(1/25) On days like today, I cant help but think: the world is ready for internet-native finance... that @ethereum is inevitable.

Well, would it surprise you to learn that all the big banks agree, that they're already believers?

Let's talk about @jpmorgan's Onyx platform.

(2/25) More of a long-form reader? No problem!

Check out this same article at its permanent home on my website, Inevitable Ethereum!

inevitableeth.com/en/home/ethereum/world-computer/projects/onyx

(3/25) In 2021 I listened to @haydenzadams explain @Uniswap to @tracyalloway & @thestalwart, and my life changed forever.

I am a child of the 2021 bull market.

My first crypto purchase was in August... by December I'd deployed more than responsible.

Cost basis: >$4k per $ETH.

(4/25) By the start of 2022, crypto had become large enough that our wins and losses would begin echoing through the physical world. And while the year would begin in stadiums and arenas...

...it would end in chaos, devastation and handcuffs.

twitter.com/Degen_Alfie/status/1608118078151479296

(5/25) Just as 2022 began, the class of 2021 began the crucible that makes crypto-zealots.

Everyone has to experience their first bear market.

I bought $OHM at the top, I got chopped out of >10x positions, I panic sold at the bottom (when the FTX Hacker made his entrance).

(6/25) And in my personal journey I found my place in this community. Somewhere at the intersection of @ethereum and finance that we call De-Fi.

I studied computer science, I have a background doing operational finance at a global corporation and I started enjoying threading.

(7/25) While 2022 was a particularly bad year for crypto, for me it will always be remembered as my particularly incredible journey deep into the heart of De-Fi.

By the start of 2023, I thought I understood how @ethereum and finance are coming together.

I was wrong.

(8/25) Last week I was at ETHDenver, meeting @DrewVdW in person after developing an internet-friendship through talking about the @ethereum roadmap.

Honestly I don't even remember what I was running my mouth off about. I don't really remember what brought him to say this...

(9/25) "A ton of banks are doing repo txns on-chain right now. Have you heard of @jpmorgan's Onyx platform? A ton of the huge banks use it for repo transactions. Billions of dollars, already happening today."

I had never bothered to look at what banks are doing in crypto

(10/25) I spent the next day thinking through the implications of already having that kind of market already operating on a blockchain when I finally texted Drew "is this JPM thing private or can I talk about it."

"just google 'jpmorgan blockchain repo'"

(11/25) The next few tweets will have some interesting links worth digging into, but here's a good summary.

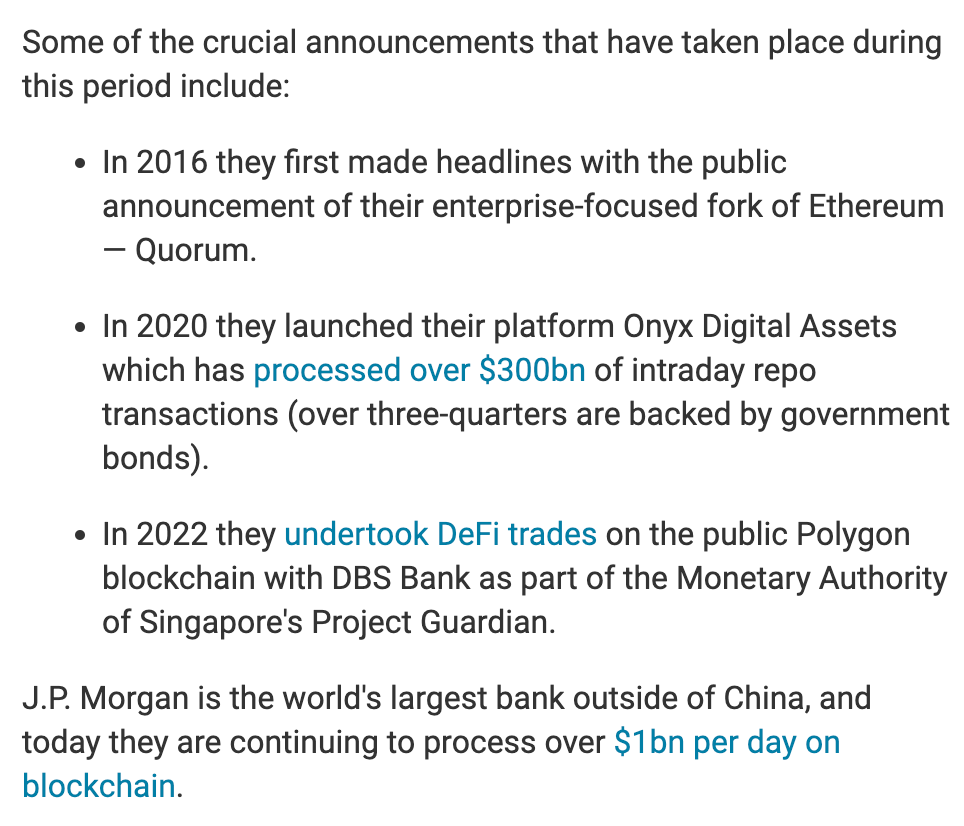

Tl;dr @jpmorgan has been in this space A LOT longer than I have... and J.P. Morgan has already built an empire.

