the largest TVL on $METIS and every gauge added further spreads out the ~750k weekly emissions to more pools, also supporting price.

The @MaiaDAOEco has also been buzzing lately as they are about to reach their supply cap at 180k tokens and yield begins being paid in ETH/USDC.

Only a few days away...

twitter.com/MaiaDAOEco/status/1564048864499449858?s=20&t=YFCgTxmoT0-F4RD2YjWKXg

@MaiaDAOEco also partnered with @VastMetaverse to bring their yield capabilities to the first Metaverse project on Metis.

Partnerships are rolling in nonstop for $MAIA / $HERMES.

twitter.com/VastMetaverse/status/1564286521406103553?s=20&t=YFCgTxmoT0-F4RD2YjWKXg

In my opinion, this is the one proposal outside of $AAVE/$HUM that has the opportunity to kickstart the entire $METIS chain. It still needs the MetisDAO to approve, but I'm guessing it will happen.

As $METIS liquid supply falls and price rises, nearly every project benefits

Disclaimer - Nothing posted here is financial advice and it's all for my own record.

I'm terrible at trading/DeFi because I'm a Scientist. Please don't follow any of the projects I talk about... Bill Nye Rules.

GL 📈