(1/24) 🚨 There was a big airdrop that launched yesterday on June 9, 2022, for @HopProtocol and their new token, $HOP!

Keep reading to learn more about what @HopProtocol is and the $HOP airdrop 👇

#blockchain #crypto #exploit #DeFi #security #Ethereum #cryptocurrency #airdrop

@HopProtocol (2/24) @HopProtocol is "a protocol for sending tokens across rollups and their shared layer-1 network in a quick and trustless manner." They focus on replacing the Native Token Bridges between the layer-1 base chain and the rollup that are typically slower and expensive.

@HopProtocol (3/24) An example of this is the native bridge (bridge.arbitrum.io) between @Ethereum and @Arbitrum. @Arbitrum is a layer-2 optimistic rollup solution and because of that, the standard fund withdrawal process from @Arbitrum takes at least 7 days: help.uniswap.org/en/articles/5538762-how-to-withdraw-tokens-from-arbitrum#:~:text=To%20withdraw%20funds%3A,Arbitrum%20back%20to%20Layer%201

@HopProtocol @ethereum @arbitrum (4/24) As stated in the article, the 7 days is required "to allow sufficient time for verifiers to detect fraud on the Arbitrum network" because @Arbitrum is an optimistic rollup. @HopProtocol remedies this situation by providing much quicker bridging transactions.

@HopProtocol @ethereum @arbitrum (5/24) @HopProtocol calls themselves a General Token Bridge (instead of a Native Token Bridge) that bridges generic ERC-20 tokens between networks. It's also important to note that they also convert between layer-1 tokens and their canonical layer-2 representations.

@HopProtocol @ethereum @arbitrum (6/24) Bridges primarily work by storing the tokens sent on the original chain in a pool and minting an equivalent token on the chain being bridged to. When users bridge back, they return funds back to the bridge where tokens on the original chain are released from the pool.

@HopProtocol @ethereum @arbitrum (7/24) In the process of bridging to a new chain, the bridge can mint a new layer-2 token representation of the layer-1 token being bridged or the bridge can mint an existing layer-2 representation. You typically want the existing layer-2 representation, or the canonical version.

@HopProtocol @ethereum @arbitrum (8/24) This is because the canonical version is likely the layer-2 token produced by the Native Token Bridge and the most adopted version of the token on layer-2. @HopProtocol has built out a specific function through their Hop tokens and AMM to provide the canonical version.

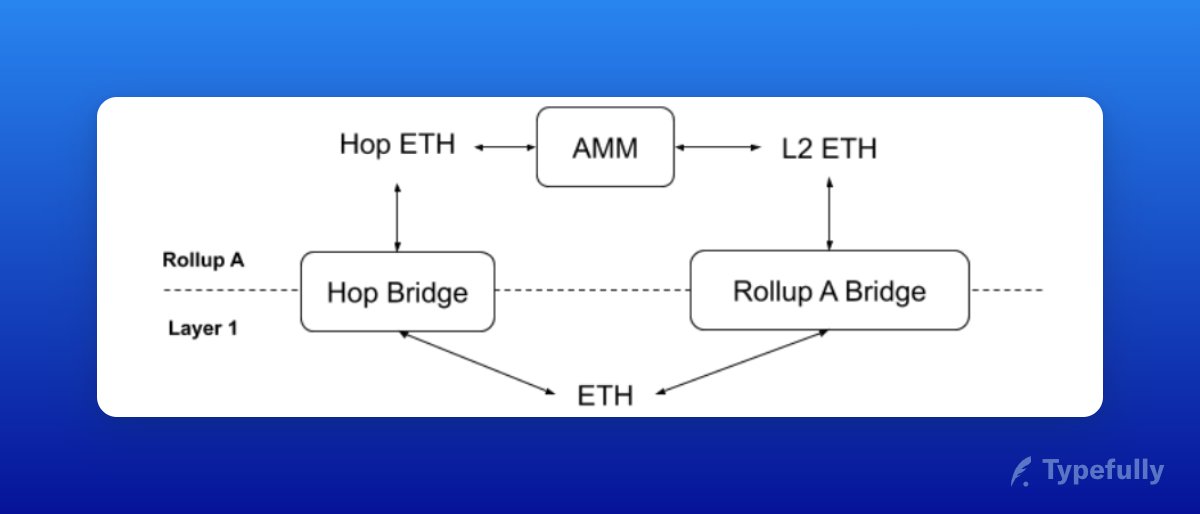

@HopProtocol @ethereum @arbitrum (9/24) @HopProtocol uses Automated Market Makers (AMM) to swap between bridge tokens and canonical tokens on the rollup to dynamically price liquidity and incentivize the rebalancing of liquidity across networks. Below is a swap between a layer-1 and layer-2 rollup using ETH.

