SASE is the fastest-growing sector in cybersecurity. We've seen the results show up with $ZS & $PANW.

Gartner est. by 2025, 65% of enterprises will have implemented a SASE component (up from 20%)

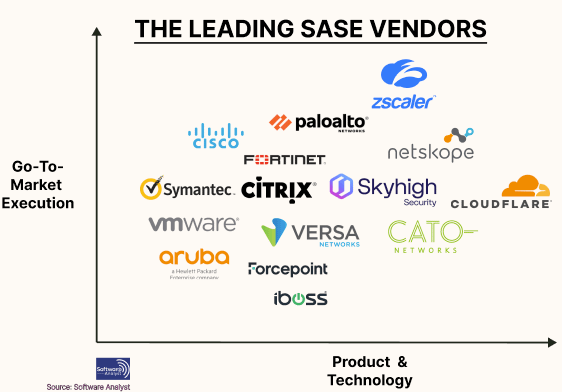

Here are some differences btw the top players in SASE based on my work w/ experts:

First, what is SASE?

SASE is simply the convergence of traditional networking and cybersecurity features into one platform that secures users' access to their SaaS apps, from anywhere (either at home or in the office).

See more explanation below...

x.com/InvestiAnalyst/status/1638015984140451840?s=20

I've discussed the ways to evaluate SASE vendors from an investor perspective:

Two things guarantee success in this market.

1. The underlying technology infrastructure and delivery.

2. Implementation and channel partners on the GTM.

See more below:

x.com/InvestiAnalyst/status/1638018196853895169?s=20

Zscaler remains the market leader, generating $2B ARR from SASE/Cloud platform.

Their core advantages:

- First mover with a purely cloud-native platform

- Investing early into the Fed vertical + achieving the highest FedRAMP certification

- Strong GTM with loyal channel partners

$PANW SASE is growing 60% YoY, solid.

They get to leverage a large install base of firewall customers where SASE could be an easy cross-sell for those wanting hybrid SASE + SD-WAN deployments.

However, they need to deepen their GTM in Federal and with large channel partners.

Cloudflare makes the most noise.

Yes, they have the technical edge for clean SASE deployment using their edge network as a CDN and global PoPs

However, as one of the newest entrants, it'll take them time to gain share as they lack the channel distribution + GTM chops needed.

Fortinet gets to leverage its core competencies in enterprise networking, SD-WAN and ASIC chips to deliver SASE over an appliance, but honestly, they are sooo far behind.

Netskope, Cisco and Cato Networks remain core competitors on the private markets to watch.

To learn more about SASE and the future of cloud network security, check out @BreakingSaaS & I's bootcamp.

For more on $ZS and the SASE market, see my piece

softwareanalyst.substack.com/p/sase-breakdown-a-deep-dive-and-the

(It's the last day! Use: FRIDAY30 for a final 30% discount)

maven.com/saas101live/saasbootcamp