$APE staking delays have cost holders $57,979,795.

And we're about to lose another $17,921,570.

It's not too late to stop it... but it'll be at our own risk 🫣 (1/27)

TLDR:

1. APE staking implementation is full of delays & uncertainty

2. Delays have cost holders millions bc APE's real value has declined

3. The AIP-134 bug bounty proposal will further delay staking

4. I'm voting against the proposal

If you hold APE, you'll want to know...

How it all went wrong.

APE staking was announced when @apecoin went live.

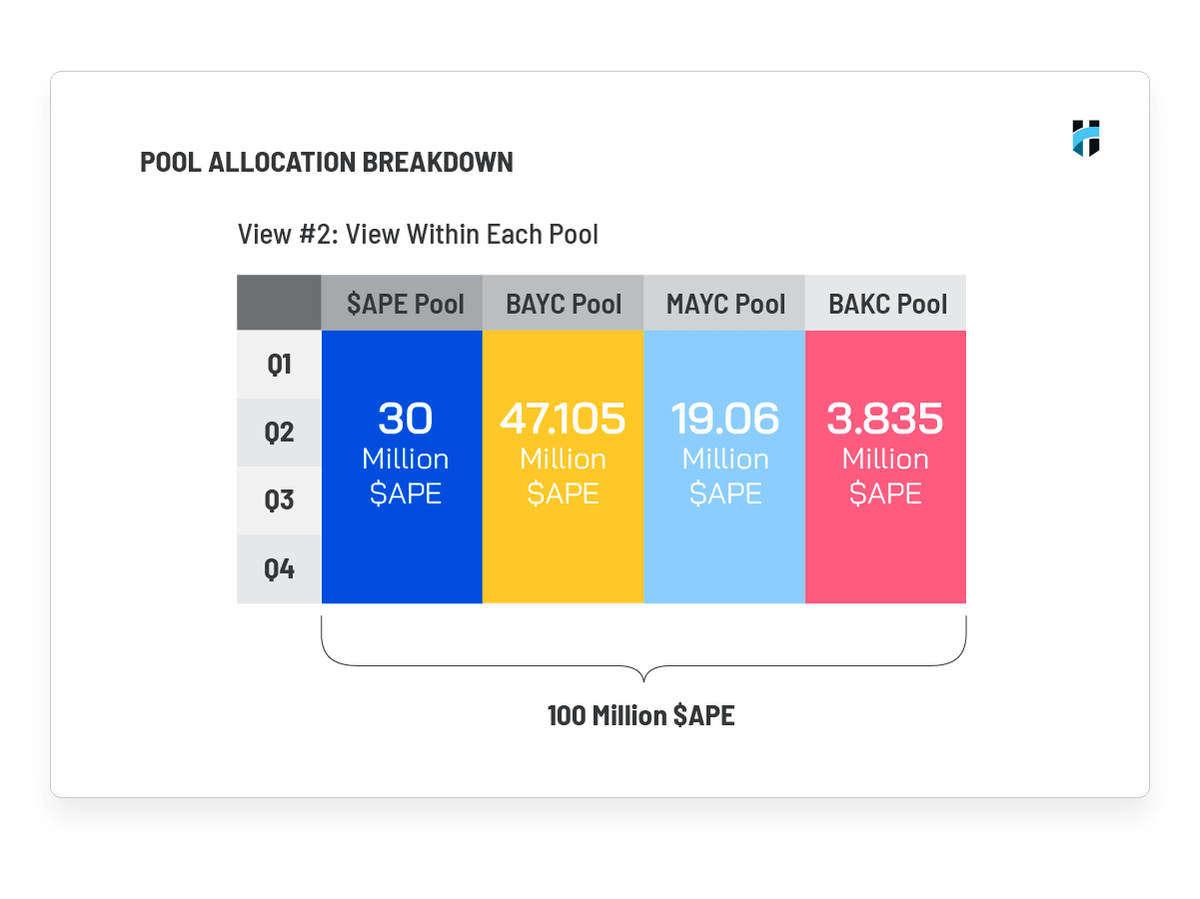

BAYC, MAYC, BAKC, and APE holders could earn APE by assigning their assets to a staking pool.

