Snowflake's Q2 2022 earnings report had many surprises that caught many off guard!

Beyond the headline metrics, the devil was in the details, with lots to unpack.

I've taken the time to review the report in-depth; here are the most important takeaways for Investors:

$SNOW

1/

2/ Thread Outline

- Q2 Revenue

- FY Guide

- Customer Growth

- RPO

- Operating Metrics

- Consumption Model

- Tech stuff

- Databricks v $SNOW

- Acquisitions

- Future Growth

Thread is broken down into the metrics (Thread 3) and Product/ Tech developments (12); Feel free to skim

3/ Q2 Revenue:

Beyond headline 83% top-line growth, some details:

- Q2 saw 18% QoQ growth, the strongest in 3-Qtrs

- Sequentially added $75M Net New Revs (highest in 2-yrs)

- They beat 6% above consensus. One of the highest in SaaS in Q2.

The Qtr was solid & I was SURPISED!

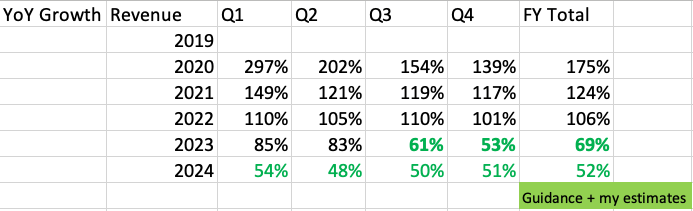

4/ Looking forward - Guidance:

- Next Q3 Guide - 61% YoY and 8% QoQ (very WEAK).

- Their average beat is around 3-6%, so expect a beat of 65% roughly.

- FY 2023 Guide raise was a 1% raise - expect to grow 68%.

Overall guide was the weakest part of the Qtr - may be cautious?

5/ Customer: BEST PART of the Qtr!

The headline was total 6.8K customers (36%, whch is a slowdown from 67% last year)

However, this is the Seq. Customer add the past 6-Qtrs:

393

458

426

528

378

486

I've heard this was the result of the $SNOW Conference where m. deals happened!

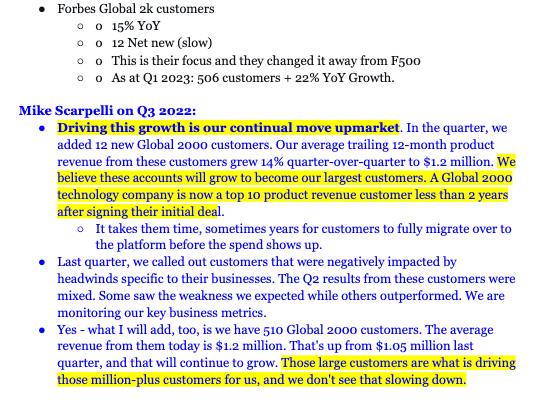

6/ >$1M Customers

Net New Add was +40 vs. 22 last Q. A record!

They said Financials custs make up over 20% of revenue.

SNOW has said G2K cust are priority + moving upmarket.

Fun fact: Databricks (7k) has more customers than Snowflake (6.8k) and >100 $1M Cust as of Q1 2022.

7/ RPO & Billings (Another weak spot)

Headline was 78% YoY, it was 4% QoQ which d slowest in a while!

However, they showed 57% of current RPO to be hit nxt 12-mnths grew 12%

This is similar to other large SaaS who are having trouble w/ large deals, but Q4 should see a bump up!

8/ Operating Metrics:

+ NG-Gross Margins *70%

+NGAAP Losses, +4%

+GAAP Losses, -42% from -72%

+FCF is improving (haters will say it's negative when you add SBC, and it increased YoY) fact is $SNOW doesn't have a cash problem

+ Over $4.3B in Net Cash!

twitter.com/InvestiAnalyst/status/1562576181085360130?s=20&t=RcDvXnagz-z3SnCkG11wCw

