Tracking the right wallets can make you rich.

Etherscan is a great way to do this for FREE.

Here's how you find & track wallets in 5 minutes 🧵

I have a step by step video demo on my youtube.

Here it is: youtube.com/watch?v=zHkVYjduBGo&t=509s

2/

Investors & whales have more information & leverage than you do.

You can make a lot of money by following them. We're diving into:

• Using Etherscan for wallet tracking & watching

• Using

@DeBankDeFi

• NFT wallet tracking

3/

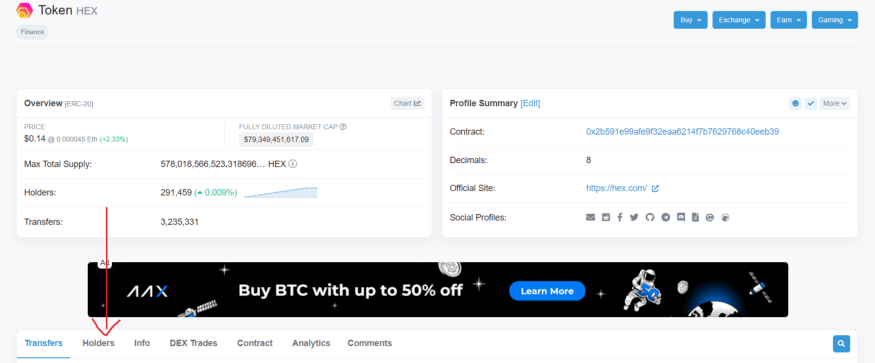

Let’s use Etherscan

Go to etherscan.io/tokens. You’ll see all the ERC tokens here.

This is the page for $HEX. There’s a bunch of useful info here for research.

Go to the holders section.

4/

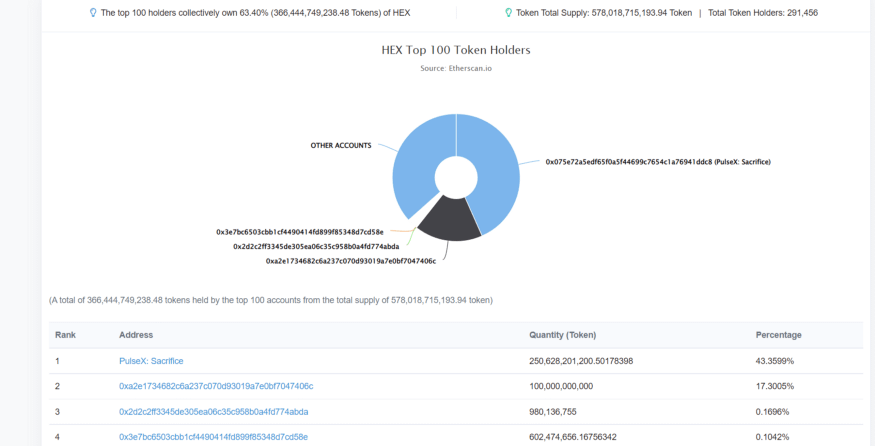

This tells you a lot:

• If the tokens are concentrated, it could be a bad sign, because if they sell price will tank.

• If a large % of tokens are sitting in exchanges, could mean that holders are only there for the short term

5/

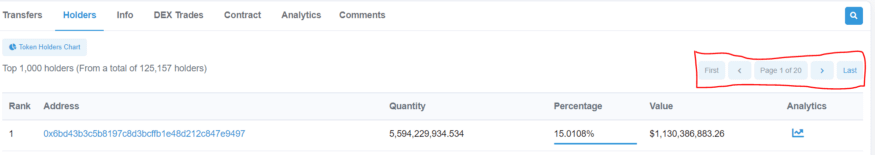

Your goal is to find wallets who got in big positions early.

You can filter through based size of holdings

6/

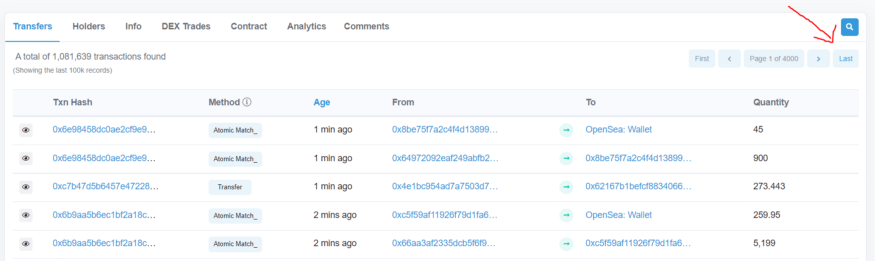

You can also look through the transfer history to do this.