finextra.com/blogposting/23554/jp-morgans-long-term-bet-on-blockchain

(12/25) The first live blockchain-based repo transaction was in December 2020. The transaction was between two entities within @jpmorgan, but the service has (clearly) evolved to include many external partners.

businesswire.com/news/home/20201210005155/en/J.P.-Morgan-Executes-Intraday-Repo-Transaction-Using-Blockchain

(13/25) This is a good walkthrough of how the system works.

soonparted.co/p/jpm-coin

(14/25) @BNPParibas became the first European-based bank to settle a repo trade on the Onyx platform, giving the private blockchain a truly global scope.

globalmarkets.cib.bnpparibas/bnp-paribas-trades-intraday-repo-on-j-p-morgans-onyx-digital-assets-platform-2/

(15/25) In November 2022, @dbsbank completed a blockchain-based repo trade, making it the first bank in Asia to participate in the Onyx platform.

financefeeds.com/dbs-bank-completes-blockchain-powered-intraday-repo-trade-on-j-p-morgan-in-few-hours/

(16/25) Bottom line: Onyx is big, and only going to get bigger.

And now let's address the looming question: should we celebrate that a private blockchain created by one the US's most bankiest banks is getting so massive?

What does this mean for @ethereum?

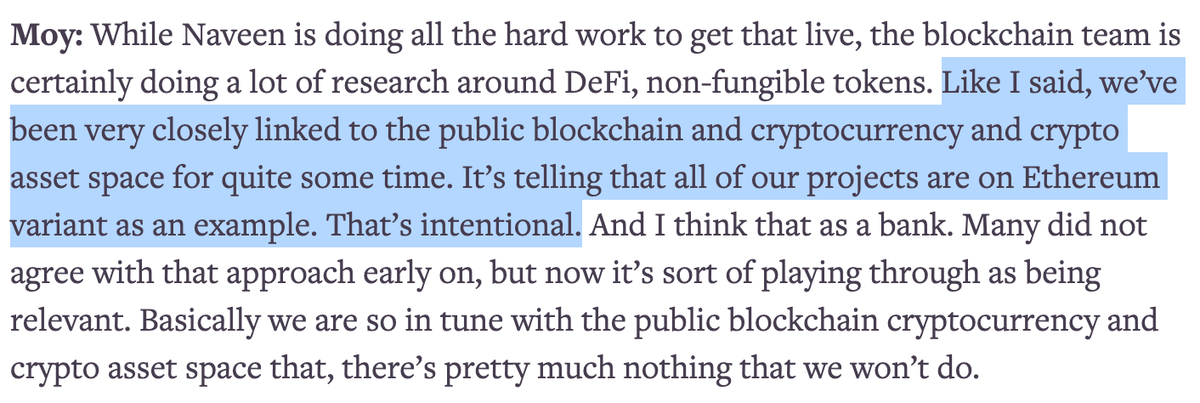

(17/25) By its very nature, much of Onyx is private, but here's what we do know: @jpmorgan gained its blockchain expertise developing Quorum (an @ethereum fork).

We also know that the team intentionally builds with an eye towards Ethereum.

forkast.news/video-audio/jpmorgan-onyx-jpm-coin-banking-blockchain/

(18/25) We know that @jpmorgan is interested in De-Fi enough to be testing real-world transactions on a public blockchain. They picked @0xPolygon, unimpeachable @ethereum zealots.

And we know that De-Fi needs access to deep liquidity.

blockworks.co/news/jpmorgan-trade-on-public-blockchain-monumental-step-for-defi

(19/25) But let's just take a step back and think big picture. Consider the things Onyx is used for: sending assets, repo transactions, creating digital representations...

...there's no functional reason Onyx needed to be a blockchain-based.

(20/25) All of this functionality could be implemented much quicker and much more cheaply if Onyx was just a server and an API, backed by the full faith and credit of @jpmorgan.

Instead, they chose to build with this brand-new technology that almost no one understands.

(21/25) Onyx is built in the image of @ethereum, the World Computer.

The World Computer is globally shared computing platform that exists in the space between a network of 1,000s of computers, (hopefully) growing more decentralized over time.

inevitableeth.com/en/home/ethereum/world-computer

(22/25) As the @ethereum network gains more computers controlled by different people, its becomes more and more certain that no-one can corrupt the system.

This creates credible neutrality, the necessary ingredient for internet-native settlement.

inevitableeth.com/en/home/ethereum/world-computer/internet-settlement

(23/25) And so, maybe @jpmorgan is trying to create an @ethereum-killer. Use all the same technology except for make sure all the node operators maintain absolute control.

But then... why bother? If J.P. Morgan wanted to kill Ethereum, they should have called Uncle Sam in 2016.

(24/25) This thread is getting long so I'll stop being coy.

In the @ethereum Endgame, I see a world shaped by @eigenlayer where $ETH will act as the collateral of trustless trust...

inevitableeth.com/home/ethereum/world-computer/endgame/trustless-trust

(25/25) ...and I see @jpmorgan's Onyx as a permissioned/private @ethereum rollup that manages the banking systems assets on-chain.

I am pretty sure that J.P. Morgan sees the same thing that I see...

Ethereum is inevitable.

inevitableeth.com/