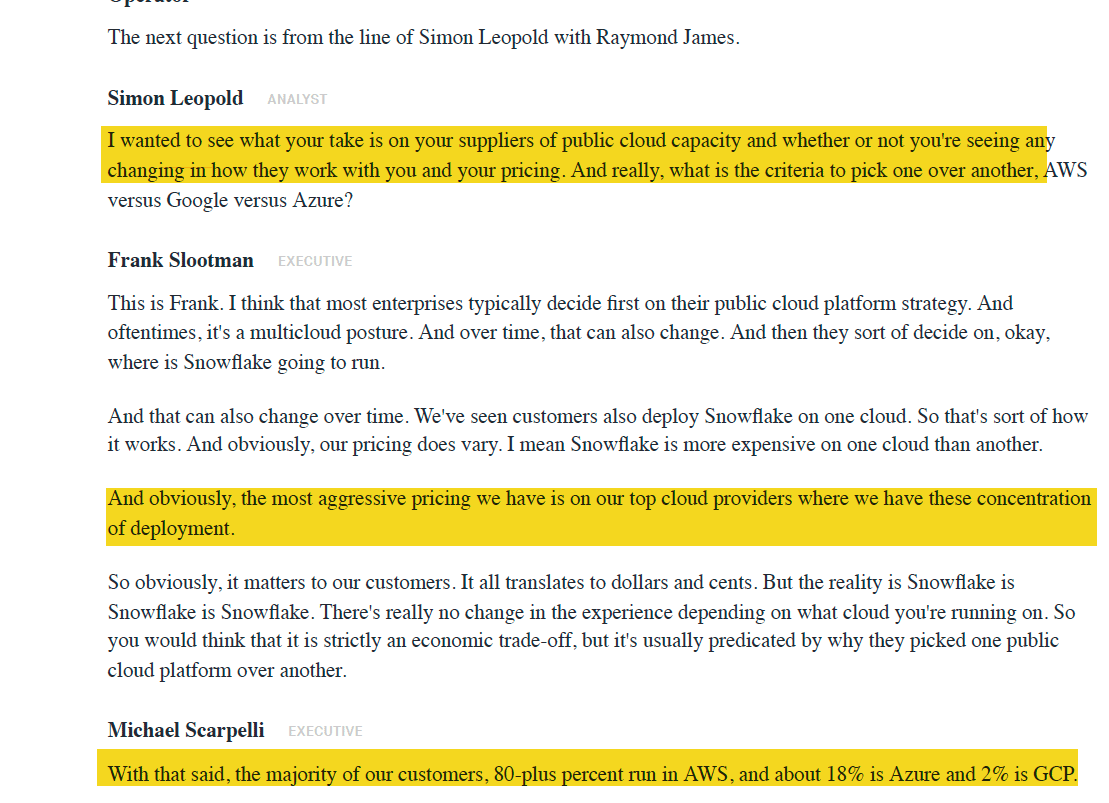

9/ Interesting fact on data cloud providers running snowflake workloads + pricing:

$SNOW customers:

+ 80% run on $AMZN

+ 18% run on $MSFT Azure

+ 2% $GOOGL GCP

Likely AWS Marketplace + Graviton + better pricing effects). I cant imagine the cross-sells happening - thoughts?

10/ ALAS! I mentioned this a while ago, but many thought I was crazy lol.

As an FYI, Databricks tilts towards the opposite side of the spectrum amongst all three cloud providers.

This makes me think Top 10 is too low? Maybe Top 5?

twitter.com/InvestiAnalyst/status/1549944651020247040?s=20&t=RcDvXnagz-z3SnCkG11wCw

11/ Consumption v SaaS Model:

When yu think abt the optionality customers have to sign a range of contracts + know its usage pricing - this likely attracts more custs & Lowers churn.

Evident from the DBNRR @ 171%!

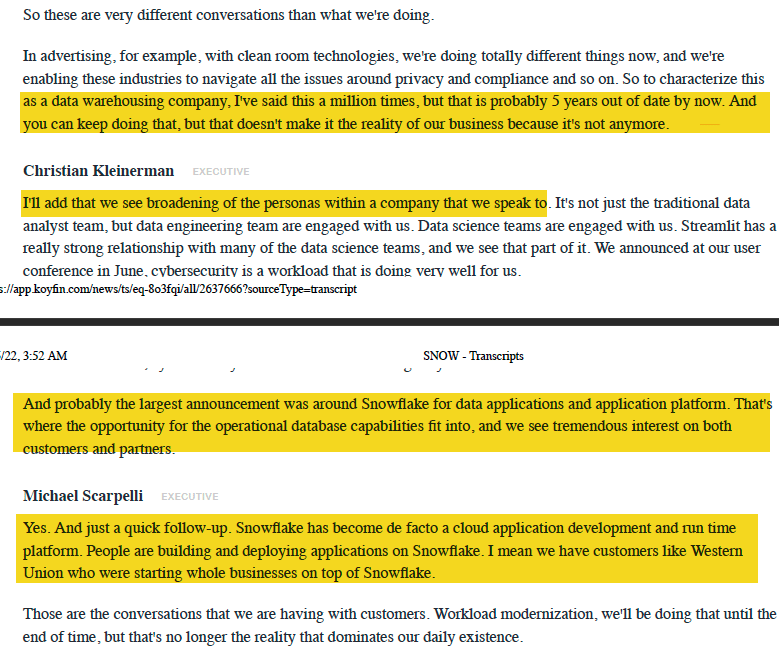

2 key excerpts from d call (More on this in the future from me)

