GameFi is set to become the next Hot Space in Crypto

CMC released a GameFi report containing:

• The state of the industry

• Top tokens, games & chains to watch

I’ve read it all so that you don’t have to.

Read this to understand everything about the next hot space in Crypto

In this thread we’re diving into:

• Current state of GameFi

• Top Takeaways from this year

• What the VCs are doing

• Upcoming game & tokens to watch

• Thoughts & Comments along the way

Let's dive in

Crypto X Games Synergy

Crypto, NFTs & Games have a natural synergy.

• Trading & Selling In-game items as NFTs ( ownership of virtual assets)

• New ways of funding games → More experiments→ Better games

• Community Owned

• Better monetization methods

Learn more here:

twitter.com/bottomd0g/status/1512473932431257600

We’re not there yet.

Despite the benefits, we’re yet to see a revolutionary crypto game.

• Good Games take lots of time & money to make

• Existing games are unsustainable

• Blockchain tech is new, building on new tech is difficult

• Gamers outside web3 detest crypto & NFTs

This will soon change

This will all change through a great game that is actually fun & sustainable.

Right now, there’s a huge rush to create a breakthrough game, led by industry veterans & huge amounts of money.

Here's where we're at:

GameFi Overall Market Performance

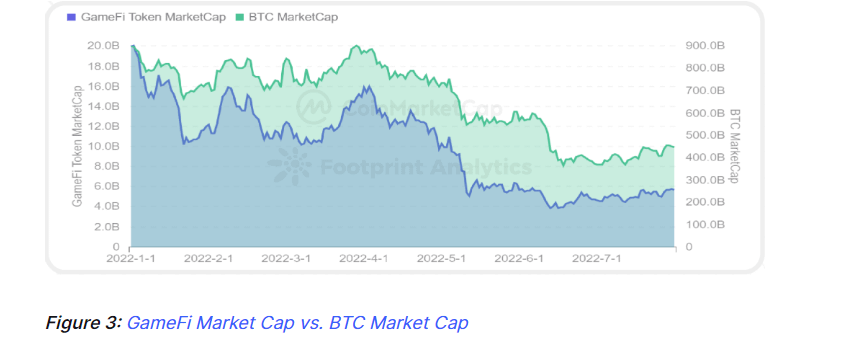

2022 has been a rough year for crypto, with everything moving downward due to bad macro & rising inflation.

GameFi active users (unique wallets interacting with games) gradually declined

This is the first bear cycle for the GameFi industry.

Top Chains by Volume.

Ronin, BNB & Harmony were the volume leaders.

BNB: low fees & ease to build brought on a lot of projects

Ronin: All the Volume came from Axie Infinity

Harmony: All the Volume came from DeFi Kingdoms

Top Chains by Transactions & Average Users

@WAX_io & @hiveblocks, gaming-focused chains, stood at the top.

Wax has 29% & Hive has 24.2% of the Market Share

Key Takeaways

1. Mainstream hype during the bull market has not been a good indicator of sustainability or future success

2. A dominant, go-to chain for GameFi projects has yet to emerge

3. Developers are increasingly aiming to create multichain ecosystems

Let’s dive in

Mainstream Hype & Sustainability

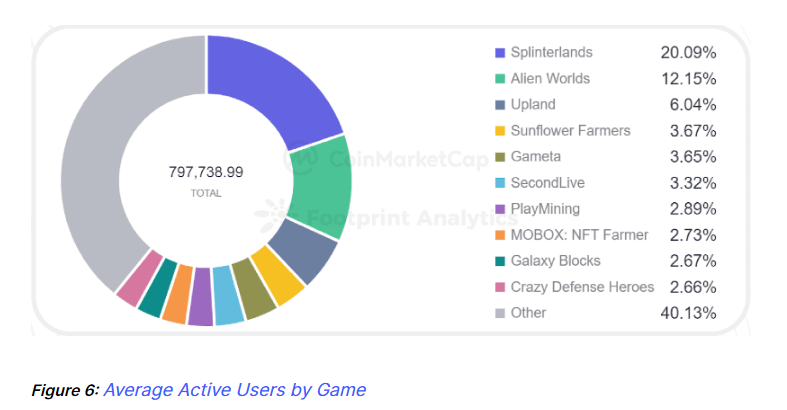

Axie & STEPN became household names.

