Distribution > Product

An exploration into why $BILL remains one of the highest valued and fastest-growing Fintech/SaaS companies.

I'll try to explain what makes this 'boring' company's distribution unique, crack at the reason for its premium Val. and my thesis in this thread:

1/ Simply, Bill is a provider of the accounts payable, accounts receivable and payment automation for SMB's.

They pretty much remove all the hassle of managing all the inflows and outflows of money, making the job of an accountant easy.

The business model is attached below -

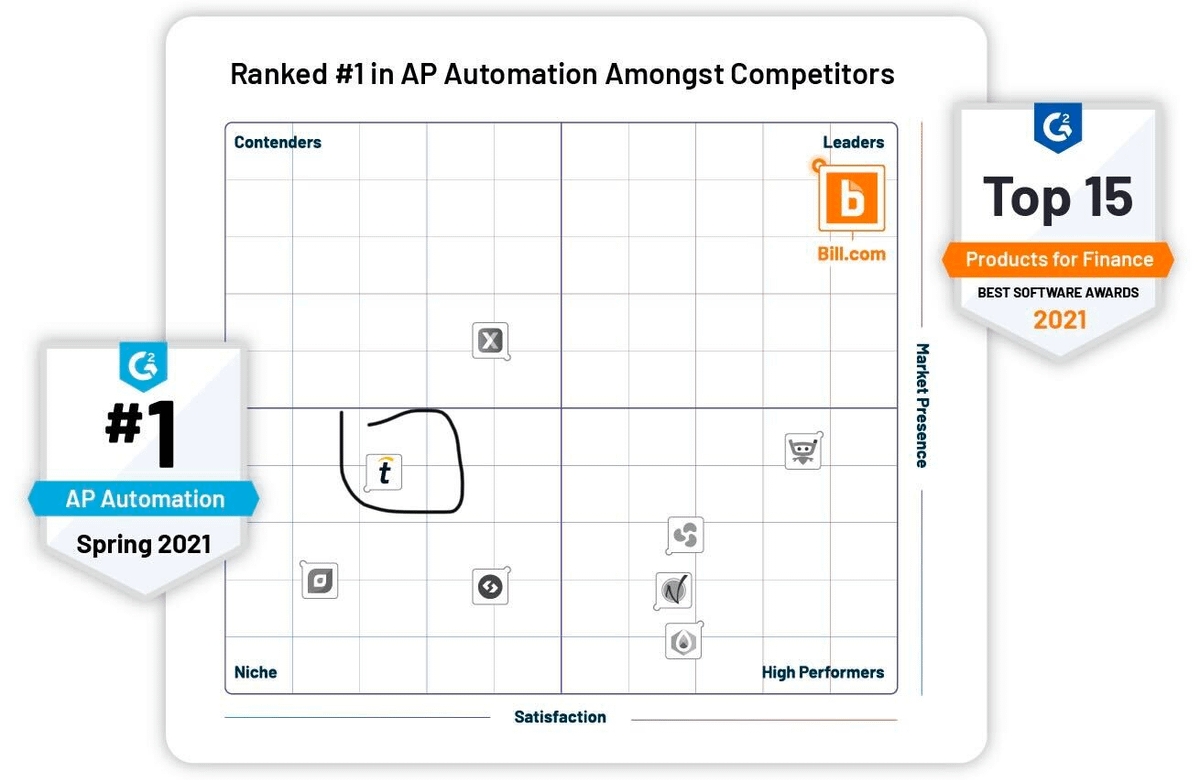

2/ They're one of the first movers primarily in automating tasks within the SMB back-office and running fast with a successful interesting GTM strategy.

They don't have face any "major" competitor in their space especially since $COUP has primarily focused on large ent.

3/ Less competition in SMB + Large TAM, especially since Coupa & others are focused on AP/AR for *large/mid enterprises.

The large players HATE the SMB segment due to churn. This has created abundant room for $BILL. This is one of the reasons why the biz continues to grow fast.

4/ $BILL's GTM sales strategy is their key secret.

They've built an incredible GTM engine that leverages hundreds of large partners like the Big 4 Accounting firms and many accounting software vendors (importantly Intuit) that help resell products/spread awareness wide and far.

