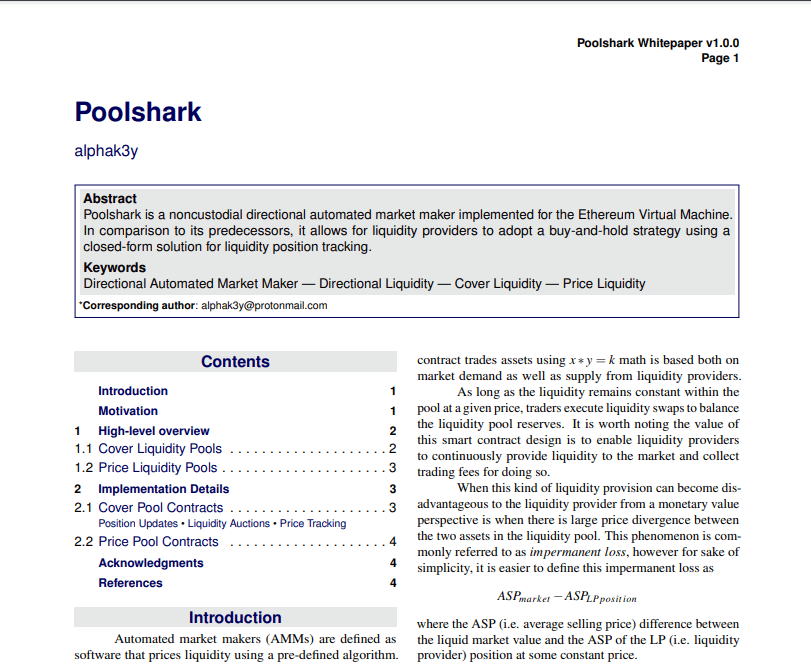

Today we are grateful to present a detailed overview of Poolshark, the first-of-its-kind directional AMM where LPs can adopt buy-and-hold strategies.

@arbitrum Mainnet launch is scheduled for early March.

@fuellabs_ Testnet launch set for early April.

docs.poolsharks.io/whitepaper/poolshark.pdf

The release of this whitepaper marks the end of a long journey and the start of a new one: one to improve outcomes for liquidity providers and end passive LPs being forced into mean-reversion strategies (i.e. Uniswap, Curve, etc.).

LPs can now balance out their holdings.

Flavor #1 of directional liquidity:

Cover Pools:

Standard Range LP positions always take the losing side of the market.

If the market wants ETH, they take DAI.

If the market wants DAI, they take ETH.

Cover LP Positions do the opposite, where as the price of ETH increases, we're going to:

- unlock liquidity

- purchase ETH

...or another desired asset from the market

This can be equated to a Stop-Loss Range Order.

Rebalancing LP positions becomes a losing game, where losses for price divergence get locked in over and over.

This is a part of the game in order to earn fees, however, Cover LP Positions can be utilized to neutralize losses with profits from Buy-and-Hold.

This Buy-and-Hold profit is intended to offset any Impermanent Loss experienced from the POV of the LP.

In the whitepaper, it is detailed how an on-chain TWAP oracle (e.g. Uniswap v3) is leveraged to gradually unlock liquidity.

As each bit of liquidity gets unlocked, a Gradual Dutch Auction (designed by @paradigm) takes place which will fit the natural market price starting from the current TWAP.

Gradual Dutch Auctions can be read about here:

paradigm.xyz/2022/04/gda

Flavor #2 of directional liquidity:

Price Pools:

Price liquidity trades the same similar to current AMMs, except without one key caveat:

The trades are irreversible.

This allows users to lock in profits and find entries while providing liquidity to the market.

Use Case:

Quick Entry 🦈 📉

Alice wants to buy 1 ETH from 1200 down to 1000 DAI per ETH.

Quick Exit🦈📈

Alice then sells 1 ETH from 1300 up to 1400 DAI per ETH.

Price Pools open up a range of opportunities for pegged assets such as stablecoins and LSDs (liquid staking derivatives) where there is price deviation around fair market value.

We're excited to see how protocols leverage this to increase yield and sustain liquidity operations.

With that...

We're excited to have you all here along for the ride and enable traders to provide a more liquid market for DeFi.

Let's build a more liquid market for DeFi together and unlock more opportunities on-chain.🦈

You can check out the full documentation here for more information on the topics covered in this thread:

docs.poolsharks.io

Or join our Discord to plug us with any questions not answered anywhere else:

discord.gg/FZRnydkyx2

Bye for now fren.

You can read the unrolled version of this thread here: typefully.com/poolsharks_labs/v7n3AMa