Crowdstrike and SentinelOne used to be serial competitors.

However, I'd argue that this macro env. has further drifted them apart.

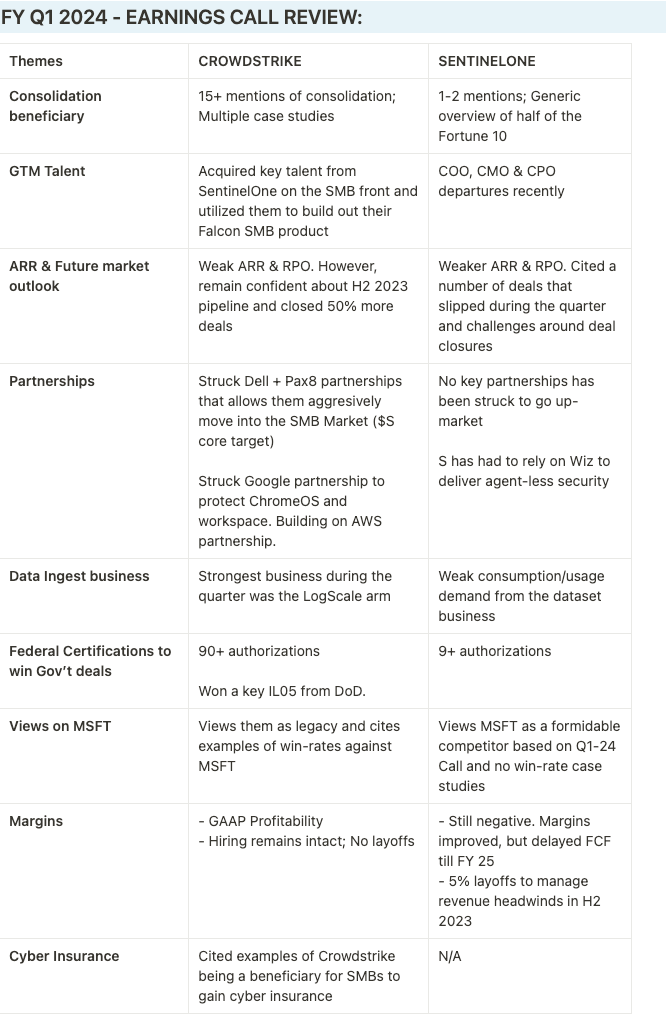

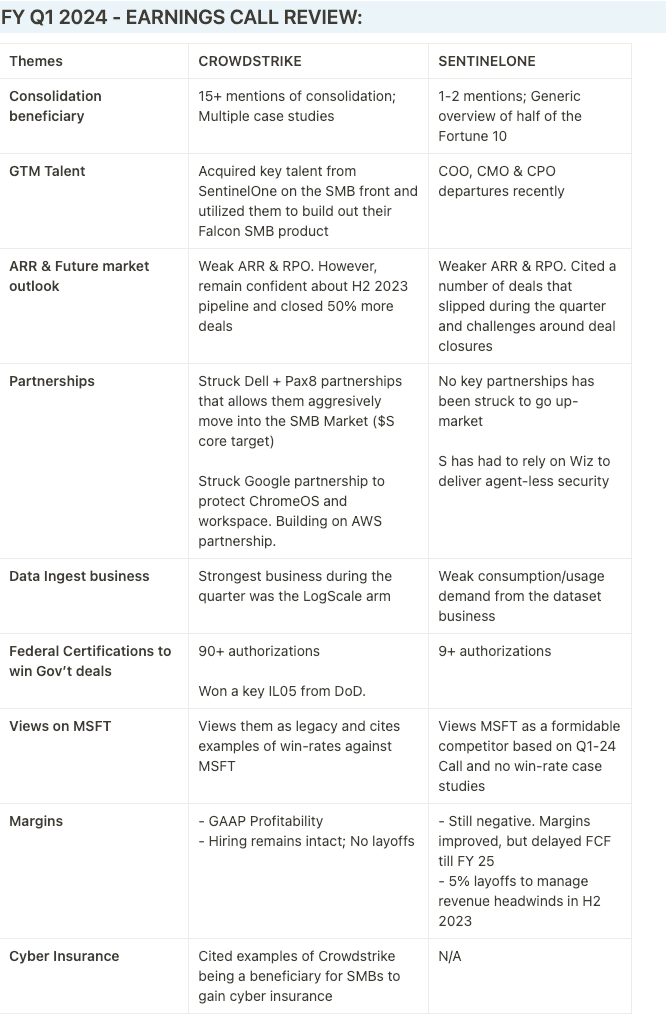

Below are some quick notes from their recent earnings, but I want to go into more depth on the factors leading to this divergence in this thread:

$CRWD and $S were founded 2-yrs apart.

Today, $CRWD generates $3.3B growing 35% YoY meanwhile, $S generates $600M and is estimated to grow 41%.

Why this divergence despite only 14-months apart?