@HopProtocol @ethereum @arbitrum (10/24) You can see from the image above how users can bypass the slow and expensive Rollup A Bridge (Native Token Bridge) using the Hop Bridge and Hop Tokens (in this case, Hop ETH (hETH)). Users can move their ETH into the Hop Bridge where it then mints hETH on to the rollup.

@HopProtocol @ethereum @arbitrum (11/24) @HopProtocol then swaps hETH for ETH using the ETH:hETH AMM on the rollup for the canonical version of ETH. A user who wants to move ETH back on to layer-1 then returns their ETH to the @HopProtocol bridge where it's swapped for hETH and redeemed for layer-1 ETH.

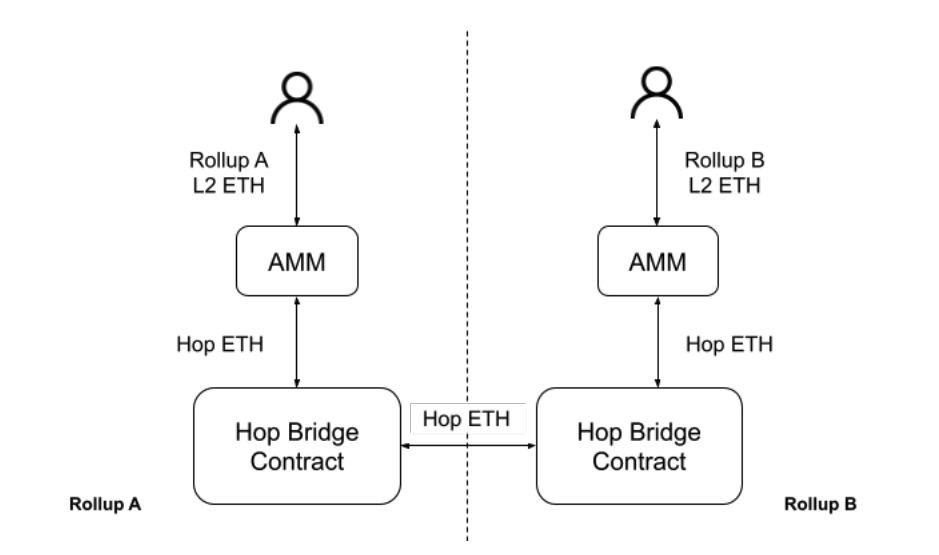

@HopProtocol @ethereum @arbitrum (12/24) Below is another example of a swap using @HopProtocol bridge except in this scenario, the swap is between canonical tokens on two different rollups. @HopProtocol is able to use hETH as liquidity between chains before using the AMM function on each respective rollup.

@HopProtocol @ethereum @arbitrum (13/24) The whole transfer process requires three more crucial components, arbitrageurs, liquidity providers, and bonders. Arbitrageurs are a group of actors that take advantage of price differences between layer-1 tokens and their canonical layer-2 counterparts in the AMMs.

@HopProtocol @ethereum @arbitrum (14/24) By taking advantage of these price differences, Arbitrageurs rebalance liquidity across the supported rollups. This is essential when Hop Tokens (e.g. hETH) and native tokens (e.g. ETH) are constantly being swapped and there is price movement between hETH and ETH.

@HopProtocol @ethereum @arbitrum (15/24) Liquidity providers also play a big role in each AMM since they wouldn't be able to function well if there was low liquidity. A lot of slippage would occur for users bridging assets with low liquidity that would cause them to lose out on part of the value of their tokens.

@HopProtocol @ethereum @arbitrum (16/24) Bonders in @HopProtocol are the final piece that verifies transfers by running a verifier node for rollups and provide up-front liquidity on the destination rollup to fulfill immediate transfers. Their funds are ultimately restored once the transfer is complete.

