Today I want to write about risk management.

I wrote awhile back about finding your trading edge & #candlestick basics:

(twitter.com/RobotDefi/status/1511834023676497924?s=20&t=qocrLreyKZVkLCRivJRhrw)

My friend @Zetoveraleenzet pointed out that knowing this stuff doesn't help much without risk management.

So here's a thread

🧵/1

First, what is risk management?

Technically it's the identification of risks and the procedures necessary to minimize them.

However, for trading I think the more accurate terminology would be risk mitigation.

🧵/2

So, how do we mitigate risks while trading?

For proper risk management, you need three things:

1. A system

2. A stop loss (also known as an invalidation point)

3. A target

Let's go through each of these...

🧵/3

A SYSTEM:

What is this? This is your trading rules. The rules that dictate when you will enter/exit a trade.

If you just trade random concepts from time to time (like, today I'll trade some candlestick patterns, but tomorrow I will use indicators) you are gonna lose.

🧵/4

The reason is because a system keeps you from making emotionally clouded decisions.

ALSO, a system defines consistent entry points.

In trading, consistency is 🔑

WHY?

🧵/5

Because you can't win every time. The key to success is not to always be right. It isn't even to be right most of the time.

It's to manage risk and apply rules consistently, so that over time your trade account grows.

🧵/6

So you NEED a system. You need rules that strictly define when you will enter and exit a trade.

Whatever those rules may be; a certain candle setup, a certain indicator cross-over, a certain support bounce, etc

Once you have that, next you need to define your stop loss.

🧵/7

STOP LOSS:

This is, in my opinion, the crux of risk management.

A stop loss is how much you are willing to lose/risk on a trade.

This in and of itself is kind of a system.

As my pal @ProfessorDegen_ calls it "a system within a system"

🧵/8

Here's how it works...

You should've tested your system enough times to know how often it wins/loses.

The goal isn't to be right more often than wrong (traders...even the best...rarely are).

The goal is to know with decent certainty the system's performance.

🧵/9

Once you know what your "win ratio" is, you need to also figure out your percent gain vs percent loss on average.

So, when you win, how much do you win by?

And when you lose, how much do you lose by?

HERE you want your win amount to be greater than your loss amount.

🧵/10

See, chances are you are gonna lose more than you win.

BUT, if you win BIG and lose small, you still end up on top. This is how the vast majority of traders make money. They aren't always calling winners (some do, but those are very few and far between).

🧵/11

Profitable traders mainly know how to make their wins big and their losses small.

Now that you have those numbers from your system, you can set a stop loss.

Here's how the math works...

🧵/12

Let's say you have a win ratio of 40% (not bad at all)

And let's say your wins are typically 10% (modest)

That means for every 10 trades, you win 4 of them for a total of 40% profit/increase.

Your stop-loss determines how much the 60% takes from your account.

🧵/13

If your wins are 10%, but your stop-loss is set to risk 5%, based on your system performance you end up with:

10 trades =

+40% win

-30% loss

net +10% = +1% per trade avg

🧵/14

Not bad. But if you made your stop even tighter you could profit even more.

Anyway, so how do you calculate all this?

You need to look at support and resistance levels and timeframe high's/low's to determine position size first.

🧵/15

The reason for this is because STOPS SHOULD NOT BE SET BASED ON YOUR RISK TOLERANCE. THEY SHOULD BE SET AT KEY LEVELS!

You don't create the stop based on your position, you create the position based on your stop. (<--- read that again)

🧵/16

Ok, let's say you decide to have a tight stop (recommended) of 1.5%.

That means, you will not risk losing more than 1.5% of your account on any one trade.

So, for the asset you are considering trading, you need to identify the key levels where price might drop to.

🧵/17

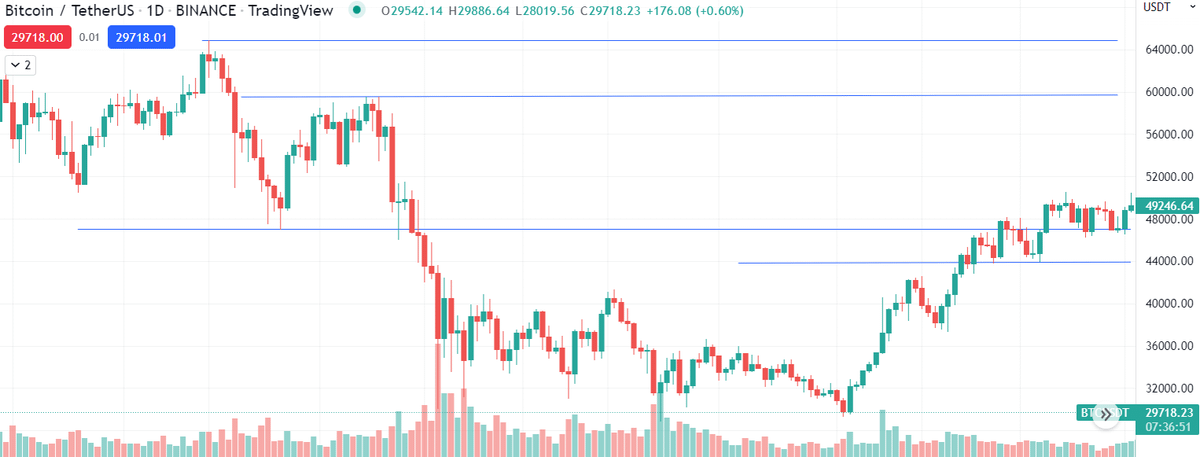

To illustrate, let's take this segment of $BTC price from a few months ago.

I've marked key levels of support/resistance with blue lines.

🧵/18

In this example...I see that 48000 has been strong support in the past. So I'm thinking I'll set my stop at or slightly below that. This will help me determine my entry price, based on what I can risk.

🧵/19

So, what have we got so far?

The system ✅

The "system within a system" i.e. stop loss ✅

What's left?

The Target 🎯

🧵/20

Here is literally where most wannabe traders drop the ball.

You can set a stop loss, you can set an entry price...but if you risk it all on every move, then more often than not you'll lose.

🧵/21

THE TARGET...

Having profit targets is essential to surviving in trading because it allows you to take profits.

Knowing where you'll get out usually only allows you to wait to be stopped out...which you will end up doing regularly.

🧵/22

You need to also specify where you will take profits along the way.

That's what your targets are.

And no, this doesn't mean you close out your whole position at your target price.

These are stopping points where you simply take profits.

🧵/23

It's probably a good idea to set your profit targets near key levels as well, though you may also decide to set them at indicators.

That's a personal preference.

OK class...what have we learned today?

🧵/24

RISK MANAGEMENT =

Have a System of rules that dictate how and when you trade

Have a Stop Loss that dictates your total risk on any trade

Have Targets that dictate when you'll take profits along the way

*Pro tip you can also move up your stop loss (called a trailing stop)

🧵/25

I hope that was educational and helpful.

Stay tuned for more trading and #DeFi content.

And if this thread was helpful....