4i/ BILL's product is OK. Not sexy or anything,

But they made a conscious effort to focus on distribution (and making the product easy to use for free before paying). Bill focused on winning big banks/firms which allowed scale across many customers and increased network effects

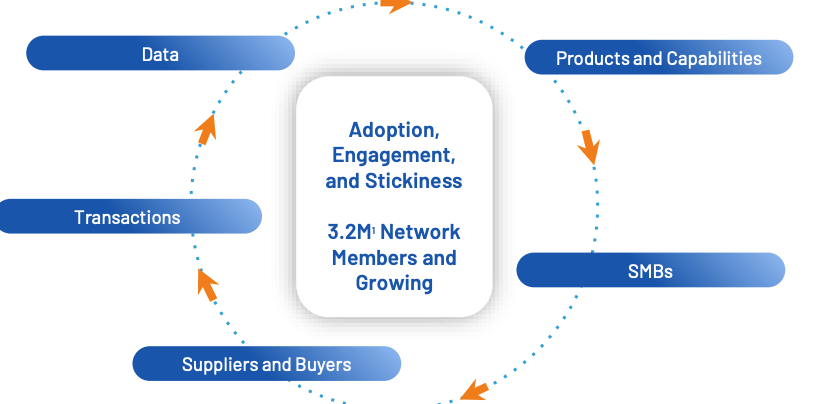

5/These wide partnerships have led to an incredible natural GTM engine.

As a result, $BILL has an efficient S&M spend. This has helped $BILL have one of the lowest CAC Adjusted payback periods of <6 months. Best amongst fintechs (and even better than some pure-play SaaS).

6/ For context, in their FY Q4 2021, they spent around $29M to generate over 80M Revenue and a Total Payment Volume of $41B. Subsequently, that number is still growing organically 85%YoY 2-qtrs in.

Additionally, their high gross margins of 85% also helps the CAC payback period.

7/Importantly, they have a DNBRR of 124%+. This is particularly impressive for a business that is purely focused on SMB. Not even $SHOP can boast of this metric

Although they experience churn, they've managed to keep retention high and keep expansions high amongst their target.

8/ $BILL's important partnerships w/ Accounting firms and $INTU play a key role in their success. I've read as much as 70% of firms (roughly 4000). Accountants love the software bcos it also helps them keep their clients.

BILL has an entire GTM focused only on accountants.

9/ Many financial organizations or SMB generally have only one AP/AR platform (similar to QuickBooks) to simplify their payments in and out of their business.

Hence, if biz has already implemented BILL, you don't need another one.

Some WOM comments:

twitter.com/AlwaysBeHedging/status/1489369687813242883?s=20&t=0pjXodj20_a61tXNf2CyVw

10/ The more payments you have running through BILL or the more customers that are already on the platform, the harder it is to switch and hence creates high switching costs once BILL has been implemented.

Additionally, the product is good. G2 ranks them as 2022 best Acct SW -

11/ Overall. these differentiated key reseller partnerships serve as bargaining power for BILL.

They act as a barrier to entry for competitors trying to enter into the space since they can't match the breadth of $BILL's network within the accounting industry.

12/The business is Founder-led but more importantly, they've shown themselves to be shrewd capital allocators.

They acquired invoice2go and Divvy. Both businesses have seen tremendous underlying growth and helped to increase BILL's take rate on their customer's transactions.

13/ Divvy is an employee-spend management software that charges almost 3% interchange fees.

Divvy is great biz and has experienced tremendous growth that is also turbo-boosting BILL's revenue growth in their recent qtr.

For context, Ramp is similar.

twitter.com/InvestiAnalyst/status/1506001697658871813?s=20&t=SJH9rOHR-2zdR_zMQv16og

14/ Below are the key growth metrics for BILL over the last couple of years:

I've broken it into the core and organic growth. A dip in Covid, but a strong bounce back.

15/ As I conclude, some lessons:

Using a freemium model that still delivers value is powerful.

$BILL's customer acquisition (S&M), partnerships, and freemium pricing are targeted to drive WOM/Virality.

$BILL is a story that shows distribution is more important than product.

16/Tl;dr:

a/$BILL can upsell Invoice-mgmt, employee spend w/ their AP/AR & payments software. This helps sustain high DBNRR and growth at scale.

b/ Biz has switching costs

c/ Less competition, differentiated partnership & GTM

d/ Efficient S&M Payback.

e/ Distribution is key!

17/ These are just a few reasons why this biz consistently commands a premium valuation over its peers.

I have more to say about their margin profile, Divvy, the future of AP/AR/payments but I'll share those overtime!

Disc: I'm long sub <19B EV. DYODD. Ty, @InvestiAnalyst.