Back by popular request - Pre-seed startup valuations!

Let’s look at over 4K pre-seed deal submissions @hustlefund has gotten over the past year+ and see what's happening in the world of US pre-seed venture capital 🧵

#Startups #VC #Entrepreneurship

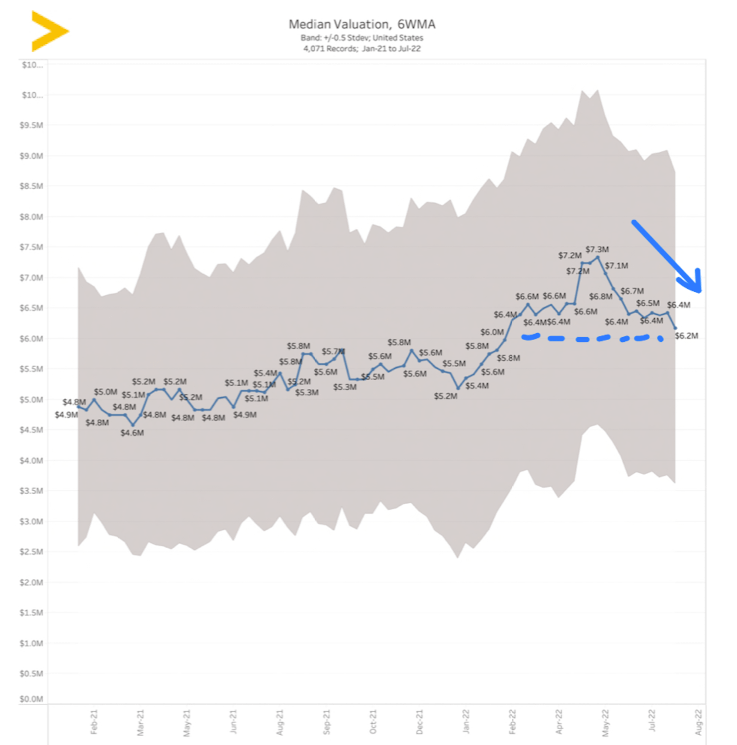

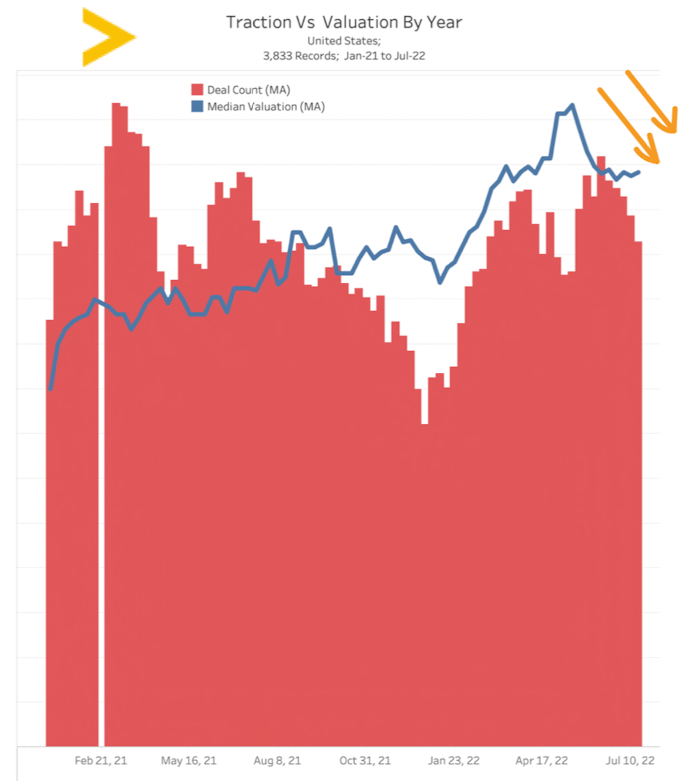

What we are seeing - valuations have trended lower in q2.

Valuations are back to EOY 2021 levels (~$6M USD) down from all-time highs of ~$7M USD in 1Q2022

Things to note

- Data is based on submissions we received from US non-crypto startups

- Pre-seed startups are all very different & there is a lot of dispersion in valuations.

- Median trend <> the trend holds true for all pre-seed startups

There are a couple of drivers I am seeing (and many more I am probably missing)

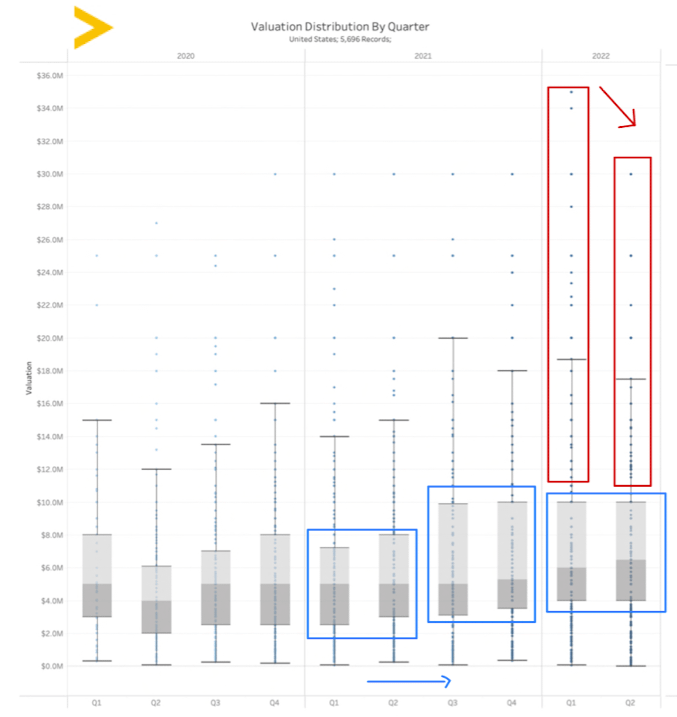

#1 - less high valuation startups & less dispersion in valuations.