The initial NFT pool yields are projected to be 300%+

Since then...

It's been a roller coaster of uncertainty and disappointment.

The initial proposal had a design flaw bc it allowed anyone with a B/MAYC to stake unlimited APE — which would've killed yield.

It was rewritten as AIP-21 and passed with August as the estimated launch period.

twitter.com/ysiu/status/1504208292385476611?s=20&t=zr7ICIdJaokKPHH6zbfh4A

Then, things went silent until...

July 22nd when @apecoin announced @HorizenLabs as the staking protocol developer.

The 12-16 week timeframe restarted (3-month delay).

APE holders were frustrated with the slow execution and lack of communication.

The next we heard was on...

twitter.com/apecoin/status/1550616722809536512?s=20&t=J4dldWRKavgFO8DiAajGOg

Sept 10 when Horizen announced an APE staking Twitter space for Sept 22.

The space was delayed last minute bc someone was sick...

After some outrage, Oct 31 (yesterday!) was announced as the launch date.

@apecoin and @horizenLabs haven't had a formal update since these tweets.

twitter.com/HorizenLabs/status/1568653073849159680?s=20&t=TOzdARun2ZPYOfKt4cik8Q

Soon after on Oct 11, the SEC's probe into Yuga Labs was announced.

A whirlwind of uncertainty hit the markets...

Would APE staking be cancelled?

Was @OthersideMeta sale an unregistered security offering?

All the FUD accelerated APE's 35% fall against ETH.

Wait! There's more...

