The STIP voting results have determined the future of protocols on @arbitrum.

In case you haven't realized, some protocols may be hit hard and may not survive in the long term.

Check out my theses and see what you need to do with your bags 👇🏻

I am writing this thread in order for everyone to:

• See the near future

• Manage their bags properly

• Allocate assets to incentivized protocols effectively

Without further ado, let's get right into it.

I will stick to the main points here:

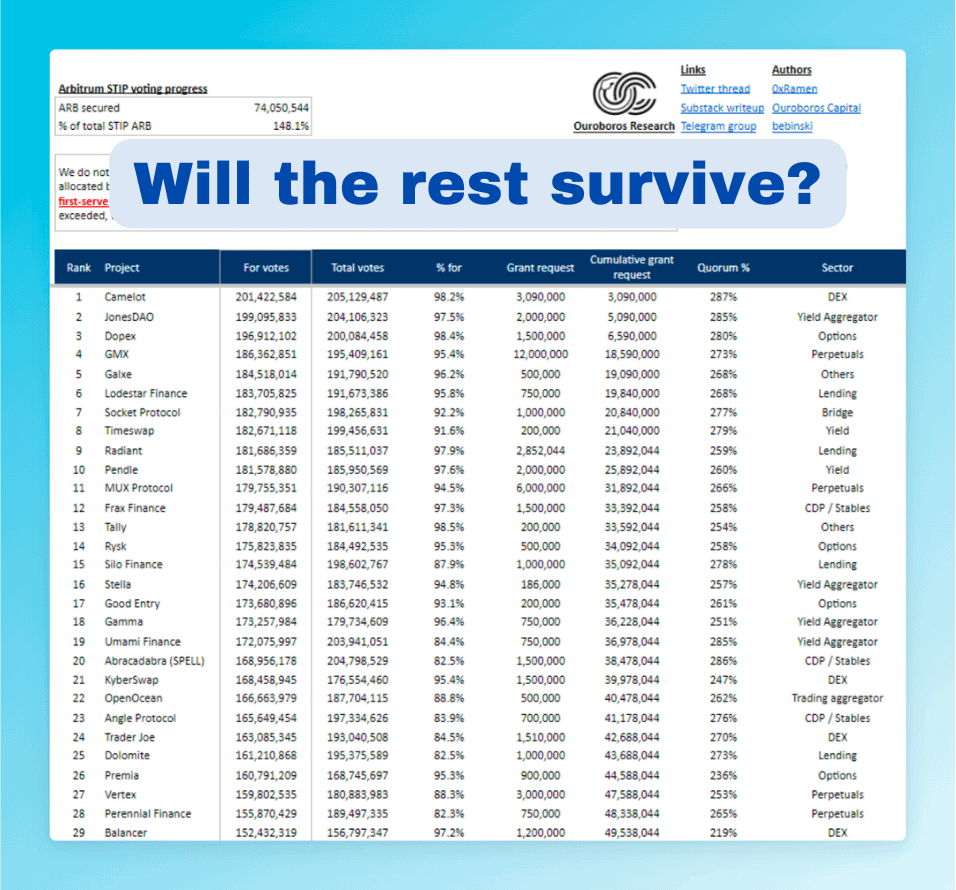

The 29 projects are going to receive $ARB incentives.

Regardless of the ongoing discussion regarding extending incentives to other protocols, these 29 projects will dominate TVL growth in the next three months.

My core concept is that:

🌊 All users and liquidity will flow towards protocols with higher APRs and rewards.

🔴 The rest, who don't get the incentives, will need to struggle hard to keep up with the boosted yields on these 29 projects.

Now let's see the endgames of each one.

📈 Perps sector:

@GMX_IO and @muxprotocol will be the winners.

GMX and MUX have plans to reduce trading fees and incentivize trading competition.

Moreover, liquidity providers (e.g. GLP, GM V2, MUXLP) will be heavily incentivized.

Imagine liquidity providers getting 30-40% APR on ETH/USD GM LP on GMX.

How will Gains and HMX (which don't get the incentives) compete to attract more liquidity in this scenario?

I don't think such a case exists.

If you're holding $GNS or $HMX, you better monitor how they will fare against others who have the higher cards.

Adding some $esXXX won't help in this case, as getting $ARB is so much better.

And if you have idle liquidity, it's time to consider getting back to farming yield.

🪙 DEXs Sector:

Current and new liquidity will flock into @TraderJoe_xyz, @CamelotDEX, and @Balancer.

While @Uniswap will lose its #1 DEX positioning on Arbitrum.

It's pretty clear that the winners in this sector will have the upper hand as they can provide higher APR to the LPers (market makers).

And with its novel functionality, it is possible to outperform yields on Uniswap.

E.g., Liquidity Book by @TraderJoe_xyz > Uniswap V3

💊 Yield Aggregator Sector:

@JonesDAO_io, @stellaxyz_, and @UmamiDao will be the winners.

Other protocols in this sector will have a hard time competing with the winners.

The only reason users use these protocols is the APR.

You should prepare to provide more liquidity to the winners in the near future:

➤ Jones will promote more use cases for jUSDC and jGLP.

➤ Stella will add incentives to all leverage LP and LST strategies.

➤ Umami will increase yield in the vault.

If you read until this part, I believe you understand the whole concept of this thread.

The next key action is trying to think of other sectors.

There are more that I haven't mentioned, like yield trading e.g. @pendle_fi that is already a clear winner and will get even better.