The DeFi insurance industry is one of the most flawed sectors in the Crypto realm

If you do not understand the risks associated with DeFi insurance, you are unlikely to get any insurance claims

We expose the wild west of DeFi insurance and present a viable option for you:

🧵👇

In this thread we will discuss:

• WHAT IS DEFI INSURANCE?

• HOW DOES DEFI INSURANCE WORK?

• THE WILD WEST OF DEFI INSURANCE

• A VIABLE OPTION

Before we get started...

You can read the unrolled version of this thread here: momentum6.substack.com/p/risk-associated-with-cryptodefi-insurance?sd=pf

• WHAT IS DEFI INSURANCE?

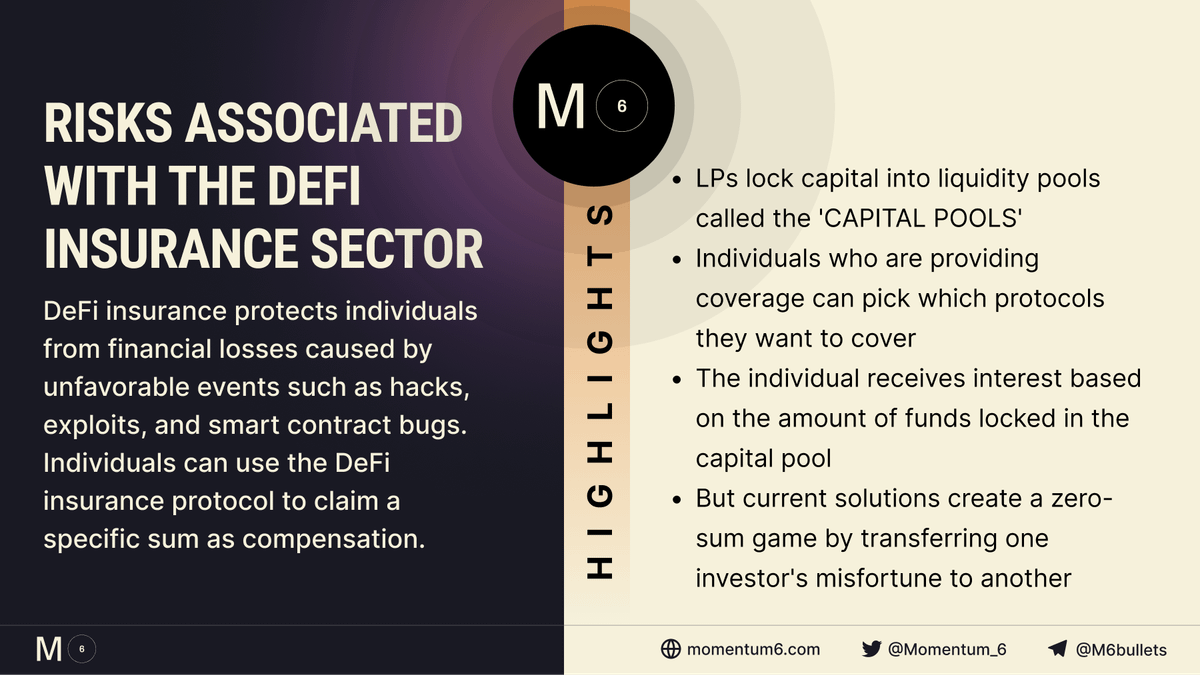

#DeFi insurance works in the same way as traditional insurance in that it protects individuals from financial losses caused by unfavorable events such as hacks, exploits, smart contract bugs, and so on

Individuals can purchase DeFi insurance if they want to safeguard themselves against losing money on the DeFi platform

If the individual loses money, they can use the DeFi insurance protocol to claim a specific sum as compensation

But the individual must pay an insurance premium for the coverage based on a wide range of variables such as length of the policy, type of exploit, etc.

• HOW DOES DEFI INSURANCE WORK?

In DeFi insurance, liquidity providers lock capital into various liquidity pools called the 'CAPITAL POOLS'

The individual who is providing coverage has the freedom to pick which protocols they want to cover

Existing DeFi insurance protocols aim to cover specific DeFi risks, typically smart contract failures or exchange hacks

This is achieved by staking specific projects, but this approach puts the entire stake at risk in the event of failure!

