Blaming individuals for the risks in @ankr may be easier, but systemic risks remain unmitigated. The security and robustness cannot be built on the assumption that no one within the system will make a mistake.

🧵EigenPhi has delved deeper into the event in an in-depth report.

twitter.com/zachxbt/status/1610315825080336384?s=20&t=x9tPqNaHfHNN7UxEjL3OCQ

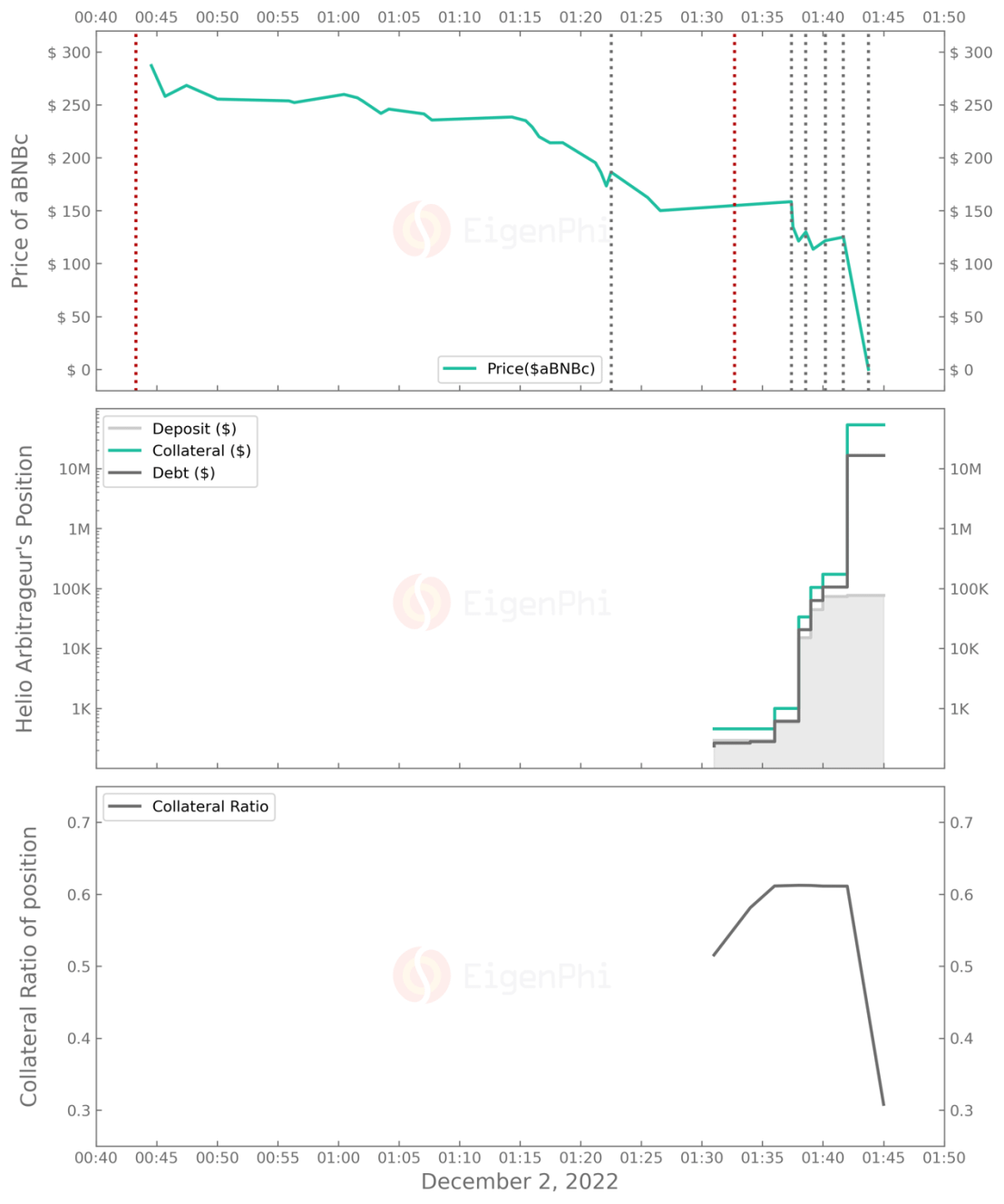

Let's review the core process of the attack in the picture below.eigenphi.io/report/ankr-exploiter-report

Here are some 🥡s from our research: eigenphi.io/report/ankr-exploiter-report

FIRST OF ALL: the security and robustness of the DeFi system cannot be based on the assumption that no one involved in the system can make a mistake.

TWO CAUTIONARY TALES for DeFi protocols:

1️⃣ Information monitoring bias: The actions of arbitrageur and other followers demonstrate that searchers perform better than protocols in gathering information and detecting trading opportunities or risks.

2️⃣ Oracle manipulation: For the lending platform, it would be unwise to evaluate a reward-bearing token on top of some ideal assumptions. So the relevant protocols should always be alert that there is no absolute anchoring relationship between the values of different tokens.

👉👉 ACTION ITEM

Protection against abnormal liquidity: Many protocols do not react promptly when extreme events occur in the market and DeFi system. This lack of response resulted in the drain of the Helio lending platform and some DEX pools suffering severe losses.