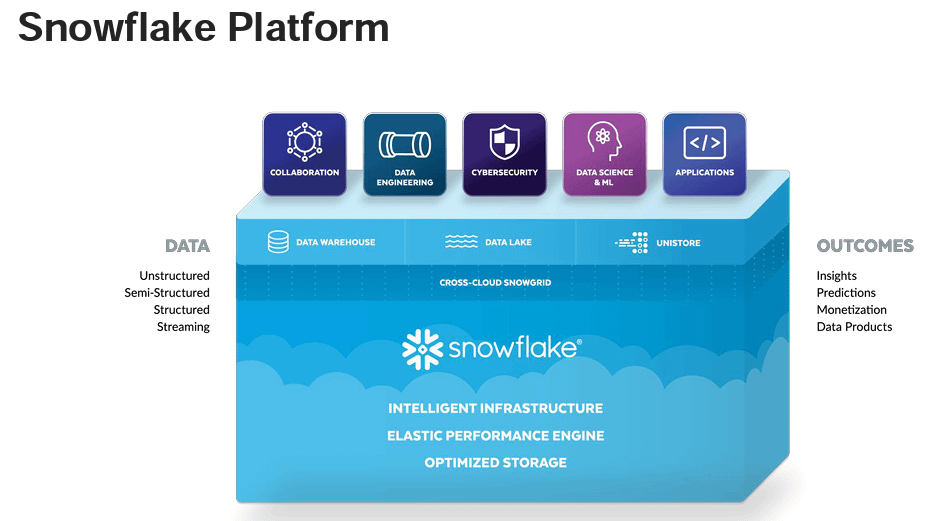

12/ Tech:

Overall, we see $SNOW's ambitions to build the ONE data stack that caters to different:

A-Data types

B-Workloads

C-Users

This is manifested by:

- Support more Unstructured data

- Native Application framework

- Streamlit 4 Apps

- Data sharing

- Unistore

- Cybersec

13/ A-Data types:

Traditionally, as an SQL DWH, SNOW is great at dealing w/ structured data (tables).

But to provide a stack that solves many enterprise data issues in ML, they need to support unstructured data. They are focused on this weakness to better serve data scientists.

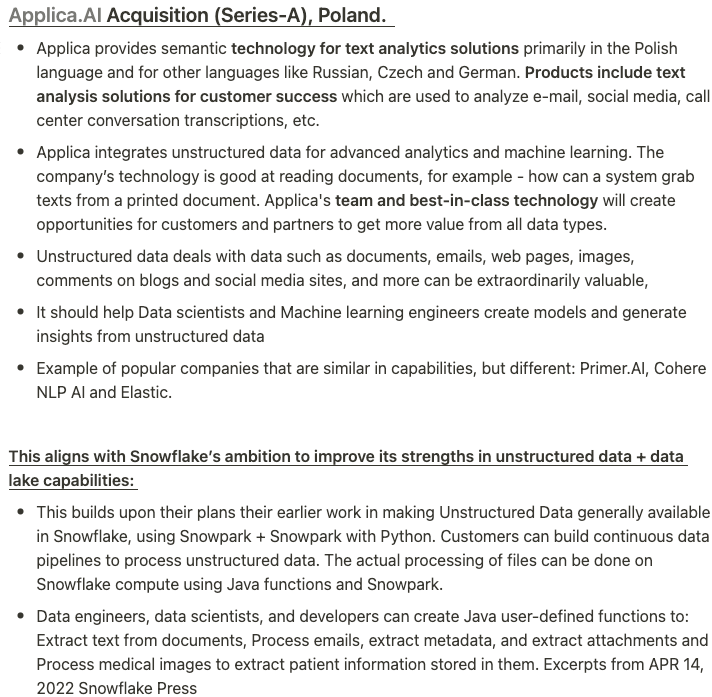

14/ B-Acquisition for workload types:

They're acquiring a Co. for $SNOW's to close the gap on managing unstructured data and catering to Data Science teams.

Instead of a thread, I wrote abt the acquisition BELOW + how it fits into d LT strategy (of catching on to Databricks).

15/ C- Databricks vs SNOW:

For context, databricks is built on object storage on the hyperscalers as a data lake.

Hence, DB is better at dealing w/ unstructured data for ML.

SNOW is closing in the gap w/ Apache Iceberg + Snowpark + this acquisition.

twitter.com/InvestiAnalyst/status/1562636541713063938?s=20&t=RcDvXnagz-z3SnCkG11wCw

16/ C-Broadening User types across the enterprise using $SNOW was another goal Christian (the CPO) emphasized.

I've discussed this b4 but overtime, we'll see more parts of the IT team like SWE heavily use SNOW. They mentioned Western Union as an example twitter.com/InvestiAnalyst/status/1562253084847472640?s=20&t=vAxKQVXgH-6H10UxTjEqiQ

17/ MAIN strategy for $SNOW is to allow more IT workloads run on SNOW.

