🧵

This is a thread for entrepreneurs looking to leverage the benefits of blockchain, and facing the fundamentally important question — which network should I choose?

Let’s get started, and try to separate the signal from the noise.

When I asked over 100 teams "How did you choose your deployment chain?", the answers were:

→ 75%, brand awareness. They'd simply heard of the chain.

→ 20%, "encouragement" from their VCs.

→ 5%, some deeper, more considered reasoning.

I was shocked.

Around 3/4 of the teams simply punted on the problem, though the importance of getting it right can hardly be overemphasised!

Often, there's no margin for pivot, so making the right decision is critical.

Step one is understanding the contract runtime.

If it's EVM (Ethereum compatible chain), you'll find plenty of tools, developers, expertise (security audits), etc. And you'll avoid vendor lock in.

With non-EVM compatible blockchains, you need to deeply understand and *really need* their unique value propositions.

An example may be @NEARProtocol, which offers theoretically infinite scalability, through sharding.

In case you go for EVM-compatibility, you face a large and growing number of options.

Comparative evaluation metrics typically include TVL, MAU, market cap of the native token, etc.

Let’s dive into these.

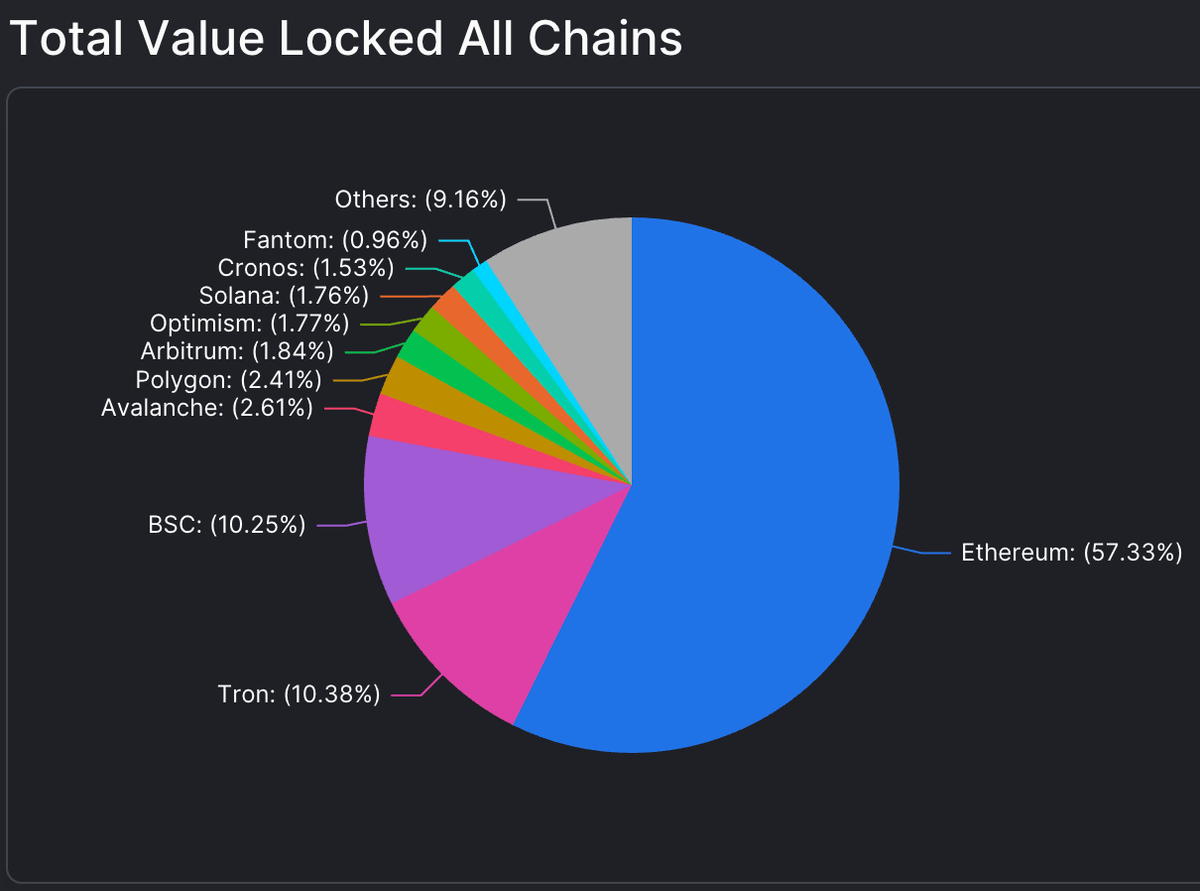

Total Value Locked (TVL) represents the amount of "money" or value located within the ecosystem.

Given the mercenary and transitory nature of TVL observed throughout the history of crypto, this metric is more noise than signal.

defillama.com/chains

If the chain has enough bridges, liquidity can and will flow in from other chains, but generally this is a short-lived function of farming incentives, such that TVL as an evaluation metric should more or less be tossed in the bin.

MAU stands for Monthly Active Users. It would seem straightforward — the higher MAU of the chain, the bigger the addressable market, right?

Wrong.

Why? Because it turns out that these “active users” are usually not users of the ecosystem, but rather specific apps.

