Recently the EU has begun the process to regulate web3, targeting transactions (Trf) and ‘unhosted wallets’ (Mica).

We worked with global innovators in the space to help our political leaders manoeuvre uncharted territories in an open letter.

See final tweet to sign.

1/40

We believe the proposed regulatory path will negatively impact the citizens and businesses of the EU.

What is at stake? Simply put; Europe’s position as a leading economic power.

2/40

Rather than embrace this technological revolution the powers that be want to regulate it before a fraction of the full potential of change is realised. twitter.com/peterlih/status/1513123365208350725

3/40

The innovation of Bitcoin to bring digital scarcity to reality, has opened the door for digital scarcity in many business sectors that exist in the digital world.

4/40

Limiting EU citizens' interactions with these systems contradicts the ideas that the European Union has been founded upon - democracy and civil liberties like freedom of speech.

5/40

As well as this, it limits opportunities for innovation, and to set the standards for the next epoch of humanity.

twitter.com/punk6529/status/1457370810679808006

6/40

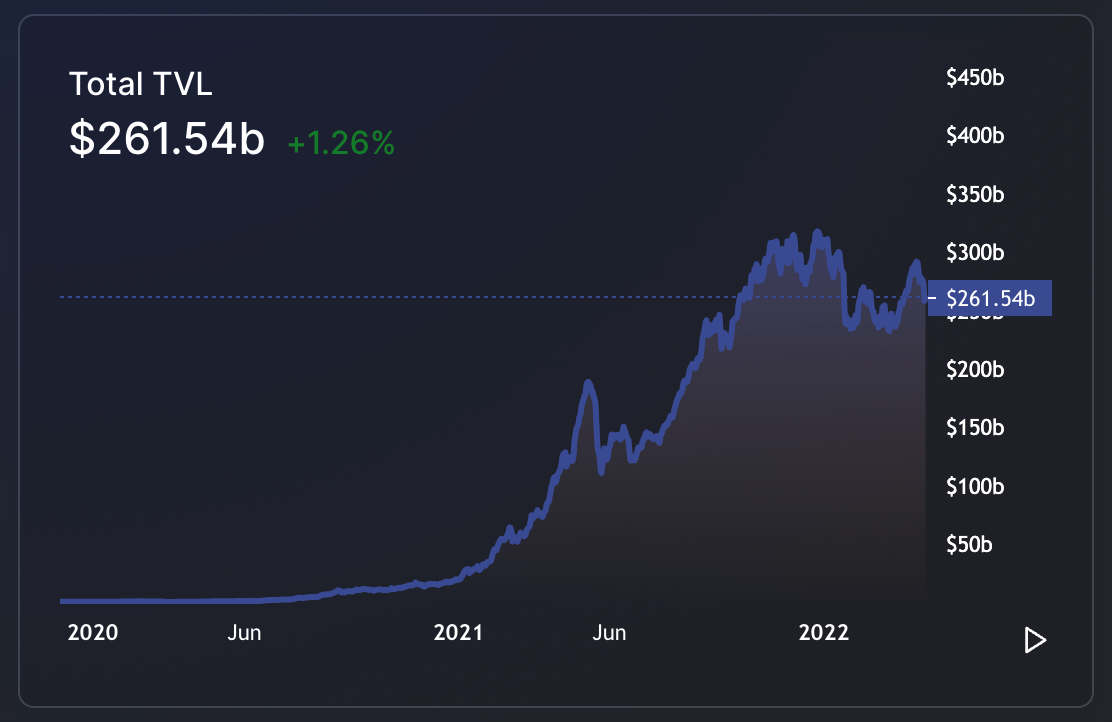

Bitcoin has existed for over a decade, recent innovations have birthed the world of DeFi, programmable financial services eg. @AaveAave @LidoFinance @CurveFinance

DeFi gained traction in 2020, and now >$250bn of value is held in these protocols.

cc: @DefiLlama

7/40

Perhaps even more important than DeFi, we are beginning to see the development of a broader economy of virtual goods in the form of NFTs. and a cambrian explosion in online organizations in the form of DAOs.

twitter.com/PastryEth/status/1445565823192473602

8/40

We understand that paradigm shifts introduced by new waves of disruptive innovation are challenging, especially to politicians focused on other things.

The answer to this is not knee jerk regulation, but education + understanding and we would like to help facilitate that.

9/40

Noncustodial (’unhosted’) wallets reduce cyber risks, break open monopolies and are essential to use any blockchain based applications.

The private key owner, controls the data and assets in the public key address.

Ownership of the private key = ownership of an asset.

10/40

Today only a fraction of the ~300m crypto holders are using the technology to its full potential, the majority just hold their crypto assets on a centralised exchange (Custodial/ ‘hosted’ wallet).

Funds are never 100% safe on exchanges.

twitter.com/BVBTC/status/1068904794184540160

11/40

Non-custodial wallets (or ‘unhosted wallets’) provide an alternative.