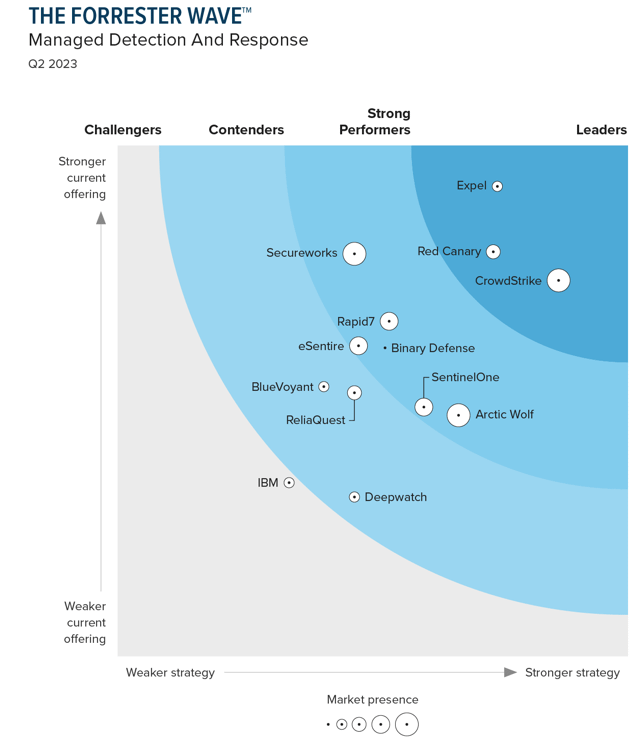

My thesis is built around $CRWD's early decision to invest in its managed service.

When $CRWD was founded in 2011, they brought their cloud-based Falcon EDR to market quickly and complemented it w/ human-driven managed services.

$S decided to delay the launch of their product into the market until about late 2015/16 and also refused to add managed service.

Adding a managed service was key at this time bcos when $CRWD launched their EDR in 2012 many SOC analysts in enterprises didn't knw how to manage cloud EDR.

$CRWD analysts were always at hand to offer support in analyzing the telemetry their device generated. $S never got this.

To explain a managed service (MDR vs MSSP)

MSSP is where you pay $CRWD to watch your data & let you know if they see anything that should be flagged.

MDR is alternatively where you can pay for them to just take over all your IT stack and say, "If you see something, fix it."

Now, this mgd service has been key in helping $CRWD stimulate growth in other areas of the business.

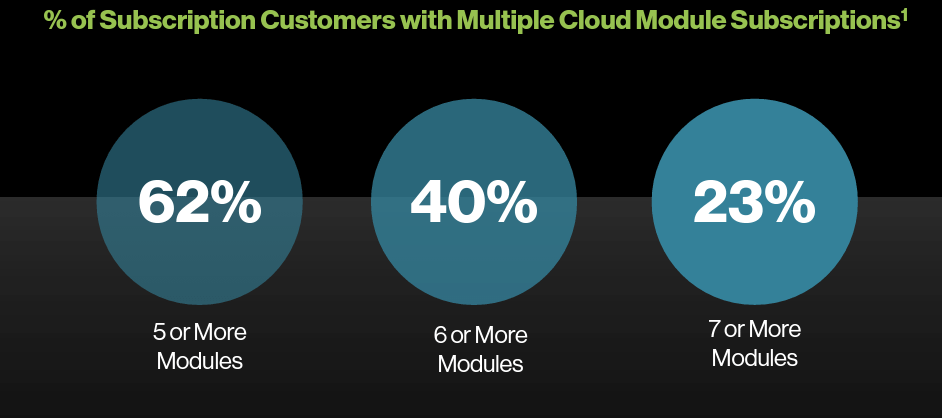

As $CRWD has added 25+ product modules, this human element has helped them build trust, allowing to upsell more modules.

It's become so good, $CRWD report cust w/ 7+ modules.

Although $S now has a managed service, from its early days, it always believed that AI could take this role of MDR. They never emphasized building out this arm as much as $CRWD.

This is why they dubbed their flagship product as "autonomous AI", but this strategy hasn't worked.

In cybersecurity, compared to other tech sectors, companies rely on MDR/MSSP recommendations before buying products.

$CRWD's recent leadership in MDR makes them an ideal candidate for SMBs who don't have the budget to staff a full security team in this macro environment.

Channel ecosystem of MDRs, MSSPs, VARs etc who recommend products to clients get to buy the product from $CRWD at a discount, then re-sell to their clients & make money on added services.

As a result, they're incentivized to recc./sell Gartner's leading products that are popular

The dynamic currently at work:

1. $CRWD is the leader on Gartner

2. $CRWD has a strong managed service and partnerships to support customers (SMB & Ent)

3. Full breadth of product modules for customers to consolidate on

This makes it easier for MSSP/VARs to pitch CRWD over $S

This is translating to issues especially in this current environment.

For example, $S saw a 'pronounced' Q1 than did $CRWD.

However, $CRWD closed more deals and is confident about the back half of the year.

These are stack differences for similar competitors.

Also, GTM & Talent issues are beginning is show up.

The CEO talked abt the challenges of closing deals on the call.

$S lost two key talents *within SALES. * Dan was CMO and held many of the keys to $S MSSPs. He led channel partnerships and business dev roles at several SaaS Cos

In my opinion, this small but important decision is leading to the divergence between these two companies.

Many of these are manifested on this list below:

In summary, $CRWD early decision to invest in managed services complemented w/ human analysts has led to advantages that are currently benefitting them in this macro env that demands consolidation.

$S' lack of investing here has further drifted them away from $CRWD in many ways.

There are other structural differences btw $CRWD vs $S versus the likes of $MSFT, $PANW that cut across the endpoint industry.

We'll be diving into these differences and dynamics next week w/ myself and some security leaders.

2-days left, sign-up below.

maven.com/saas101live/saasbootcamp