@HopProtocol @ethereum @arbitrum (17/24) If you wish, you can continue reading more in-depth in @HopProtocol's whitepaper here: hop.exchange/whitepaper.pdf, and look at their FAQ and extended FAQ section here: docs.hop.exchange/faq.

@HopProtocol @ethereum @arbitrum (18/24) I've also linked @HopProtocol's statistics page covering all the volume that is traded through @HopProtocol categorized by each supported chain here: volume.hop.exchange/

@HopProtocol @ethereum @arbitrum (19/24) Now, for the airdrop 🪂. @HopProtocol announced the Hop DAO and the $HOP token on May 5, 2022 here: twitter.com/HopProtocol/status/1522284534598967300?s=20&t=NeG0LOTd1lnk4eNixwBlBA. The Hop DAO will manage day-to-day functions of @HopProtocol and will be initially organized in a delegate model similar to @ensdomains.

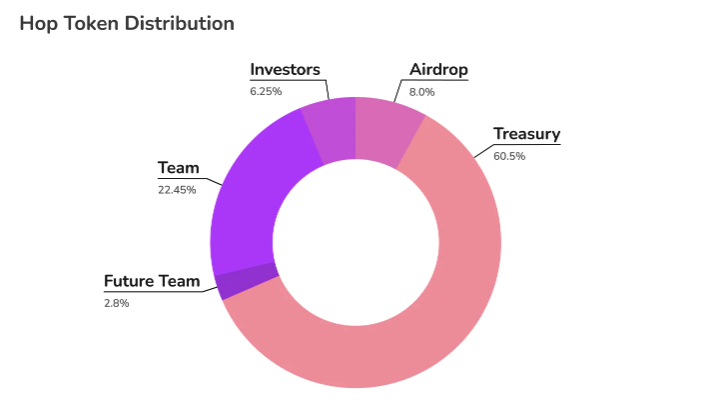

@HopProtocol @ethereum @arbitrum @ensdomains (20/24) The $HOP token will have an initial supply of 1,000,000,000 tokens and be allocated as:

• 8%: Airdrop

• 60.5%: Hop DAO treasury

• 22.45%: Development team (3 year vesting, 1 year cliff)

• 2.8%: Future team members

• 6.25%: Investors (3 year vesting, 1 year cliff)

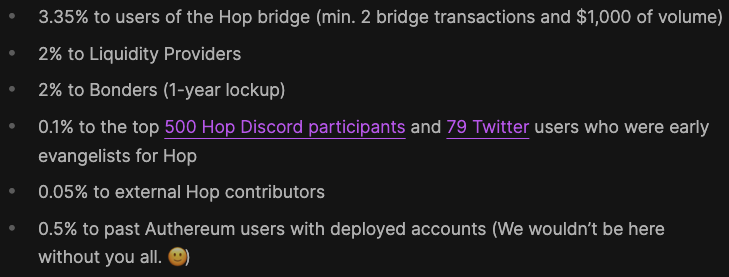

@HopProtocol @ethereum @arbitrum @ensdomains (21/24) The airdrop snapshot was taken on April 1, 2022, at 12:00am UTC. 8% of total $HOP tokens, or 80,000,000 $HOP, were distributed among different participants of @HopProtocol. You can see the breakdown below:

@HopProtocol @ethereum @arbitrum @ensdomains (22/24) To continue reading, see here: hop.mirror.xyz/AI5fOUR0X_l0mktShDOx3mwr-hsB24gp8GvTWtS-MBc

@HopProtocol @ethereum @arbitrum @ensdomains (23/24) And as I said, the airdrop went live on June 9, 2022. If you are eligible for the airdrop, there will be a minimum 6-month period to claim your tokens before it can be reclaimed by Hop DAO. To check if you're eligible for the airdrop, see here: app.hop.exchange/#/airdrop/preview?token=ETH

@HopProtocol @ethereum @arbitrum @ensdomains (24/24) Best of luck and congratulations on your airdrop and free money!

I hope you found this thread helpful! Please like, retweet, and follow me for more resources and informational threads in the future. Thank you!

twitter.com/Khrippet/status/1535265707759480835?s=20&t=v4QGmo8tKv8WfgARvBE2qQ