However, now, neither of them is close to the Top 3 games by number of average active users.

They came & they went.

Crypto games people enjoy

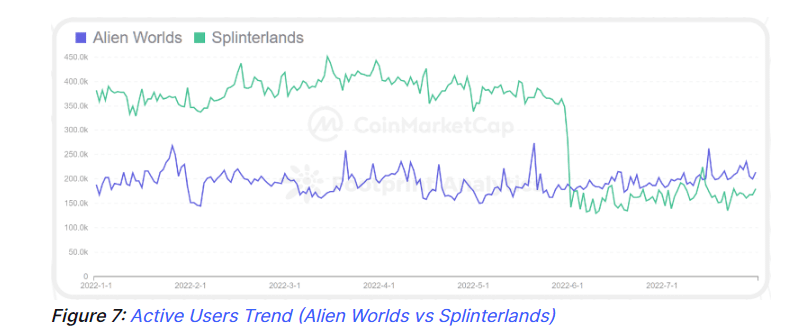

Conversely, Alien Worlds & Splinterlands are dominating, even after a price drop

They’re both averaging around 200k active users, even in this market.

Clearly, people enjoy playing them.

Hyped games come & go, but so far they haven't stuck around

There’s no go-to chain for GameFi yet.

Wax & Hive are GameFi leaders by number of transactions.

But, both are largely dependent on the success of a single game each.

55% of Wax’s market share comes from Alien Worlds

99.85% of Hive’s Market Share comes from Splinterlands

Devs are going Multichain

DFK & STEPN expanded to 2 chains each in March to get more users & disperse risk.

But it hasn't been smooth sailing. There’s been some tokenomics trouble.

Multi chain projects face tokenomics trouble

STEPN launched on Solana & expanded to BNB.

At it’s peak, there was a 9x difference between the price of GST (utility token) on Solana & that on BNB.

Multichain price discrepancies will continue to be a problem for multichain games.

The Death Spiral Problem

The curret play to earn model has a big risk: death spiraling

The model has positive ROI as long as new players join the game

When there’s a price drop or the number of new players reduces, there's reduced ROI & mass dumping

metaversus.substack.com/p/social-contract

Gameplay first or Earning First?

The first popular model in GameFI was play to earn.

Games primarily focused on the earning aspect & users came on primarily to earn money.

But, the risk of death spiraling is real. Games need to acquire users with a fun game instead.

Play & Earn

Play & Earn offers a middle ground.

Play a fun game & earn a little along the way.

With Crypto & a long term focus, they can offer some ROI, while being more sustainable.

@0xRyze talks about this more here: metaversus.substack.com/p/play-and-earn?utm_source=substack&utm_campaign=post_embed&utm_medium=web

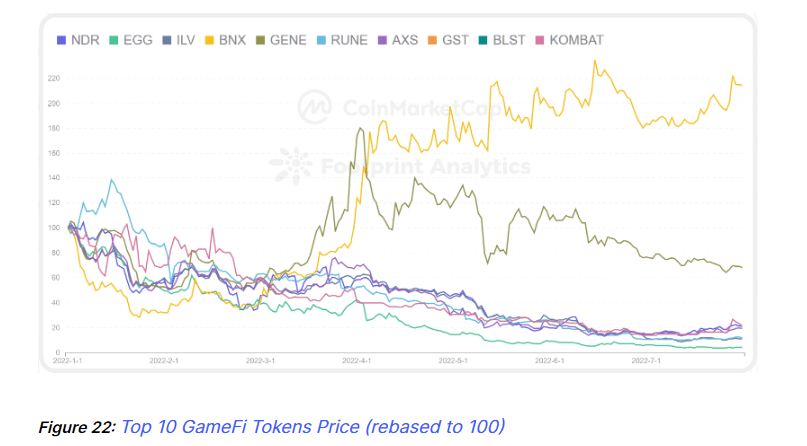

Top GameFi Tokens To Watch

Here the tokens to watch according to the report.