Sort by Last.

You essentially want to look through the first few weeks & look for accounts that made big plays early.

7/

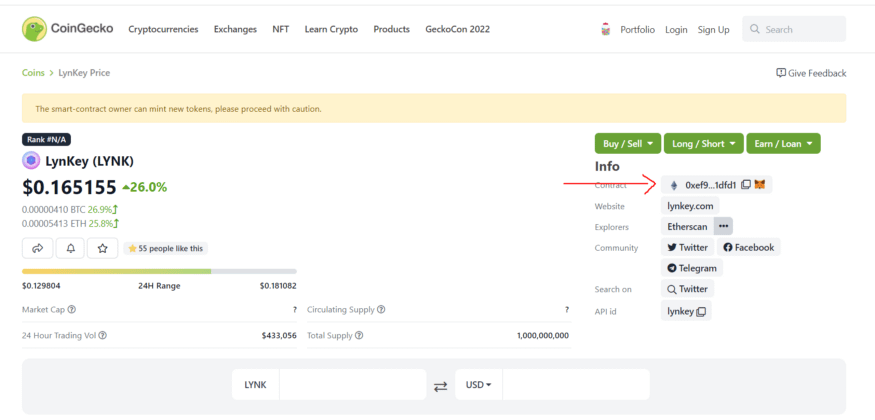

You can do this for ANY token.

Just go to CoinGecko and search up the token.

Here’s a random token that I found. When I found this, $LYNK up 26%.

Grab the contract address.

8/

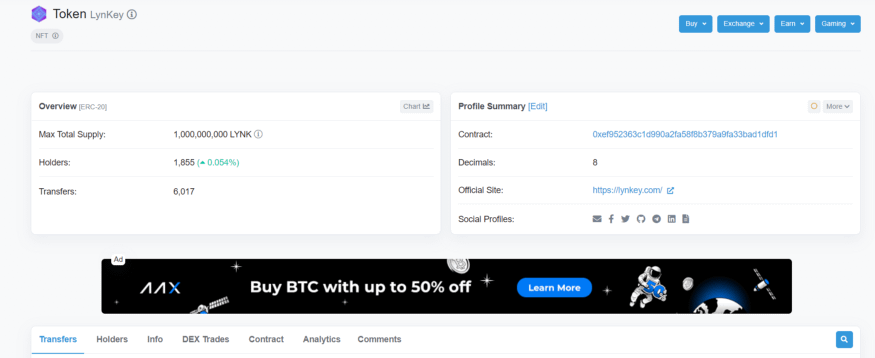

Search it up in the relevant block explorer and you can start your wallet hunt.

Let’s use LYNK to demonstrate wallet finding & tracking.

I sorted by oldest transaction and went from there.

The goal was to find an address that took a big position early on

9/

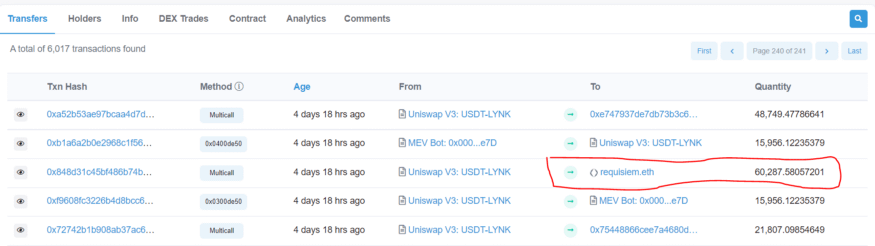

This trade caught my interest.

This account bought 60k $LYNK tokens 4 days after launch.

I wanted to investigate more.

10/

You can copy their address & paste in the block explorer.

It will pull up their transaction history, their account balance & what they’ve invested in.

This is their Erc20 transfer history.

Looks like they’re used to buying large portions of unknown coins.

11/

I want to know if they’ve a history of success to determine if they’re worth watching.

This is the hardest part.

You can look through their Etherscan data to get some insight.

12/

Analyzing successful wallets is a great way to learn.

You can gauge how they allocate, what they look for & how they ape.

It’s a great way to become a better investor.