About 33% MAUs on Polygon are users of a coinflip gambling game. Is this really your target market?

gokustats.xyz/dashboard

dappradar.com/polygon/high-risk/make-me-rich

“But, if a user holds AVAX, then it’s simpler to onboard them if we run on Avalanche, right?”

True, but the significance of this reasoning diminishes over time, and IMO, you can omit this consideration, too.

And here’s why.

Blockchain pioneers quickly discovered that UX is a problem, and consequently are focused on improving the onboarding experience — bridges bring the assets, wallets do airdrops, some apps offer gasless transactions, etc.

If your focus is Web3 users, then differentiating on UX may be a challenge, because switching costs, in terms of experience, is generally low, as the interaction paradigms from chain to chain are mostly identical.

But there’s an even larger consideration.

For every thousand Web3 users that exist today, there’s a million Web2 users just waiting to discover the blockchain!

This is a blue ocean, and so your best choice may be the chain offering the best path for Web2 onboarding.

Surprise-surprise, @auroraisnear offers great advantages here; including protocol-level "meta-transactions", available since day 1.

Web2 users frictionlessly onboard in less than a minute at Aurora+, enjoying 50 free transactions per month!

aurora.plus/

(Alpha-leak for those who actually read threads — this process will become even simpler by the end of 2022! NIA, DYOR, you know the drill. 😉)

Back to our story, and it looks like MAU belongs in the bin next to TVL. 🤷♂️

Continuing with “brand value”, often connected in perception with the market cap of the base token. Turns out, 99%+ of L1 token value is in the brand.

twitter.com/AlexAuroraDev/status/1523635464632414208

As part of the brand, it would seem that a network’s Foundation and VCs can help with direct investment and introductions, increasing an entrepreneur’s chances of success.

Regarding Foundations, these can be bad investors, as their focus on the ecosystem tends to dwarf their focus on any given app. And a Foundation would never advise an app to leave the ecosystem, even when that’d be the best option.

Regarding VCs, access is generally independent of network choice. Given how relatively narrow the Web3 space is, the whole crypto VC ecosystem is interconnected, never more than two handshakes apart.

So even if the premise of brand-value inheritance exists, its influence is negligibile, sometimes even less than the influence of a single strong personality in the space.

Therefore, we can probably toss brand into the bin along with TVL and MAU.

“We’re going multi-chain. So the starting point doesn’t matter, right?”

Wrong, and potentially twice.

First, is found in the thread you’re reading now on the importance of chain selection.

Second, is that multi-chain is much harder than you think.

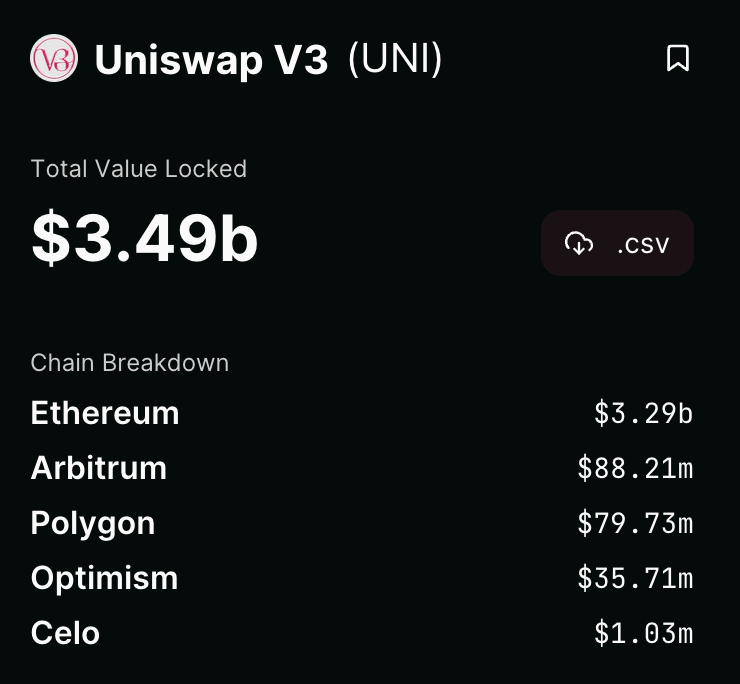

Consider Uni V3. Industry leader. Multi-chain. But hardly enough TVL on the Celo network to function with low value swaps.

Multi-chain deployments can be considered franchises. Just like in the real world, the success of a franchise comes down to location.

If we discard TVL, MAU, 90% of brand value and consider that multi-chain is usually too hard, what’s left?

Well, the unique offerings by the given ecosystem — architecture, scalability, containers, native oracles, even expertise!

And users.

Never forget that an ecosystem with investors and LPs, but without users transforms into a Ponzi, in which latecomers simply end up being the exit liquidity of the early settlers.

Here, the past can inform the future. Web2 leaders like Meta, Google, Amazon, Apple & AliBaba are giants because of users.

Millions of users.

While investor capital may be needed to get off the ground, it’s the users who are the key ingredient needed for long term value.

Bottom-line entrepreneur cheat-sheet:

→ EVM compatibility is usually the way to go

→ Infinite scalability is critical, because…

→ Seamless onboarding of Web2 users is your path to real growth.

And I couldn’t be more excited being the CEO of a company delivering all three!

Big thanks to @dafacto for helping me with this thread! It won't be that crisp without his additions! 💚