🤖DEGEN AF STRATEGIES VOL 2🤖

👉 Lending Loops

Let's talk about lending loops. These are far and away one of the most #degen strategies you can employ.

Why?

👇

🧵/1

Because, in a normal lend/borrow situation, you risk your collateral, but you still have the asset you borrowed.

In a lend loop, you risk EVERYTHING;

Your collateral AND your borrowed asset.

If you get liquidated, you have NOTHING.

🧵/2

First, let's talk briefly about how lending and borrowing work, so the loop scenario becomes a bit more clear.

In traditional finance, when you borrow money, you either put up something for collateral (your house or car) or the lender takes a risk based on your credit.

🧵/3

In the pseudonymous world of DeFi, we don't have credit (yet), so lenders will only risk the lending based on collateral.

Due to the incredibly volatile nature of #crypto, lenders will only allow over-collateralization.

🧵/4

Meaning, you have to put up more collateral than the value of your borrowed amount. This is to avoid liquidation, which occurs when the price of borrowed $ and the price of collateral become too disparate & the value of what you owe is more than you have collateralized.

🧵/5

So why do people lend/borrow if they have to already have more than that amount in value?

Well, lenders lend because they get a fee.

Borrowers borrow, for a number of reasons...

🧵/6

Here's one illustration. Let's say you have $1000 BUSD but you see some super juicy APY's on Beefy finance on the #fantom network.

You want to farm, but don't want to swap out your BUSD for $FTM.

So, an alternate solution is to put up the $BUSD for collateral...

🧵/7

Then borrow $FTM to use to farm.

So long as you don't get liquidated, you can earn your farming rewards on Fantom while keeping your BUSD.

That's just one example.

There are many others. Lending/borrowing is also how you short the market (that's another thread).

🧵/8

OK, so we've gone over what lending/borrowing is, what it is in crypto, and why people do it.

So, what's this lending loop business?

Let's get into it.

🧵/9

A lending loop is when you put up an asset as collateral, then borrow that same asset, then put the borrowed asset up as collateral, then borrow more of that same asset, then put that borrowed asset up as collateral....

You get the idea.

🧵/10

This effectively provides leverage to your position. To illustrate, if you put up $1000, depending on how many loops you get, you could end up with an effective lend rate of $2,750 (for example).

So if you're into lending for those APY fees, sounds like a good deal.

🧵/11

Here's the catch:

You have to pay a fee on the borrow side.

So the only way this works is if the lending APY is greater than the borrow fee.

And that can be a rare occurrence.

🧵/12

Here's the thing though....it DOES happen.

But usually it happens due to incentives from the lending protocol.

See, if I'm lending you money, as the lender I'm not likely to GIVE you rewards for borrowing my money...

🧵/13

BUT, the protocol might.

Just like a bank, protocols also give out incentives to get more people to use their platforms.

So, what you end up with is:

➡️earning lend fees

➡️paying borrow fees

➡️getting rewards for doing BOTH

🧵/14

Now if the rewards push your gains higher than your losses, you're in the green.

This makes lend loops a fairly safe play.

BUT WAIT! "You said this was a super degen play. How can it be safe?"

🧵/15

Well, it is degen AF because you are risking everything (as stated above). BUT, if you do this with stablecoins, you severely decrease that risk.

I know I know...$UST, $DEI, $fUSD...#stablecoins aren't safe either, right?

🧵/16

There are still many that have a solid history.

However, flash dumps do happen. And a flash dump is exactly the type of event that would liquidate your position even in a stablecoin.

So here's how you play it safe...

🧵/17

First, choose a stablecoin that has a solid track record.

Using BUSD as our example again, we can see it has held peg very well.

There were a couple of flash dump instances, however, the worst of them being a drop to $0.81!!

🧵/18

Well, remember how I said crypto loans are over-collateralized? Most platforms only allow you to borrow up to maybe 75% of your deposited value.

But in stables, many will allow from 85 to 90%

HOWEVER, you can choose to not borrow so much.

🧵/19

If you chose to only borrow 75%, for example, then you would only get liquidated if the value of BUSD dropped below $0.80 (which it hasn't done like...ever).

🧵/20

Ok, so I'm not one to just regurgitate stuff I learn on Youtube. When I was researching this topic, I learned a lot from a video from @phtevenstrong where he demonstrated this strategy on @AlpacaFinance (def recommend checking it out).

But I had to try it myself.