Here the users can download a piece of open source software to their devices to control their private keys directly - without an intermediary.

12/40

This is equivalent to a wallet in the physical world. It allows users to take real ownership of their data and their assets.

13/40

Protocols are not like usual companies.

One of the most complex and controversial topics in the realm of crypto networks is the definition and legal treatment of on-chain organisational structures, such as decentralised, autonomous organisations (DAOs).

14/40

DAOs can be defined as an open, self-organised networks coordinated by crypto-economic incentives and self-executing code.

Since many consumers participate in these structures a legally secure framework should be created for consumer protection and liability risks.

15/40

One place where regulators are embracing the challenges presented by DAOs is the US state of Wyoming.

They recently enacted a framework that allows DAOs to be formed as a limited liability company. twitter.com/awrigh01/status/1369328856260354051

16/40

DAO LLCs are recognised in Germany and can operate in Europe.

Their existence should motivate European legislators to create legal frameworks which can compete with that of Wyoming and others in order to attract international talent and capital.

17/40

Security and fraud are a key concern; yes big hacks have taken place in crypto.

The largest ones, such as Mt. Gox and Bitfinex, are due to failings of security in centralised exchange platforms not related to a failure of the actual ledger.

18/40

We are optimistic to develop better security and auditing standards in order to further mitigate the risks mentioned over time.

In fact, Crypto networks are an exceptionally weak tool for obfuscation and money laundering because of their transparency.

19/40

The problems with the proposed regulation are vast, and threaten this nascent technological revolution despite the goals of web3 aligning with the European mission.

In our view they will cause various unintended, long term and devastating effects.

20/40

Problem 1: The Financial Action Task Force (FATF) is not a formal international organization and is not a representative, democratically elected legislative body.

21/40

For policies that have very far reaching implications for the civil liberties and the future EU economy we wish for an independent, public debate amongst democratically representative members of parliament.

22/40

Problem 2: The threat of crypto enabled financial crime is dramatically overestimated.

Currently existing financial surveillance regulations covering fiat on- and off ramps are sufficient.

23/40

2021: Crypto transactions involving illicit addresses 0.15%

2021: Fiat transactions linked to crime 2-5%

24/40

Problem 3: With the explosion of the digital economy and burgeoning uses for NFTs it is possible that in the near future almost every business and individual could be classified as a CASP (under the current definition), and regulated as such.

25/40

Given its enormous weight, the CASP definition should be justiciable, clearly defined and narrow.

26/40

Problem 4: The public disclosure of all transactions and digital wallets violates privacy and security for EU citizens.

It’s a de facto ban of self sovereign data ownership thereby undermining data portability and unlawfully censoring speech in non financial contexts.

27/40

It is also a certainty that the data gathered will present an enticing treasure trove of data that will inevitably be exploited.

28/40

Problem 5: Applying the travel rule to transactions between a CASP (crypto asset service providers) and a non-CASP (’unhosted wallets’) is unlawful and should be treated like a cash transaction.

29/40

We suggest to not apply the travel rules outside of CASP to CASP relationships in order to treat CASP to / from non CASP like cash transactions which are a closer analogy than wire transactions. The current travel rule implementation is unacceptable.

30/40

Problem 6: Requirements for a legal entity organization is equivalent to a ban of decentralised technologies violating freedom of speech.

31/40

If the formation of a legal entity organisation is required to write and deploy code on crypto networks the freedoms of speech and individual expression would be severely undermined.

32/40

Problem 7: Currently, the transfer of funds regulation treats crypto, and every person who holds crypto, differently from fiat. Every crypto transaction - and not just those with a EUR 1,000 minimum threshold as is the case with fiat transactions is “travel rule eligible.”

33/40

This put unacceptable burden on CASPs and would drown authorities in an ocean of irrelevant transaction reports concealing actually suspicious transactions. It would run counter the regulators intent of preventing financial crimes.

34/40

Essentially the drafted regulations mean:

(i) a de-facto ban of digital asset holdings

(ii) a de facto ban of building decentralised technologies

(iii) the introduction of unbearable bureaucratic procedures to CASPs in a hyper growth emerging economy.

35/40

If the regulations pass in their current form it would likely cause an unprecedented brain drain from the EU not seen since WW2. The regulators initial intent behind the Mica regulation would be undermined completely.

36/40

The signatories of this letter count on you, our politicians and regulators, to foster open innovation, privacy and financial freedom through a more sensitive and progressive approach to the regulation of the emerging crypto industry.

37/40

The EU has an opportunity to be the global leader in accelerating the transparent and human right benefits of web3 technology.

38/40

We look forward to continuing the conversation with policymakers to discuss the benefits of crypto and find a better balance between innovation and risk mitigation.

39/40

Heres's the link to our open letter;

docs.google.com/document/d/12P6sAmsQdBXAGWZWVFqd4lYK4vFZyesI9oSX95OPcCw/edit#

And you can sign here; zgda3e5kgj0.typeform.com/to/Vz9SOJ0w

40//40 - END