While 2021 saw wider valuation ranges, 2022 saw ranges narrow, especially for higher valuations

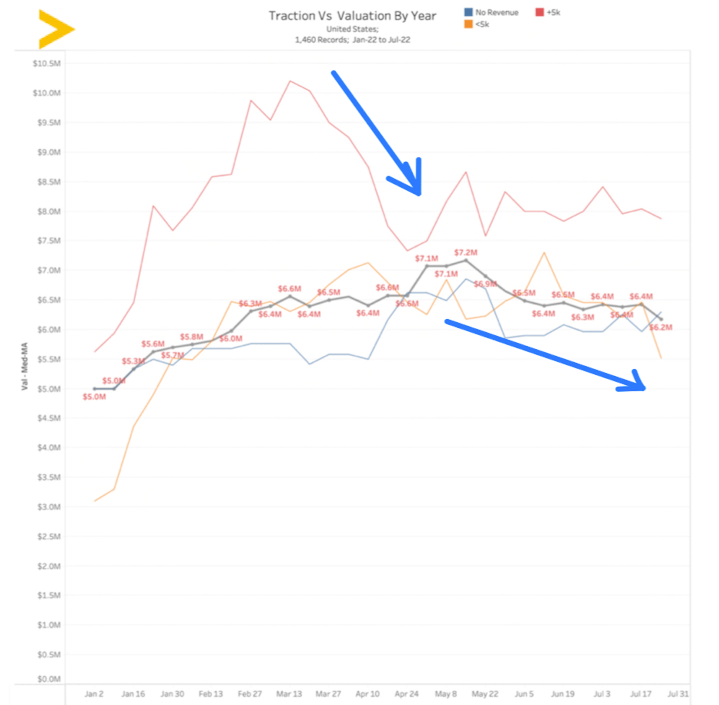

#2 - valuations for lower MRR startups decreased

While higher MRR valuations decreased in the first part of 2022, valuations for lower MRR startups came down in Q2.

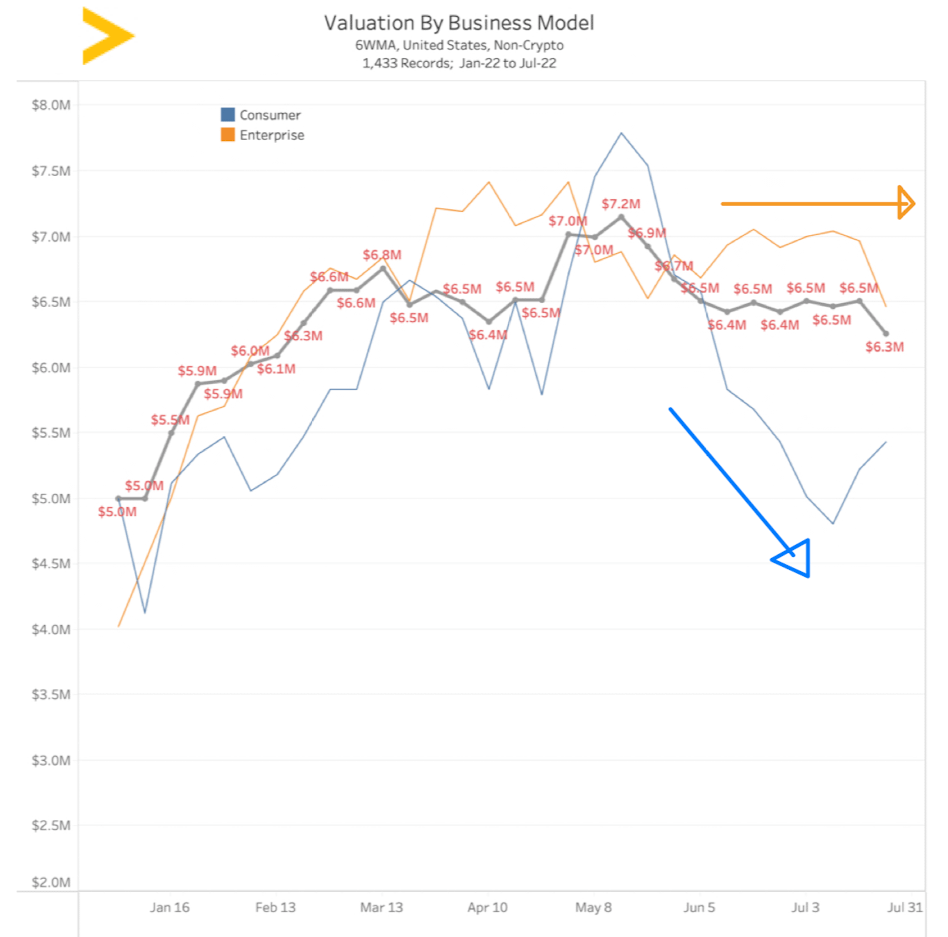

#3 - valuations for consumer startups decreased

While consumer startups had very similar valuations to enterprise startups for much of 2021, their valuations decreased more in 2022 than valuations for enterprise startups

Also of note - In addition to valuations coming down, we have seen a slight decrease in the volume of deals we are seeing. This means instead of 6-700 deals a month, we are seeing closer to 500.

Hope this has been helpful.

As always questions, comments, and feedback are welcome.

Thanks for reading!

You can read the unrolled version of this thread here: typefully.com/will_bricker/gE6FAlD