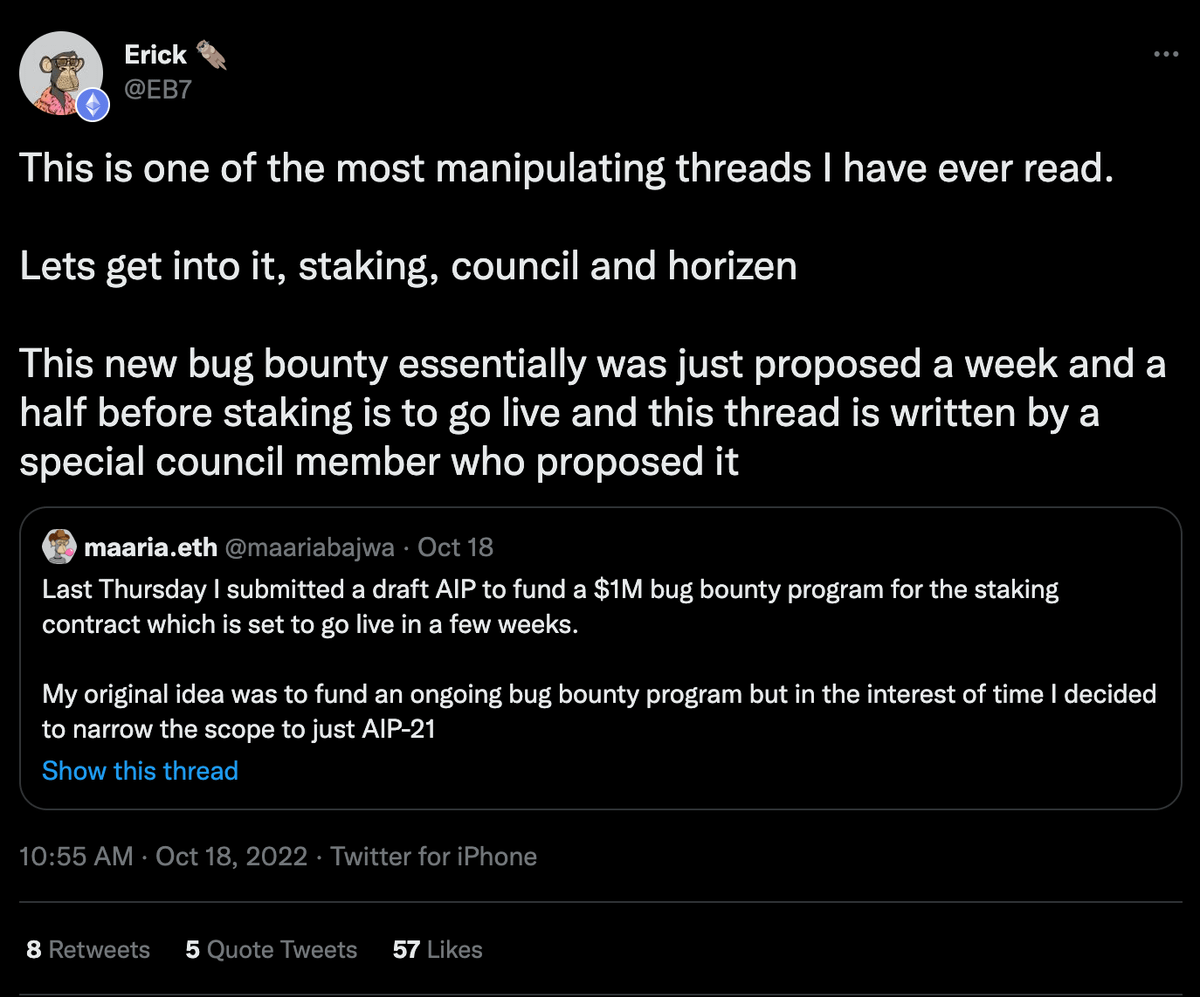

Ape board member @maariabajwa submitted a bug bounty proposal on Oct 18 that will delay staking for 3 more weeks if passed.

Some Apes were pissed about another potential delay! 😡

But, why should they care? Don't they just get the same $ later?

No!

The value of APE staking earnings is declining by tens of millions

How?

Bc the present value of something with a growing supply is greater than its future value... and APE staking delays move their earnings into the future.

Here's a simple example to show how this works:

Say a coin's value is $10B and 100M/1B of its supply is circulating...

Its price is $100 ($10B value/100M coins).

If 100M more coins came into circulation, its price would fall to $50 ($10B/200M).

This is why money printing causes inflation (money supply 📈 —> real $ value 📉)

