𝐓𝐡𝐞 𝐌𝐚𝐠𝐢𝐜 𝐍𝐮𝐦𝐛𝐞𝐫 — 𝟐𝟏 𝐌𝐢𝐥𝐥𝐢𝐨𝐧

👇 Imagine central banking as this guy: 👇

The Monopoly Man represents the central bank.

[DAY 4] #21DaysOfBitcoin cc @BitcoinMagEDU #Bitcoin

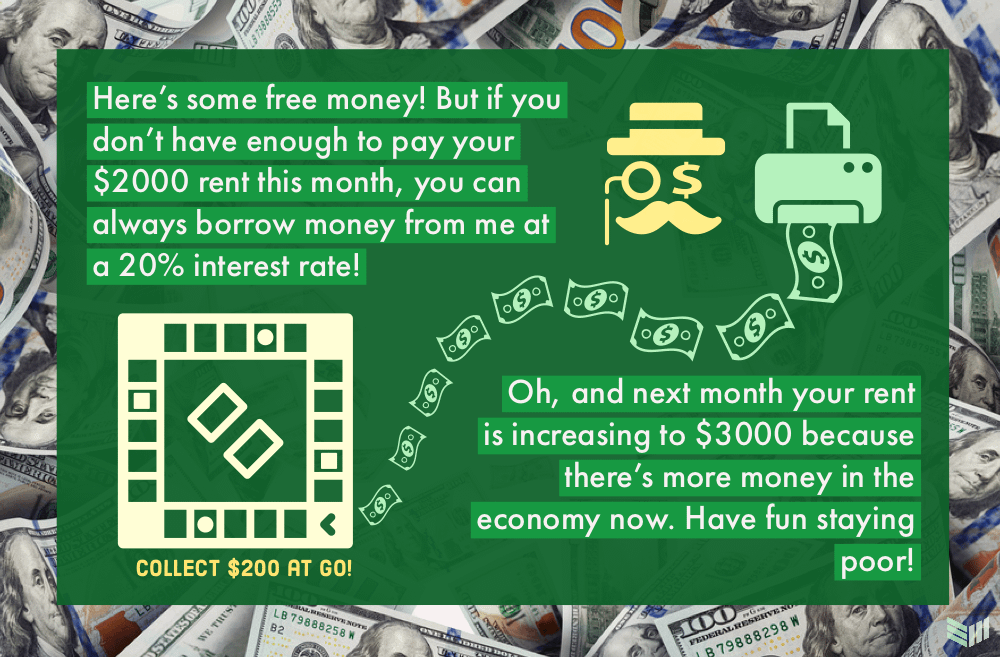

The market is open, prices are affordable, and competition is low. Sometimes, you get unlucky and have to pay a surprise fine or a hefty tax. But, such is life. He allows you to collect $200 when you pass GO, just because he's a nice guy. // cc @BitcoinMagEDU #21DaysOfBitcoin

Perhaps you've now replenished some of your savings, so you return to the board and take another pass around. // cc @BitcoinMagEDU #21DaysOfBitcoin

After a few rounds of properties purchased, rents paid out to owners, and collecting free money at GO, a certain dreadful doom starts to set in — you pray you don't land on someone's duplex, or even worse, their hotel. // cc @BitcoinMagEDU #21DaysOfBitcoin

With each pass around the board, you're still collecting your $200. Not to rain on your parade, but $200 doesn't mean much when your savings are wiped out and the rent seems to double each turn you take. //cc @BitcoinMagEDU #21DaysOfBitcoin

While this is an exaggerated version of the game of life, the basic principles remain: Those who have invested in assets (like real estate or stocks) see their net worth appreciated; those who owe debts and have little to no assets continue to see their savings wiped out.