The individual who provides coverage receives interest based on the amount of funds locked in the capital pool

This interest comes from the premium paid by the customers of the DeFi insurance protocol

• THE WILD WEST OF DEFI INSURANCE:

Insurance has become a necessity in the DeFi world given the ~$2 billion in losses caused by smart contract attacks this year

Although DeFi insurance is a clear necessity, there aren't many DeFi insurance protocols that solve the insurance problem in a sustainable way

Current solutions create a zero-sum game by transferring one investor's misfortune to another

1. RISK:

Since the stakeholders cover the cost of a policyholder's payout, project staking leads to a permanent loss of staked assets as claims are paid

This is due to a high correlation of risk between the assets staked and the project being insured

2. CAPITAL EFFICIENCY:

Project staking is the process of providing coverage for the specific projects the liquidity provider wants to cover

Project pools are capital inefficient since they require a fully collateralized position in order to offer coverage

Otherwise, the likelihood of insolvency is high!

Offering coverage at a 1:1 ratio is dangerous to stakeholders because a single claim could result in total liquidation

3. REWARDS:

The returns are generated from coverage purchased only in that pool and shared among a large group of stakeholders

Thus liquidity provider returns are reduced as new stakeholders enter the pool

However, the risk of permanent staking loss remains the same!

4. COVERAGE:

DeFi Insurance policies are created for specific projects for a specified time period covering only specific events

So, the policyholder must purchase multiple policies and pay multiple premiums for different risks since there is a limited coverage

5. CLAIMS:

Insurance claims are decided by a stake-to-vote mechanism

If you vote unfairly, you are liquidated

If you vote fairly, you get liquidated for paying out the claim

This results in a lack of a win-win situation for voting shareholders and skewed voting results

Also, most votes on insurance claims have been a 100% consensus to pay or not to pay, but in a DAO with proper incentives, votes shouldn’t have 100% consensus!

• A VIABLE OPTION:

FairSide’s solution to the lack of insurance in the Crypto space is non-insurance

@FairsideNetwork is a non-insurance solution to cost share unfair Crypto loss events amongst its members

It is an open network with no restrictions on membership

@FairsideNetwork aims to develop a decentralized, sustainable model by using the traditional insurance industry’s proven business model

FairSide spreads out risk over numerous areas to ensure that the potential negative effects of exposure to any one variable are limited

Funds are locked in a smart contract and can only be unlocked with a consensus vote of the community

The community focuses on assisting members with an immediate need due to any type of unfair #cryptocurrency loss

FairSide operates as a DAO and FairSide members will pay a membership fee and will receive cost-sharing benefits for their future Crypto loss events

Members will vote on whether the need of another member meets the community standard of an unfair cryptocurrency loss

If so, cost sharing will automatically be distributed via a smart contract to the receiving member’s wallet from the Capital Pool

The network will rely on the community’s involvement to determine types of losses to include or exclude in the network

But how does FairSide solve the problems of DeFi insurance?

1. RISK:

Network Staking diversifies the risk by spreading it across the entire network

Since there is no correlation to a specific project, paid claims result in minimal, temporary losses for stakeholders

2. CAPITAL EFFICIENCY:

By decoupling the assets from any specific project or type of loss, network staking produces 10x capital efficiency

The low correlation of risk drives capital efficiency, increases staking rewards, and provides the widest coverage

3. REWARDS:

Network Staking earns rewards from all members seeking coverage

As new stakeholders join, the distribution of rewards increases up to 85% to prevent the dilution of rewards

4. COVERAGE:

Members only need a single membership to receive FULL coverage for all approved loss types

Once a loss type has been approved by the community, it is automatically included in present and future memberships

5. CLAIMS:

Network staking allows for voting on loss events, not individual claims, to produce the fairest outcome

In this system, a vote is taken by the community to approve a claim event for cost-sharing benefits

And contributors are not liquidated if a loss is paid!

Although the DeFi insurance sector is still in its infancy, many protocols are working to develop innovative strategies for protecting users' assets

FairSide appears to be a viable option for those wishing to compensate for their Crypto losses while paying a premium

However, there are still many problems with other DeFi insurance protocols that need to be resolved

So, it is not advisable for regular people to insure their Crypto because they might not receive any compensation for their losses even if they pay a premium for it!

Get the latest news and research from M6 Labs directly in your inbox before Crypto Twitter!

Subscribe to our Substack for institutional quality content curated by a community of degens:

momentum6.substack.com/

Done? Now let's dive in!