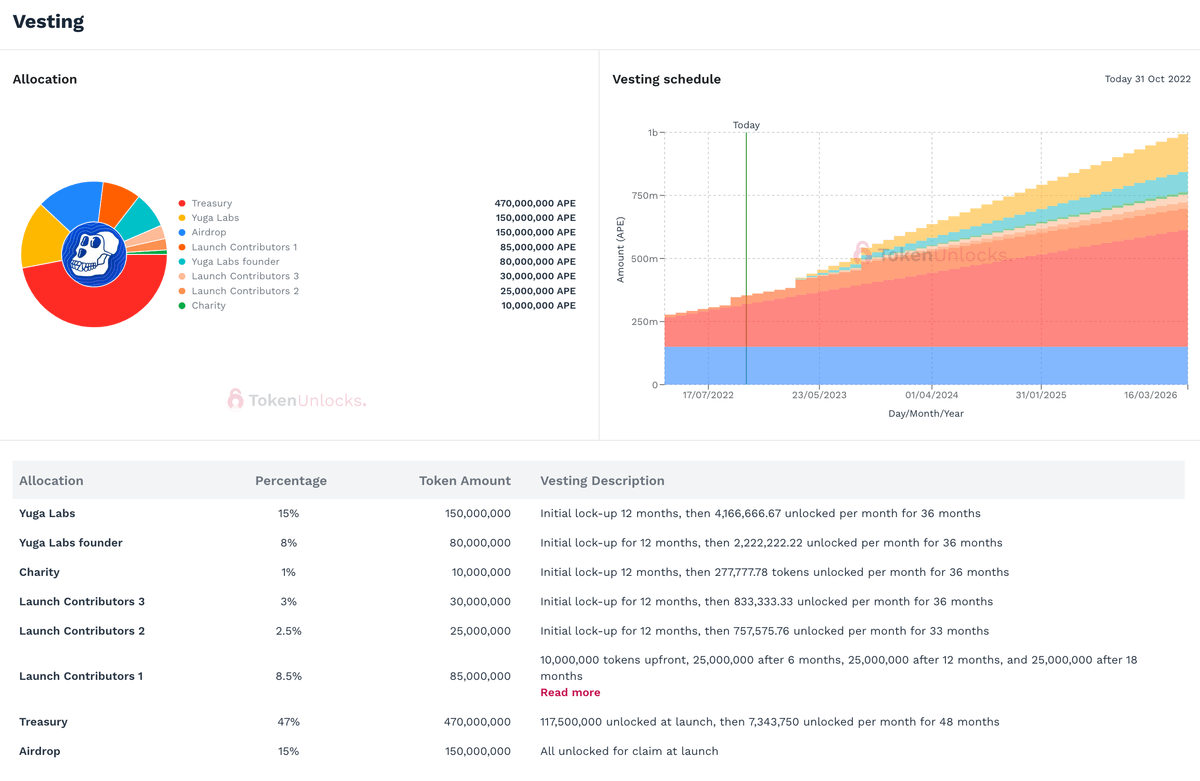

APE's circulating supply is programmed to grow every month for 4 years after launch.

APE mints coins just like the FED prints money.

The coins go to:

· Charity

· Yuga Team

· APE DAO Treasury

· Launch contributors (ie, mostly VCs)

With team & VC distributions starting Mar 2023

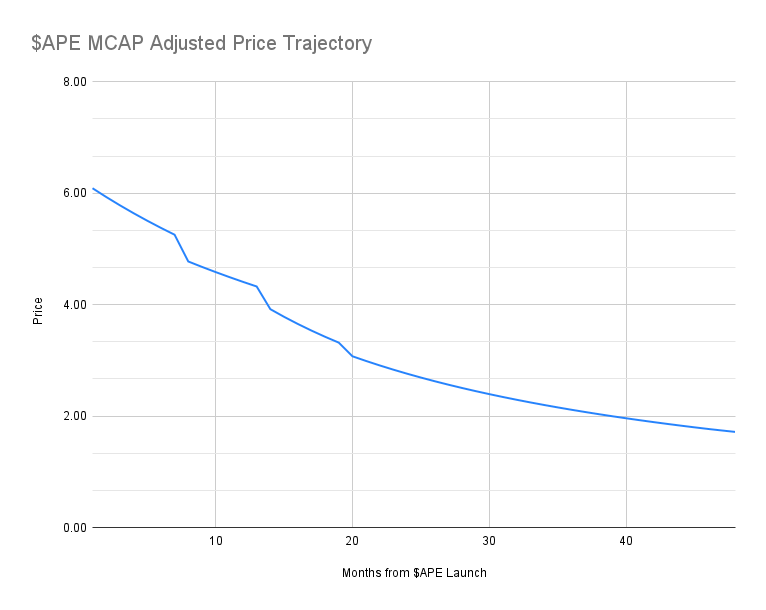

The real value of each APE coin declines over time as the supply grows (assuming the collective value of APE stays the same).

And just like how the US government printing money attributed to inflation (ie, each USD being worth less), the value of each APE coin is declining too.

Staking delays mean the circulating supply of APE is higher when APE stakers receive their coins.

Which means the real $ value of their earnings will be lower.

This may seem insignificant, but it's quite meaningful when you look at the sum of earnings over the 3-year period.