Their purchasing power weakens, commodities and assets become more expensive, and no amount of government handouts can save them. //cc @BitcoinMagEDU #21DaysOfBitcoin

In fact, the “free money” comes back to bite them even harder the next round. While the rich see their assets inflate in price because more money is introduced into the game, the poor see their savings debased //cc @BitcoinMagEDU #21DaysOfBitcoin

This is a result of #inflation: where the government prints money on a whim to fuel the economy. But in the end, the rich only get richer and the price of goods becomes more expensive, thus trapping people in a cycle of poverty — even though they may collect $200 at GO. #Bitcoin

The government is allowed to inflate the monetary supply whenever they want. They want you to think everything's under control — and it is, literally. Therein lies the issue: They'll stab you in the back while shaking your hand. //cc @BitcoinMagEDU #21DaysOfBitcoin

With #Bitcoin, however, nobody is in control. Bitcoin's supply is capped at 21 million, whereas fiat dollars can be boundlessly printed. //cc @BitcoinMagEDU #21DaysOfBitcoin

The Magic Number

Nobody knows where the 21 million bitcoin cap comes from; this is likely just an arbitrarily chosen number. However, what's important is that this number can't be changed — ever.//cc @BitcoinMagEDU #21DaysOfBitcoin

Supply and Demand

Currently, not all 21 million #bitcoin are up for grabs yet — I'll go over this later when I talk about how new bitcoin is mined. //cc @BitcoinMagEDU #21DaysOfBitcoin

Supply and Demand

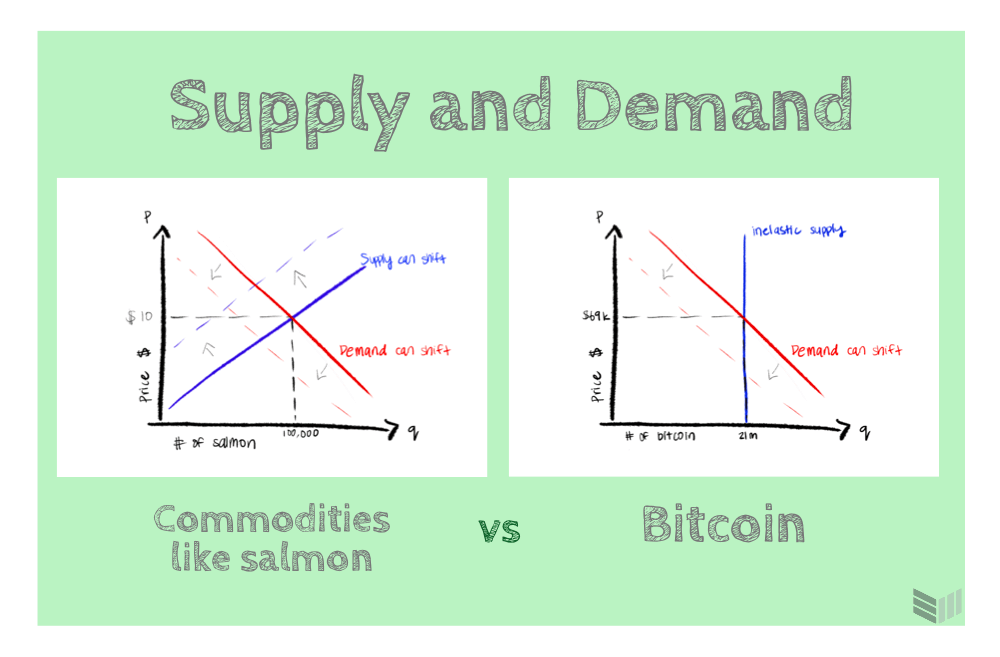

Although no economic model is perfectly representative of a real-world scenario, bitcoin's curve is a little bit special.

Let's take a look at this supply and demand chart comparing salmon and #bitcoin: #21DaysOfBitcoin @BitcoinMagEDU

While the supply of salmon is not necessarily fixed because we can farm fish and source fish from different areas of the world, the supply of #bitcoin is capped strictly to 21 million — this is what we call a perfectly inelastic supply. #21DaysOfBitcoin @BitcoinMagEDU

As a result, this means that only shifts in demand affect price; as demand continues to increase with institutional adoption and countries like El Salvador declaring bitcoin legal tender, there's only one place #bitcoin price is headed: the moon. #21DaysOfBitcoin @BitcoinMagEDU

Although we're still far from using bitcoin in the way that we use dollars to purchase goods, what we can do is hold our wealth in #bitcoin. //cc @BitcoinMagEDU #21DaysOfBitcoin

As the purchasing power of the dollar weakens due to ever-inflating supply, bitcoin supply remains immutable, and so the purchasing power of bitcoin should continue to rise over time — forever. //cc @BitcoinMagEDU #21DaysOfBitcoin