@binary_x & BNX

Despite the declining prices, BNX increased 8x from its lowest point in June, following new gameplay & upgrades

STEPN, GMT & GST

STEPN saw a drop across most metrics

Despite that, GMT has the highest trading volume: $1.1B

GST (Utility token) also saw a surge in trading volume, signaling that STEPN is unable to control token dumping.

Also most projects lost liquidity in the bear.

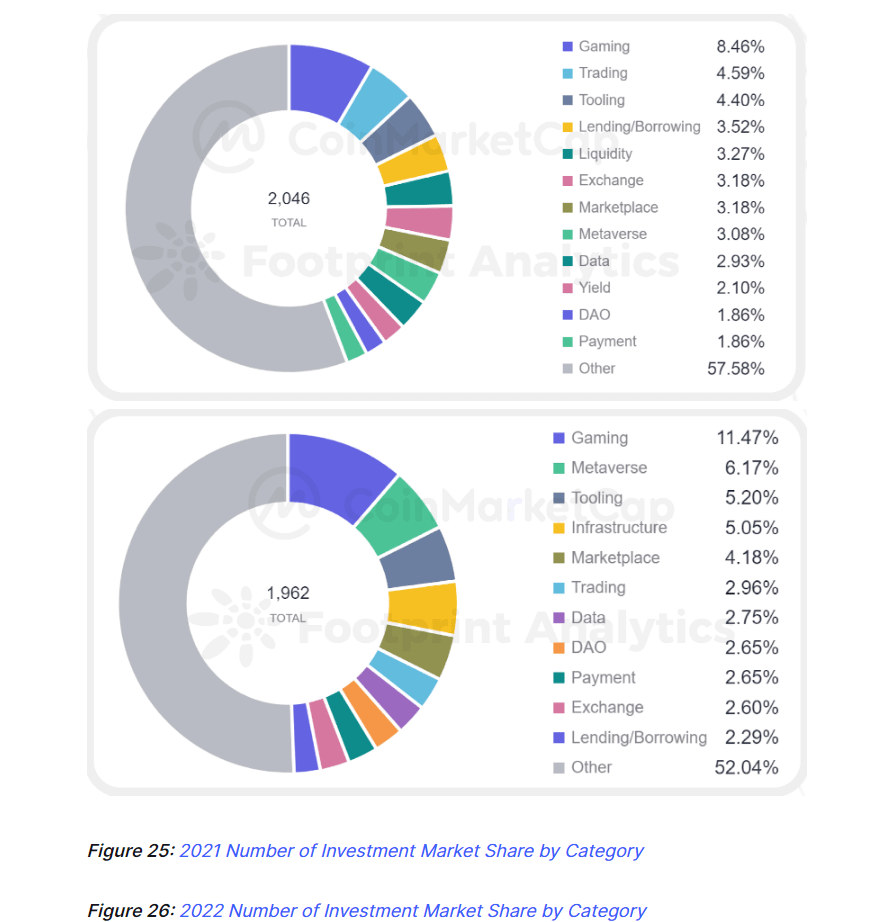

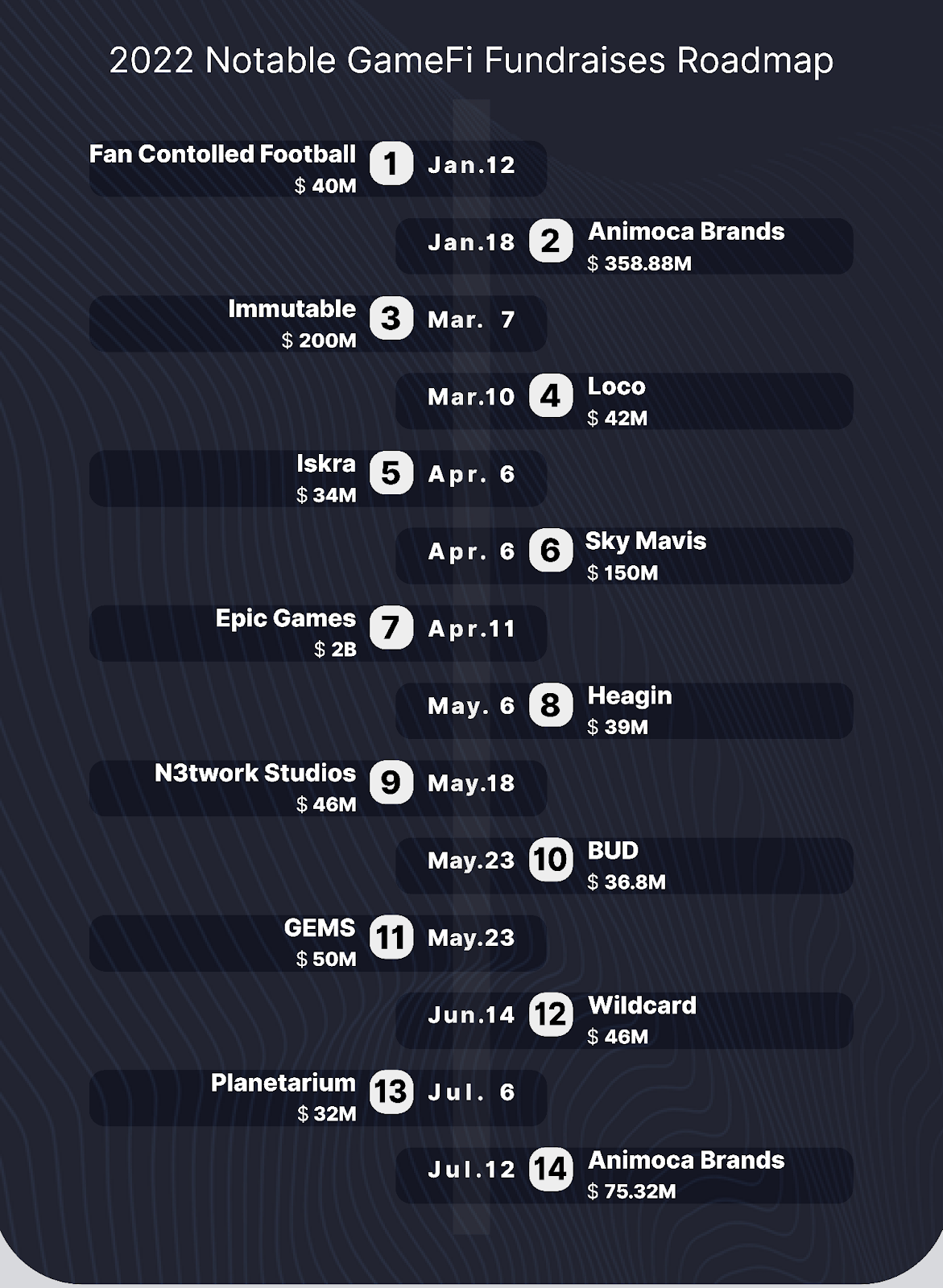

VCs in GameFi

2022 has been the year for GameFi fundraising.

Metaverse & Gaming fundraising saw a huge increase from $874M (2021) to $2.4B (2022)

Metaverse & Gaming projects got more than tooling, trading & lending projects

twitter.com/Cov_duk/status/1560503678015983616

The Big Players are doubling down

Epic Games received $2B

Animoca Brands invested in 52 projects

There’s a lot of money coming into the space.

Both Traditional studios and Crypto focused studios are raising big rounds to create a gamechanger title.

Games to Watch

@illuviumio: Promises a AAA game led by a solid team of devs

@the_phantom_g: A collaboration between proven traditional and blockchain studios, backed by huge resources

@playbigtime: Led by the co-founder of Decentraland, promises a AAA RPG and easy onboarding.

We’re still early.

48% of the investments were in the seed stage. GameFi is still early in the development phase.

We’ve proven studios, industry veterans, huge amounts of money coming in.

It’s only a matter of time before we’ve a breakthrough game.

I’m excited.

I’ve been playing video games from before I can remember.

The stars are aligning. It’s a good time to be a gamer. And there’s money to be made.

If you want to dive deeper, I highly recommend you check out the full report over here:

coinmarketcap.com/alexandria/article/coinmarketcap-and-footprint-analytics-2022-gamefi-industry-report

That’s all for this one. If you’ve enjoyed this, help me out by:

• Giving this a RT

• Following me @Cov_Duk for more

Also, subscribe to my youtube channel, I’m dropping a new video soon:

youtube.com/c/Covduk