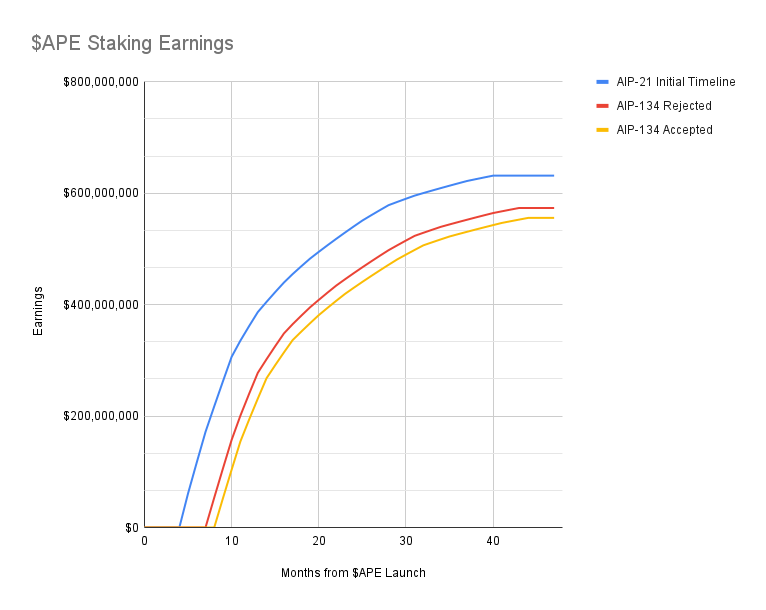

Here are the relative staking earnings based on implementation time:

AIP-22: $631.6M

Reject AIP-134: $573.6M

Accept AIP-134: $555.7M

APE holders have incurred $58M in real losses so far and accepting AIP-134 would lead to $17.9M more $ lost.

(Assuming a constant $1.69B MCAP)

APE holders also would've earned $117M through staking by now if implementation followed AIP-22's initial timeline.

Instead, we have $0 and $58M in lost value.

You may be wondering where the $58M is going 🙃

Technically, it's staying in the APE treasury as the coins earned through staking come from there.

But, it's a little more nuanced than that because the treasury is mostly dormant.

The APE holder/Yuga+VCs ratio tells us a lot.

Staking delays benefit Yuga & VCs 3 ways:

1. Lower circulating supply (excl. treasury) —> higher price

2. APE holders hodl bc staking pool yields are still high —> higher price

3. Yuga & VCs have a higher % of coins available for voting —> more control

By Mar 2023 when Yuga & VCs unlocks begin, APE should be at a much higher relative price for them to sell into if they choose.

Which would drive down the price for APE holders.

Alright let's take a quick look at the bug bounty proposal:

AIP-134:

· Vote is live & ends Nov 3 (currently 63% in favor)

· Delays staking 3 more weeks

· Proposed by AIP council member, @maariabajwa

· In partnership with @immunefi & @llamacommunity_

· Only 10K APE for setup costs and up to 1M in potential rewards

The community is split:

Staking security precautions taken so far include:

· Two week commit period

· Contract is live on testnet

· Rigorous audit by @HalbornSecurity

· Machi Big Brother's bug bounty where he's offering up a MAYC!

Here's my take:

twitter.com/machibigbrother/status/1586042543589818368?s=20&t=lgyCc61mfRr8cYKAoB9RlQ

I voted against AIP-134

I'm not a dev and can't accurately assess the need for this bounty program.

Hopefully, one of the great devs on here like @0xQuit, @cygaar_dev, @0xBender, or @0xfoobar, could provide their perspective.

I'll happily change my stance if it's necessary.

I can assess that staking delays are unfair to APE holders.

Just like delaying Yuga & VC unlocks would be unfair to them.

Why should APE holders sit back and continually lose $ to the benefit of others?

Are we less important?

A staking delay will cause APE to 📉 and B/MAYC will follow.

Meanwhile, holder trust and NFT volume are at all-time lows...