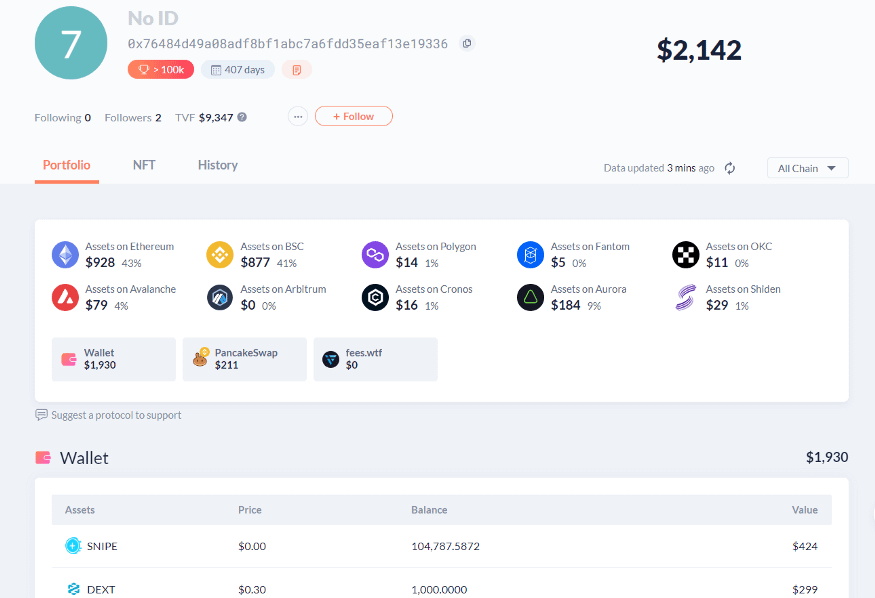

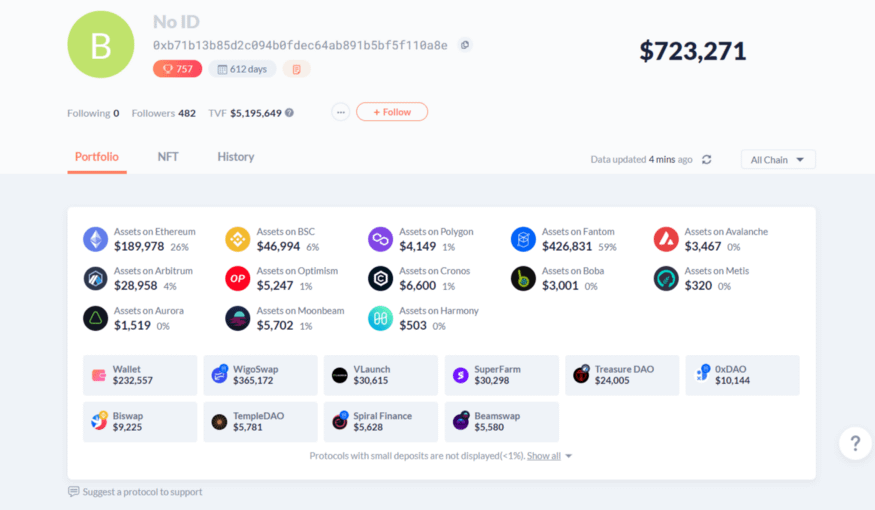

For more organized analytics, use @DeBankDeFi. It gives you a breakdown of their holdings.

13/

Examining their profile, it's not what I am looking for.

No problem, let’s repeat the steps until we find someone.

14/

I repeated the steps above and found a new address.

Turns out it’s pretty good. This account is the #757 ranked account on DeBank.

15/

Use these methods to find wallets.

Once you find an account you want to keep track of, you can follow them on Debank & periodically look through their transactions on a block explorer.

16/

NFT wallet tracking.

You can do the exact same for NFTs.

Go to etherscan.io/nfttracker or search up your NFT. Search through transactions & holders.

17/

You can look through their NFTs & portfolio on DeBank

With that, you have a solid approach for finding & tracking wallets.

This can be replicated across chains using different block explorers.

18/

Be VERY careful.

Scammers use these tools as well.

They airdrop NFTs & tokens to top wallets in order to deceive people like us.

Wallet tracking is just one part of your research process.

Couple it with proper due diligence.

19/

I hope this guide on wallet tracking was useful!

• Give this a RT

• Follow me

@Cov_duk for more

• Subscribe to my Youtube for guides, demos & interviews!

youtube.com/channel/UCk43im8I5y_noyb08D5w4OA