Per CIP-34, CoW Protocol is testing fee models with a view to long-term sustainability for the protocol and its users.

The first test – 50% of surplus on out-of-market limit orders – generated 130 ETH for the protocol and had no observable impact on retention.

More info 👇

twitter.com/CoWSwap/status/1747686274025074925?s=20

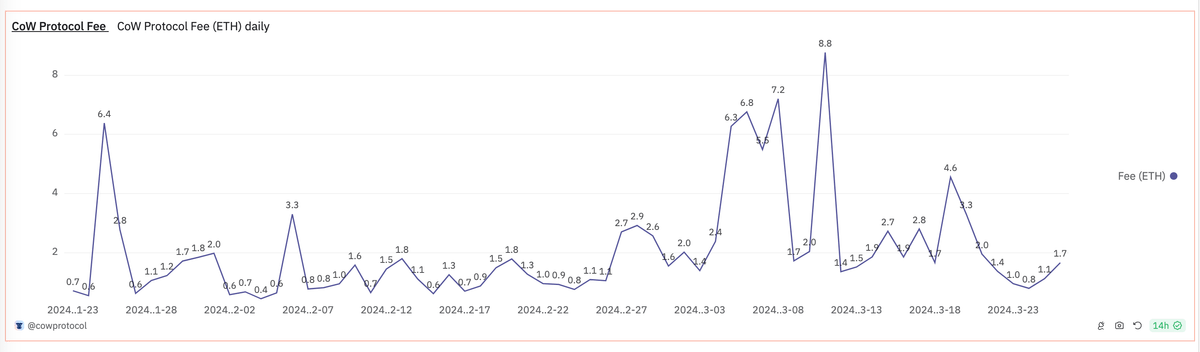

During the testing period, Jan 23rd - March 26th CoW Protocol generated over 130ETH is revenue.

In this time, we saw a normal number of small volume spikes during highly volatile market days.

📊 dune.com/cowprotocol/cow-fees

In March, there was a notable rise in limit orders' popularity.

Specifically, CoW Swap limit orders volume increased from $128M in January to $760M in March.

📊 dune.com/queries/1715231/2830822

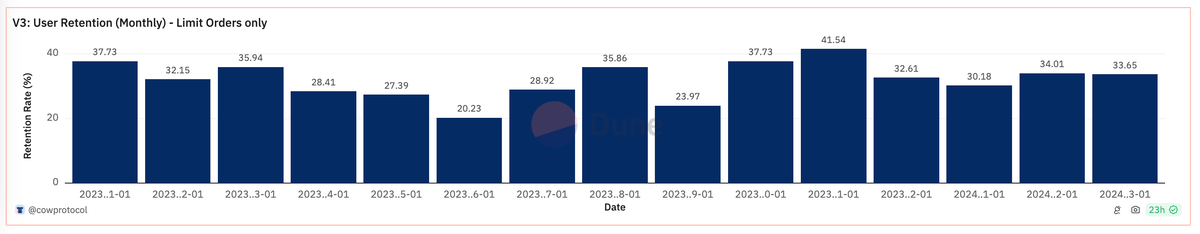

Over the testing period, ~50% of limit orders come from new users, and month-over-month retention was over 30%. This data is consistent with previous months.

We found no meaningful evidence of users moving away from CoW Swap due to the fee model.

📊 dune.com/queries/3563774/5997236

We consider this a successful test.

Stay tuned for more info on future fee testing. And remember that users can always find current information on which fees are live in the CoW DAO docs: docs.cow.fi/governance/fees

Thank moo! 🐮