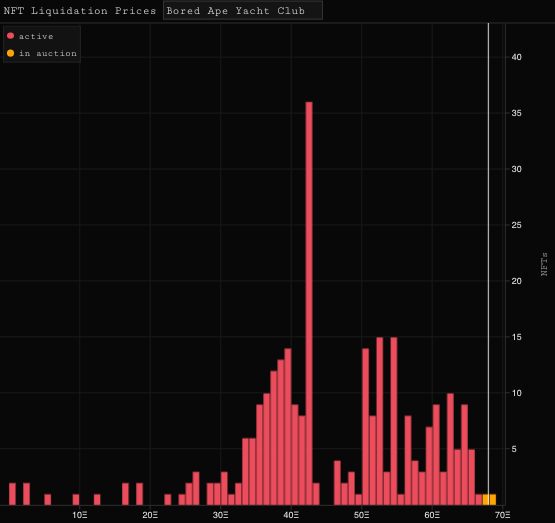

And 12 BAYC entered liquidation yesterday with 50 more set to enter if the price drops 10%.

Can the market absorb these liquidations or will it crater?

How do we know the bug bounty proposal will be the last delay?

What if there's something greater than we're being led on to believe... like the SEC investigation derailing staking altogether?

I don't wanna baghold APE in that scenario.

Lastly, how will @apecoin DAO thrive if it's this difficult and confusing to implement a staking protocol?

The APE Foundation board needs to get us back on track and regain holder confidence.

So rn... it's staking or bust for me 🫡

Summary:

1. APE staking implementation is full of delays & uncertainty

2. Delays have cost holders millions bc APE's real value has declined

3. The AIP-134 bug bounty proposal will further delay staking

4. I'm voting against the proposal

Alright...

ps, Tagging some Apes to hopefully hear their stance on AIP-134 (Bug Bounty + staking delay)!

@tropoFarmer @OGDfarmer @franlinisbored @EB7 @osf_nft @greatmando_nft @j1mmyeth @0xWave @KingBlackBored @beijingdou @nft_god @ghost93_x @tundra_v1 @ashrobinqt @Cosmo_886 @ricefarmernft

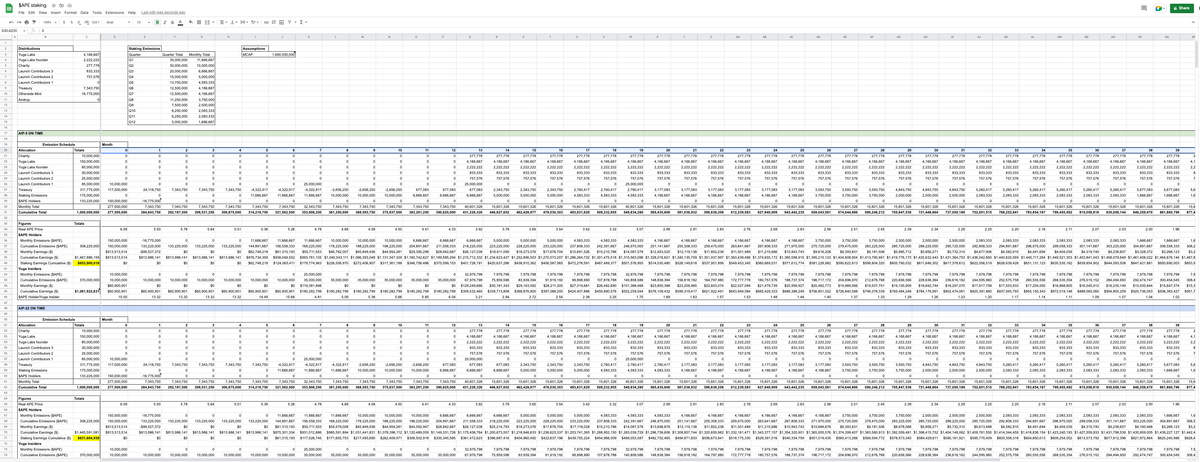

ps, Here's a screenshot of the spreadsheet with some calculations.

I'd share the link but I don't want to advertise my email to scammers.

Send me a DM if you'd like an excel file of it.

pps, thank you @just1n_eth @LambolandNFT @OuroborosCap8 for discussing this post with me!