🧵/21

Step one was trying to find a platform where the lend rates were more favorable than borrow rates cost.

Alpaca was the obvious choice BUT they require a minimum $1000 posted collateral value and I wanted to experiment with a smaller amount.

🧵/22

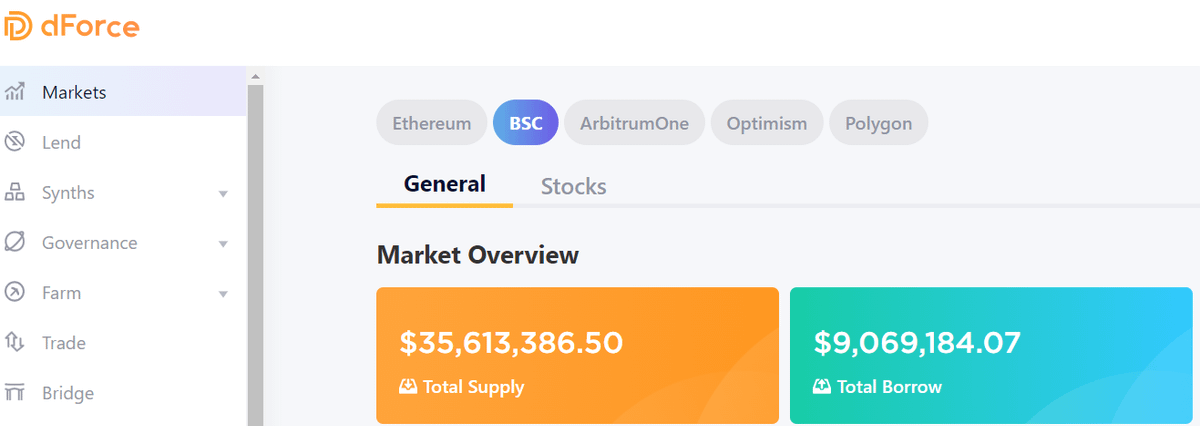

Looking at @DefiLlama I found a small protocol called Dforce.

I have assets on #BSC network so this looked like a win so far.

🧵/23

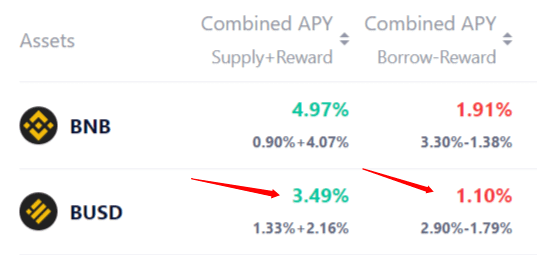

What's more, the rates on BUSD were what I was looking for...

Higher loan APY's than borrow APY's after rewards.

🧵/24

The rewards would be paid out in $DF, which is the protocol's native token. At the time of my test DF was worth about $0.05.

Here's where things got tricky though. The platform doesn't allow you to borrow and lend the same asset.

😮😮

🧵/25

This would mean I was stuck having to pair my BUSD collateral with another trusted stablecoin. I chose $USDT.

So, for every loop, I swapped BUSD for USDT. I'll explain why this is a problem in a minute.

🧵/26

At the end of one month, I had earned around 17 $DF (worth roughly $0.60).

I had earned a few cents in my base APY for the loan and paid a few cents on my borrowed assets.

So my $100 in BUSD became about $99 and some change.

🧵/27

The DF rewards would have made up the difference, except that it cost most of what the rewards were worth to swap it for BUSD on their swap platform.

So overall it ended up being almost a wash....almost.

🧵/28

Except that all the BUSD to USDT swapping added up to around $12 in gas (including three failed transactions...yes, BSC has failed transactions too).

So this experiment cost me almost $13 but taught me some valuable lessons I will now share with you:

🧵/29

For lend loops - make sure the lending platform allows you to borrow and lend the SAME ASSET (so you don't waste funds on gas).

Make sure the rewards are paid in an asset you have confidence will grow or not lose much value (when I cashed out DF it was worth around half)

🧵/30

Make sure you borrow UNDER the potential flash dump level.

If you follow these steps, you could park stables in a relatively safe way to receive yields.

This is more of a long(ish) term play (as long as the reward structure doesn't change) and better with larger amounts.

🧵/31

I hope you learned something about lending loops.

If this was helpful feel free to share it.

Also, like, follow, all that jazz.

CHEERS!

🧵/finis