Today, there's LOTS of back & forth btw SNOWs AI/ML workload and transactional databases like $MDB or Postgres (external)

Unistore minimizes this friction.

Great thread by @CackF!

twitter.com/CackF/status/1545086412541743109?s=20&t=iJc_-jjzTNa-nF6Q6GFiNw

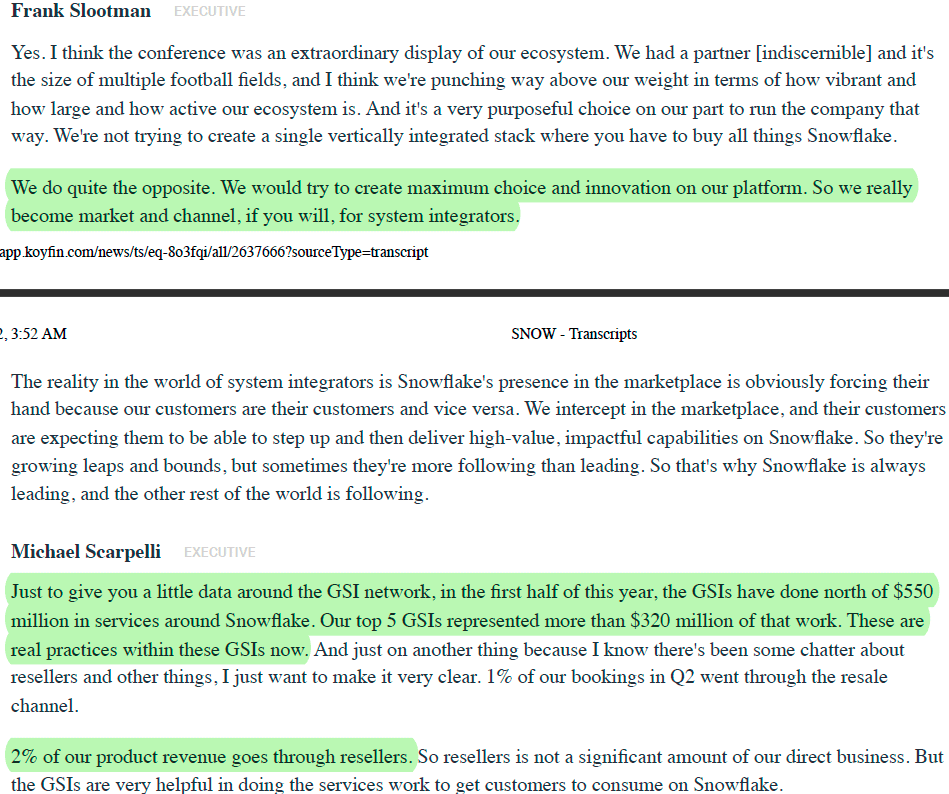

18/ Ecosystem Partners

I've mentioned this b4, but I WANT to emphasize how strong $SNOW ecosystem is building.

GSIs are growing big thing, and SNOW relies less on resellers (atleast now).

All this is key to driving new G2K Customers, which is more $.

twitter.com/InvestiAnalyst/status/1542601126016696320?s=20&t=xITgCITBueOxxuvNi6R8Bg

19/ $SNOW Marketplace

I believe $SNOW's data marketplace is going to be BIGGER than anyone expects in 5yrs.

The more they win customers within each industry, the more data can be sold + exchanged.

HUGE network effects growing + further drives compute ($).

I WROTE more below:

20/ How To think abt H2 2022:

a/Watch how fast they release Unistore + Iceberg to be generally available for ALL custs! -> will be key to driving incremental compute thereby more $$.

b/ These are Con. YoY growth estimates for nxt Qs (IMO, think we see +72% in 23 & +60% in 24):

21/ Tl:dr

a/ 17% FCF guide + NG Margins are key leverage.

b/ Customer growth was a key highlight from Q2, but note - it takes custs. over 7-9mths to start consumption + sales rep take 6-months to ramp productivity.

So expect a slowdown in H2 2022 but growth pick up next year!

22/ Below is my last thread recap from last Q1.

For today's Q2 summary:

- Improving margins

- RPO will pick up in Q4

- Booming ecosystem

- Great net new customers

- Network effects growing 4rm marketplace

SNOW caters to all user + workload + data types.

twitter.com/InvestiAnalyst/status/1499454279614021632?s=20&t=3VHu8HReSowIiScsScntig

23/

These results demonstrate more mission-critical workloads are running on $SNOW. Despite a recession, custs won't easily cut spend.

I have MORE to say but let's end it here. I might have a piece up nxt week.

Anyways, I hope this thread was helpful!

investianalystnewsletter.substack.com/